Among the most powerful and vociferous opponents of health care reform are the executives of publicly listed health insurance companies and their lobbyists. The prime concern of these executives is that, by ensuring that Americans will have the access to better, or even some, health care coverage at affordable costs, health care reform will cut into their profits.

Corporate profits are necessary to fund the investments that generate higher quality, lower cost goods and services. But that is not how the largest corporate health insurers have been using their profits over the past decade. Rather, virtually all of their profits have been spent on buying buy back their own stock for the sole purpose of jacking up their stock prices.

During the 2000s, stock buybacks became endemic among US corporations in general. From 2000 through 2008 437 companies in the S&P 500 Index in 2008 repurchased $2.4 trillion of their own stock. The average amount of repurchases per company declined from a then record $366 million in 2000 to $298 million in 2003, but then shot up to $1,256 million in 2007 before declining to $736 million in 2008.

Among the top 50 repurchasers in the United States for the period 2000 through 2008 were the two largest corporate health insurers: UnitedHealth Group at #23 with $23.7 billion in buybacks and Wellpoint at #39 with $14.9 billion. For each of these companies, repurchases represented 104% of net income for 2000-2008. Over this period, repurchases by the third largest insurer, Aetna, were $9.7 billion, or 137% of net income. In 2009 United Health Group spent $1.8 billion, or 47% of its net income on repurchases; Wellpoint $1.8 billion (56%); and Aetna $773 million (61%). When these health insurers increase their profits by raising premia, excluding people with pre-existing conditions, and capping lifetime benefits, the most likely use of those extra profits is to do more stock buybacks.

Why do business corporations repurchase stock? Executives claim that buybacks are financial investments that signal confidence in the future of the company and its stock-price performance. In fact, however, companies that do buybacks never sell the shares at higher prices to cash in on these investments. For a company to do so would be to signal to the market that its stock price had peaked, which no executive would want to do.

Instead, for their own personal gain, corporate executives sell their own stock after exercising their options to reap the gains from a rising stock price. The extent of that personal gain has been enormous. Since the 1970s there has been an explosion of executive pay. According to AFL-CIO Executive Paywatch, the ratio of the average pay of CEOs of 200 large US corporations to the pay of the average full-time US worker was 42:1 in 1980, 107:1 in 1990, 525:1 in 2000, and 319:1 in 2008. Data that I have analyzed from the Standard and Poor's Compustat database shows that the average annual real compensation in 2008 dollars of the 100 highest paid corporate executives named in company proxy statements was $20.7 million in 1992-1995, $78.2 million in 1998-2001, and $62.0 million in 2004-2007. (William Lazonick, "The Explosion of Executive Pay and the Erosion of American Prosperity," Entreprises et Histoire, 57, 2010)

Large proportions of these enormous incomes of top executives have come from gains from cashing in on the ample stock option awards that their boards of directors have bestowed on them - and that reward speculation and manipulation far more than innovation. The higher the "top pay" group, the greater the proportion of pay that was derived from gains from exercising stock options. For the top 100 group in the years 1992-2008, this proportion ranged from a low of 57 percent in 1994, when the mean pay of the group was also at its lowest level in real terms, to 87 percent in 2000, when the mean pay was at its highest. In 2000 the mean pay of the top 3000 was, at $8.9 million, only 10 percent of the mean pay of the top 100. Nevertheless, gains from exercising stock options accounted for fully two-thirds of the total pay of the top 3000 group.

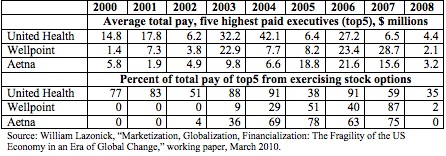

Health insurance executives have been well-represented among the highest-paid corporate executives in the United States. The table below shows the average total pay for the five highest paid executives at UnitedHealth, Wellpoint, and Aetna for 2000 through 2008, and the proportions of that pay that came from exercising stock options.

A serious attempt at health care reform would seek to prevent the profits of health insurers from being used to manipulate stock prices and enrich a small number of people at the top. Unfortunately, the need to control this type of financial behavior has not yet entered the Washington debate on health care reform. That, in my view, is a big mistake. The persistence of unregulated stock buybacks and unindexed stock options will ensure that the corporate executives who control the largest health insurers will remain part of our health care problem.

Cross-posted from New Deal 2.0.