Anyone with a heartbeat knows that Wall Street took down the economy, killed millions of jobs and hasn't had to pay a penny for the damage it caused. In fact, we are paying them for crashing the economy in the form of trillions in bailouts and low interest loans.

Well, maybe it's time for Wall Street to contribute, rather than siphoning off our wealth. How about a sales tax on all transfers of stocks, bonds, and derivatives in order to fund tuition-free higher education at public institutions?

Why are high schools free but colleges aren't?

Access to higher education is vital to our economy and to our democracy. Today a college degree or post-high school professional training are the equivalent to what a high school diploma provided and signified a generation ago. For over 150 years, our nation has recognized that tuition-free primary and secondary schools were absolutely vital to the growth and functioning of our commonwealth.

By the middle of the 19th century, New York City also provided free higher education through what would become the City College of New York. Hunter and Brooklyn colleges also were tuition-free, as was California's rapidly growing post-WWII state college and university system. The GI Bill of Rights after WWII provided significant resources to over three million returning veterans to go to school tuition-free, which in no small part, helped to build American prosperity for the next generation. (Tuition was even provided if GIs attended private colleges and universities.) A further impetus to free higher education came as America fell behind the USSR during the Sputnik-era space race.

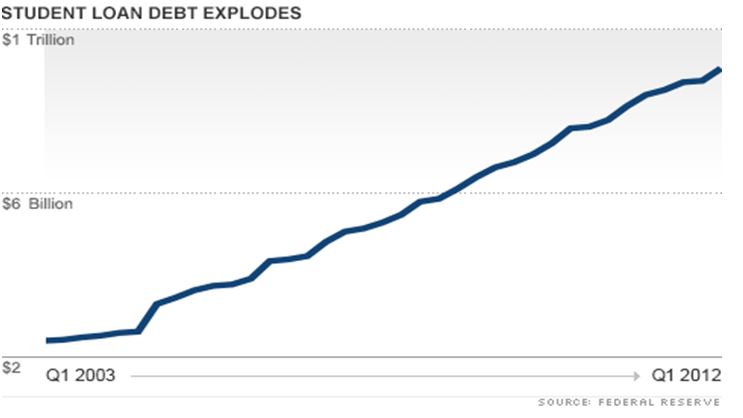

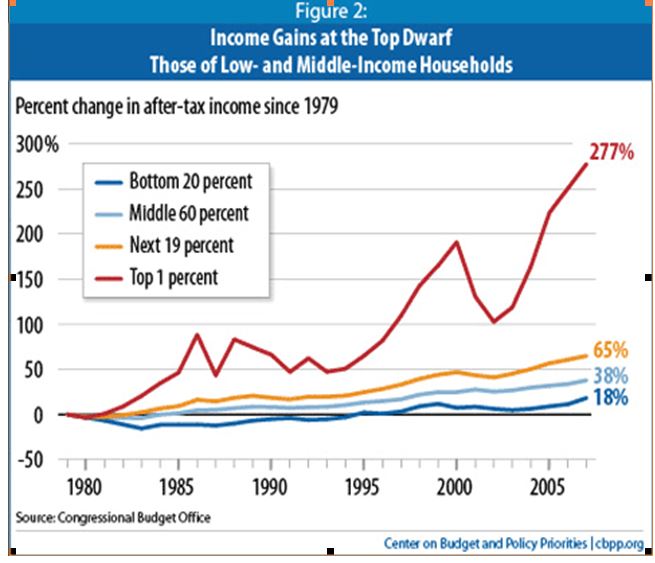

But the spread of free higher education stalled and then retreated precisely as Wall Street began to grab more and more of the nation's wealth. As financialization transformed the economy starting in the late 1970s, average wages flattened while Wall Street incomes shot through the roof. At the same time taxes on the super-rich collapsed placing more and more of the burden on working people. Low and behold, free higher education rapidly became "unaffordable." Wall Street then swooped in with loans as students and their families loaded up on debt in order to gain access to higher education. This is the very definition of financialization.

