Up to this point financing of legal cannabis in the U.S. has relied largely on private money - friends and family raises, high net-worth individuals, and small to medium sized private investment firms. Banks and large investors have shied away from companies in the cannabis space, even for businesses that do not touch the plant. The federal prohibition on cannabis has led to this situation in which small investors and venture funds have become the industry's financial backbone. This moment in time of individual investing power in cannabis is waning, however. As cannabis normalizes and as laws relax industry participation by institutional investors is inevitable. The only question is how prepared current cannabis stakeholders will be when it happens.

Consider that last year an analyst for Merrill Lynch issued a 45 page report titled "Medical Cannabis Has High POTential: A Joint Biotech & Tools Primer" and that GW Pharmaceuticals - maker of CBD-based epilepsy drug Epidiolex which is currently undergoing nationwide FDA-approved testing - presented at Merrill Lynch's healthcare conference on May 10. Consider that weeks ago pharmacy chain Walgreen published an informational article on medical cannabis. Consider that the DEA has stated that it is re-examining the scheduling of cannabis this year and will possibly move the plant to Schedule 2 - the same classification as Percocet, Oxycontin, and Vicodin. Huge companies are already putting out feelers into cannabis. Should the scheduling of cannabis change how long would it take before investment banks and major pharmaceutical companies enter the market?

This isn't even taking into account the looming shadow of big tobacco. In Kentucky many farmers that used to grow tobacco are already changing over to industrial hemp. The switch from there to cannabis isn't a difficult one, especially since there is evidence that Altria (formerly Phillip-Morris) has been periodically reviewing possible entry into cannabis for decades.

Once institutional barriers fall what will happen in the 26 states that don't currently have a regulated legal cannabis program? If those states open up with limited merit-based licensing will smaller companies be able to compete with the money brought to bear by a multinational corporation? In these areas established names in cannabis will be starting square one with no first-mover advantage over the big-moneyed interests.

Entry of big money will be a sea change for everyone in the industry. National supply chains, experience with scale, and deep, deep pockets will lead to footprints bigger than the current industry leaders put together. The biggest, most established brands will possibly be bought outright while the smaller businesses will need to rely on quality of product, a unique niche, a powerful brand identity, and a loyal built-up customer following to simply survive. It's possible to be successful in the shadow of giants much like the scores microbreweries that exist in the face of Budweiser - it's just more difficult.

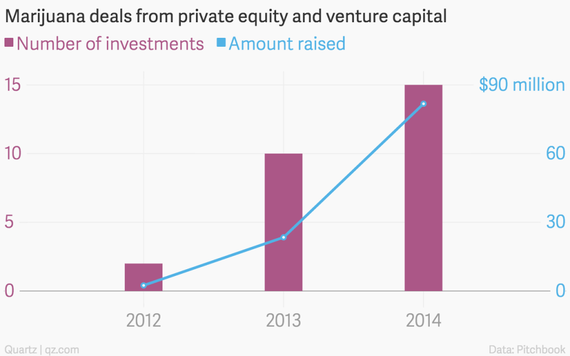

Once banks enter the marketplace private money will have to compete with huge bankrolls when trying to make deals or finance companies. Obviously this doesn't mean the end of private investment in the space since cannabis is still very much an industry of startups and investment banking has not eliminated the need for individual investment or venture funds in other industries. Will the biggest and best deals still be available for these levels of investors, though? And for those hoping to invest in a company now with hopes of an exit once laws relax that window is closing. Private investors must be assertive - but not reckless - as law change looms closer. Diversification is more important than ever, as is investing carefully in companies that will be able to survive the rising tides of competition.

Big money entering cannabis isn't the end of the world, but it will certainly reshape the world. There is still some time, though. The laws haven't changed yet, and were the law to change tomorrow - even with the current level of research into cannabis - it would likely take most institutions some time to mobilize and jump into the market in earnest. The time is now to find out who you want to be in this industry. What is your niche? What's your level of involvement? How big is your reach? Businesses and investors alike need to prepare because eventually today's big fish will find themselves suddenly swimming among whales.