The big news at this year's CERES Conference, "Scaling Sustainability", was that General Motors had joined the growing number of corporations signing the CERES Climate Declaration which declares that bold action to tackle climate is "one of America's greatest economic opportunities of the 21st century." Most of the signatories to date are companies with obvious interests in protecting the climate, like the Aspen Ski Corporation -- and a number of those have done very interesting consumer-facing educational activities. But having the biggest automaker in the U.S. join a statement that climate action is an economic plus, not a burden, is a significant step in moving away from the "climate protection as sacrifice" trap.

And there is a lot of evidence that a low-carbon economic model would be an enormous economic opportunity -- if we can make markets work as they are supposed to, seeking efficient long-term allocation of assets.

But there is also a disturbing volume of evidence that getting markets to work for sustainability is going to be very, very challenging.

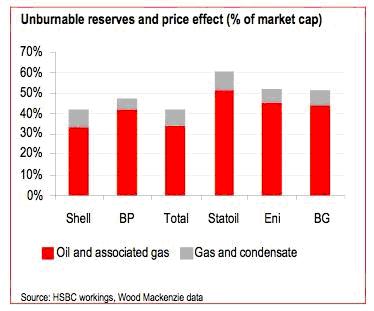

Take the very big issue of what an oil or coal company is worth. There has been a spate of recent reports -- the most interesting by HSBC -- on the reality that coal, oil and gas reserves already identified and on the books of energy companies are far more than the climate can tolerate burning. HSBC says that such "unburnable carbon" amounts to 60 percent of the reserves that underlie the market valuation of such companies as Statoil, BP and Shell.

Now The Economist has weighed in, arguing that one explanation for this apparent overpricing is that markets don't believe that governments will actually limit carbon emissions in a meaningful way, and that all of the current reserves will, in fact, be burned. But governments, climate apart, have enormous economic motivation to use less fossil fuel, because much of the reserves on the books are very expensive to produce: Canadian tar sands, Brazilian deep salt, Australian coal, and remote U.S. and Russian Arctic oil and coal are responsible for current sky high global oil and coal prices -- slightly less than $100 a barrel or ton. And we are currently only using such extreme, expense oil and coal at the margin. It is clear that there are far cheaper fuels -- efficiency, solar and wind to replace coal and natural gas in the U.S., and biofuels or electricity elsewhere to reduce oil intensity. So how much $100-fossil fuel can the world afford climate aside?

The Economist gives credence to another explanation, cited in the latest unburnable carbon analysis by Carbon Tracker -- markets irrationally value energy companies for keeping their replacement ratio above 100 percent:

"Investors... require companies to replace reserves depleted by production, even though this runs foul of emission-reduction policies. Fossil-fuel firms live and die by a measure called the reserve replacement ratio... Companies see their shares marked down if the ratio falls, even when they pull the plug on dodgy, expensive projects. This happened to Shell, for example, when it suspended drilling in the Arctic in February."

Back at the CERES conference there is a heated conversation about the burgeoning divestment movement calling for universities and other investors to sell off their stocks in coal, oil and gas companies. Most investors here -- unsurprisingly -- don't like divestment. They argue that investors should instead try to improve corporate behavior as shareholders.

But the established corporate governance reform efforts on view here may not have the punch to overcome the kind of market failure the unburnable carbon bubble reflects.

Over and over the leaders of companies who have adopted a commitment to sustainability and the CERES principals lament that on their quarterly calls with securities analysts, no one raises sustainability issues like climate or water risk. The head of KB Homes is excited by the "net zero" homes his company is putting on sale which, when you account for the savings from not having a utility bill, are highly affordable. But his company's analysts -- who guide the market -- could care less.

Dan Hesse, the CEO of Sprint Telcom, makes the same point, and offers his explanation:

"We are convinced that our sustainability initiatives are of significant value to our long-term bottom line... And our long term investors, like the people in this room, care. But we also have other kinds of market players -- traders who are in it for the short-term ups and downs or raiders who want to create such volatility. Short-term investors don't care about long-term value. Stock analysts are basically serving traders and raiders, not investors. It is short-term players who drive securities price up and down -- so CEOs have a strong incentive to ignore the long term, because it won't help their share prices tomorrow -- that's just about quarterly earnings."

A vice president for sustainability at one of the major banks tells me she is personally sympathetic to the environmental groups urging banks to avoid companies that engage in mountaintop removal mining. But she says bluntly that banks do not believe that reputational risk for doing such finance hurts their bottom lines. I then inquire about evidence mountaintop removal coal companies have turned out to be bad investments in recent years, and that BP's reckless pursuit of deep water oil had done major damage to its balance sheet. Doesn't this kind of history make companies that pursue extreme fossil fuel plays more risky than more cautious firms? "Yes, for those who hold concentrated positions," she says. "But not for the banks. We don't keep those loans. We package them into securities, bundle them and syndicate them to others. And the bundles are designed to spread the risks of an environmental disaster. So while the ultimate investors do pay the costs of, say, stranded coal reserves or tougher regulations, those risks are diluted among other investments. No one cares that much because the risk is hedged."

This, of course, is what the banks promised about their mortgage-backed bonds -- that diversifying the kinds of mortgages in each security would make it safe. That turned out to be no protection at all when the whole housing bubble burst.

But the strategy being used here by the banks also creates a different problem. Foolhardy business practices are supposed to be checked by fear of risk. Shareholders are supposed to care about the long term of their companies. Bankers are supposed to vet projects before lending. But if short-term market traders drive management on the equity side, and on the debt side the banks syndicate and split each investment so that no one investor bears significant risk from Shell's multi-billion dollar roll of the dice in the Chukchi Sea, or Massey Coal's reckless safety practices, then where in the market does discipline come from?

CERES is deeply committed to trying to create longer-term horizons among both investors and companies; short-termism is clearly the biggest systemic threat to sustainable capital markets. But given the dynamics being discussed here, or revealed in the Carbon Tracker report, it's not at all clear how to inject even the most vital, solidly demonstrated long-term profit considerations into capital markets.

Several business leaders openly call for a reversal of the current doctrine of shareholder sovereignty -- the idea that corporations exist only to serve their owners. And if shareholder influence is increasingly dominated by short-term strategies, that case gets stronger and stronger.

If neither equity nor debt players are subject to market discipline for long-range risks, more radical strategies like divestment should gain more and more traction. Markets may need major surgery if they are to respond to the new economic and environmental realities.

A veteran leader in the environmental movement, Carl Pope spent the last 18 years of his career at the Sierra Club as CEO and chairman. He's now the principal adviser at Inside Straight Strategies, looking for the underlying economics that link sustainability and economic development. Mr. Pope is co-author -- along with Paul Rauber -- of Strategic Ignorance: Why the Bush Administration Is Recklessly Destroying a Century of Environmental Progress, which the New York Review of Books called "a splendidly fierce book."