As Student Loans Rise, the Rich get Richer

As student loan debt climbed ever higher, the super-rich continued to rake in more and more income, especially in comparison to the rest of us.

- Are we resigned to be vassals to Wall Street elites or can we redirect resources to invest in our young people?

- Are we going to saddle our kids with decades of debt or are we going to make the Wall Street gamblers pay the damage they caused?

The financial transaction tax (aka Robin Hood Tax or Speculation Tax) hits hard at Wall Street gambling. A small sales tax on all financial transactions will come almost entirely from those who are gaming the system by rapidly moving money in and out of markets. Eleven European nations are about to institute such a tax and have found excellent ways to enforce it. (If you or affiliates don't pay by using shell companies and other tricks, you don't do business in our country.) England has had one on stocks for the past 300 years and it works just fine. Clearly, a sales tax would successfully collect from the super rich.

Of course, you'll hear Wall Street apologist moan and grown about how such a tax will kill jobs, steal from your pension funds, and rob your kids' piggy-banks. All lies.

Unless you play with your 401k like a high frequency trader -- which means you'll be fleeced by them anyway -- you won't feel this tax. Neither will your pension funds which are not supposed to churn your investments anyway. As for jobs, when was that last time that Wall Street produced real jobs on Main Street? They would just as soon finance a job smashing merger or the movement of jobs out of the country. The only jobs that would be hurt are a few at high frequency hedge funds who milk markets by making millions of automated trades per second. For the sake of financial stability and fairness, they should be put out of business anyway.

No, when it comes to hitting Wall Street elites, a financial transaction tax is just about perfect.

Let's encourage Elizabeth Warren to take the next step.

Senator Elizabeth Warren opened the door to this debate as she attempts to stop student loan interest rates doubling to 6.8 percent in July. She wants the Federal Reserve to loan money to students at the same rate it charges too-big-to-fail banks -- which is next to nothing at 0.75 percent. Of course most politicians and pundits think she's off her rocker. How dare she try to interfere with "market forces?" But as Ellen Brown of the Public Banking Institute shows in her excellent rejoinder ("Elizabeth Warren's QE for Students: Populist Demagoguery or Economic Breakthrough?"), it makes economic as well as ethical sense to invest in our young people. In fact, it makes a whole lot more sense than propping up too-big-to fail banks that have grown even fatter since the crash. (Also, see the path-breaking effort led by Barbara Dudley and Working Families Party in Oregon.)

But why have any student loans at all?

Why accept the perverse idea that students should saddle themselves with decades of loan repayments in order to gain access to higher education? Even with interest rates at 0%, we're still asking students and their families to load themselves up with tons of debts in order to get access to the advanced skills and knowledge that our economy and our democracy desperately need. Isn't it in the national interest to invest in our young people, rather than loading them up with debt?

Can we really beat The Street?

Maybe. It's starts with having the nerve to ask for what we really want, rather than compromising before we start. Do we think Wall should pay reparations for what it has done to the economy? Do we think it fair to use that money to fund free higher education in order to rid our young people of crushing debt? If the answers are yes, we can start organizing.

The next step is to convince those working on the Robin Hood Tax to tie it to free higher education. That would allow financial transaction tax advocates to reach out to an enormous constituency -- students and their families.

And yes, we also we need some organizational magic, not unlike what sparked Occupy Wall Street. Perhaps, websites like Alternet.org can link up with like-minded media outlets and progressive groups to form a vast coalition of the pissed-off! Millions might be ready for that.

The anger towards Wall Street is there. The outrage over ever rising student debt is there. Now is the time to connect the two and provide some extra organizational juice.

No one has a magic bullet and no one can guarantee success. But unless we try, we will guarantee that Wall Street and it's Washington minions will continue to rip us off.

Surely we have enough creative energy to build another path.

Les Leopold is the Executive Director of the Labor Institute in New York. His latest book is How to Make a Million Dollars an Hour: Why Wall Street Gets Away with Siphoning off America's Wealth (Wiley, 2013).