High-impact Design Driven Startups are investors' darlings and the INDEX: Award is taking advantage of this by applying their unique design award evaluation process to vetting candidates for venture capital funding. The organization's newly launched Danish Ventures - Investing in Design to Improve Life foundation is the next step in securing that high-impact, contextual and superior fashioned offerings are actualized.

How does one effectively assess design quality and relate it to funding potential? In studying the Industrial Design Society of America's Industrial Design Excellence Award, along with hundreds of new product development projects in established and startup businesses together with the INDEX: Award, we found three key performance metrics: Design Index, structural integration and technology. When assessed by investors, these act as strong predictors of a design's investment worthiness.

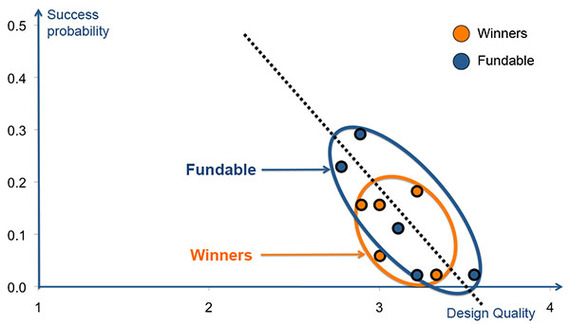

The three key performance indicators are straightforward to determine. The Design Index is the average rating of nine Design Quality Criteria, divided into three categories: Strategy (Philosophy, Structure and Innovation), Context (Social/human, Environmental and Viability) and Execution (Process, Function and Expression). Each criterion is rated on a scale from one to five, one being least and five being most and together, with market and technology risk, they are assessed on a scale from zero to one hundred percent likelihood of success. The combined risk can be calculated and the design value of a new venture can be determined.

A variety of unconscious biases, however, influences assessment of design quality. Startup founders show to be biased towards over assessing the quality of their design and design experts are found to be somewhat skewed towards breakthrough innovations. However, potential investors have a wider focus and are, thus far, unattached to a design. Even more importantly, they seem to intrinsically know that top-level design performance is required to take advantage of high impact and high-risk opportunities.

Studying the INDEX: Award process and outcome we learned how founders, investors and external experts assess designs differently.

Founders tend to consistently overestimate their ventures and rate design quality, on average, approximately twenty percent higher than that of investors. Also, their assessment did not correlate with either that of investors or design experts. However, founders' assessment of technology risk correlated strongly with execution risk. The higher the technology risk, the higher the execution-risk. They showed, however, no correlation between market risk and technology risk.

Design experts assessment of the design quality level, on the other hand, was on par with that of investors, on average, though the two stakeholders assessments did not correlate. As with founders, design experts' assessment of technology risk correlated strongly with that of execution risk, however market risk did not factor into execution risk.

Investors' assessment of a new venture's design quality correlated strongly with their propensity to invest. They also showed a strong correlation between their likelihood of investing and a design's structural performance (how well the design internally integrated, its integration with the surrounding ecosystem and the supply chain.) However, investors did not see technology risk and market risk having an influence on execution risk.

In assessing risk on breakthrough innovative high-impact new ventures, founders, design experts and investors are flying blind, when it comes to market risk. However design experts understand technology and execution risk, founders understand technology risk and investors see the connection between design quality and investment potential.

Therefore, combining the three stakeholders' assessments of design provides the best insights into design quality and risk. It can also help 'red flag' discrepancies between founders' perception of individual Design Quality Criteria and that of design experts and investors. This, in turn, can help founders focus on where to improve their design performance.

The INDEX: Award's first-to-world design valuation vetting process, now tied to an investment organization, offers a breakthrough innovative approach to attract, assess and fund high impact new entrepreneurial ventures. The Design to Improve Life Investment program has a competitive advantage when selecting design driven startups and thus represents a vanguard for progressing our world.