In this article, I will discuss the thoughts, goals, and, ultimately, the vision behind each of my previous innovation proposals.

I always start with a wish or goal for a service or business that I think would be great to have and enjoy. Then, I ask myself whether my desire is relevant and shared by a large number of people and, most importantly, if it provides a real added value.

Focus on Added Value

The great difficulties of an innovation do not consist primarily in the discovery of an idea. The idea always needs to provide a clear added value and a successful implementation in order to bring it to life.

I am not thinking primarily of the technical difficulties of the implementation, which is itself a significant topic.

My primary focus of the implementation process is the problem of convincing management of the benefits and added value for their customers and also for themselves. Secondly, I focus on how to implement change management; in other words, how to motivate the people in an organization to pursue a new goal and vision and to follow a new direction. Last but not least, a successful implementation should allow all of those involved to participate in the success of the vision and change.

Future Business Model

A future business model cannot and must not be aimed primarily at optimized cost savings. This often represents an indictment, since it seems that the management lacks a strategy for a sustainable profit business model. The company must always follow a vision and goal that provides fair profits but simultaneously satisfies and wins customers with superior service and innovation that add value.

The vision I described is part of the basics of most successful customer-oriented service companies in other industries, but it seems it has not yet arrived at many banks. FinTech companies take advantage of this situation successfully and can, therefore, undermine the business model of financial institutions.

Improving Bank Image

The financial world and many customers still seem to be at loggerheads. In order to change this situation, you have to try to merge the dreams and desires of both worlds and solve the tense situation. Banks and customers see each other as, indeed, necessary partners, but many clients reject the feeling of a desirable long-term relationship with the bank.

Many existing bank visions are perceived by many people as mere lip services because they are not lived. In order to change this, financial institutions must continuously improve their services with excellent offerings that create real added value for their customers. Then, the customers will be willing to pay a fair price and, most importantly, commit to a long-term partnership.

The most important thing is to improve the prevailing trust dilemma between clients and banks, rather than finding someone to blame, which only leads to negative emotions and distrust. Only then can we start a better future business environment that merges our joint goals, dreams, and visions.

FinTechs are Speedboats

The FinTech companies, for example, are much more flexible in adjusting to the dreams and desires of customers than the big financial companies. In addition, their legitimacy and future are very closely linked to the satisfied needs and wants of their customers.

Without clear added value proposition, FinTechs have no chance of survival. Major financial institutions, however, have greater staying power, but the advantage of their size is often accompanied by the disadvantage of their inflexibility.

Both worlds - the customers and the banks - will have to try to understand the fears and desires of their respective counterparts.

The Shared Dream

It is time to convey a vision and dream that is commonly desirable for customers and banks.

If we look at the basics of the relationship between financial institutions and customers, it comes down to this: The bank contributes their services and expertise to the partnership, and the customer entrusts their hard-earned assets to them. So both want to get a fair return for their contributions to the business partnership.

The problem arises when both parties think only of their benefits, and both seek to maximize profits without understanding the needs of the other. Then, both will lose in the long-term. Banks will lose a customer, and the customer will lose first-class advice.

This must be prevented at all costs. Therefore, it is of utmost importance to try to strengthen credibility and trust.

Creating a Win-Win Situation

All of my innovation proposals start with the idea of creating a win-win situation. With each innovation, I always begin with an elaboration of how to provide real added value for clients and then adjust it, so it makes sense for the financial institution. Thereby, one must always remember that innovations are never primarily aimed at profit maximization but at long-term relations.

Customers and banks have to try again to understand where the journey will take them. A journey that you want to take together and where both are dependent on each other, during both good and bad times.

As much as customers should be willing to pay fair prices for excellent banking services, banks should try everything possible to provide the best possible services and performance to customers. Then, customers might feel that they are provided something special, and any sense of overpriced services will slowly diminish.

Walk the Talk of Fairness

In order to achieve our common goal, we must believe in the vision of an equitable partnership and mainly live it. Customers must disconnect from the feeling that they always get a bad deal, and the banks should strive to help customers to do so. Only then can the vision of a fair partnership be lived.

Many young FinTech companies are trying to live this vision. I also believe that many of their clients consciously or unconsciously understand and feel it.

Everyone who sees the innovation goal and vision to create added value for all parties will help to overcome the deep divide between customers and companies. Therefore, this builds a bridge that creates a connection and allows the building of mutual trust.

With every innovation that I develop, constantly scrutinize, and optimize, I must always have this vision in mind and ever-present.

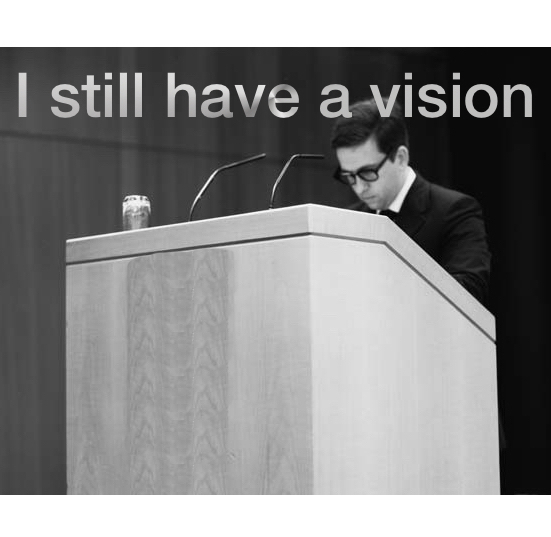

"I Have a Dream"

Martin Luther King