In the last few months, China's economy has been faltering, and it has been having an effect on world financial markets. Due to this recent development, gold prices have shot up compared to what it used to be before.

During the period of the introduction of the Gold Reserve Act back in 1934, the price of gold was set to be $35 an ounce. That is a record increase of more than 300% between then and now.

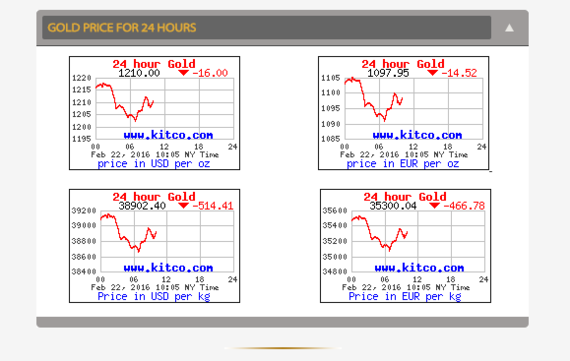

Actually, gold is a volatile investment. From the picture below, you can see how its price fluctuates within a period of just 24 hours.

Credit

When it comes to gold, prices can go down as well as up, and over the last few years they have done both. At the height of the recession, way back in 2011 for instance, gold hit a record high of $2,000 per ounce. But by the end of 2014, the price of gold had fallen to $1,200 per ounce.

Right now, the price of gold is hovering around the $1,250 mark, which is 18% higher than it was at the beginning of 2016.

Considering all these is gold a safe investment and if so, why should you invest in it now?

It provides a good option for diversification

To be a successful long-term investor, you must diversify. A lot of people are always quick to jump into shares and stocks. But judging from the financial meltdown that took place in 2008, it will not be a wise move to have only one form of investment.

This does not mean that gold prices shoot up when stock prices goes down or vice versa. Actually, they are not directly correlated in any way. But large chances are that when one is going down, the other will be going up.

Moreover, whenever there happens to be a case of global instability or turmoil, investors most likely flee to gold. And if this happens, the demand for gold will increase, and so will its price. At such times, you'd be glad to have diversified.

Different Ways to Invest in Gold

There are three main ways to invest in gold:

1.Exchange Traded Funds (ETFs)

This is a mutual fund type which trades on a stock exchange just the same way an ordinary stock does. ETFs track the price of gold and can be bought through an investment broker. Generally, it its portfolio fixed in advance, so it doesn't change.

2.Single Stocks

This involves investing in a gold mining company the same way you would invest in any other stock. The major disadvantage here is that it equally comes with the regular risks associated with single-stock investing. Worse still, there is also the risk of gold being highly volatile.

3.Physical gold

This option includes - coins, bars, bullion, and jewelry. For most people who would want to bury gold in the back of their houses, or keep it in their personal safe, this is the best option.

According to the World Gold Council, jewelry is the most popular way to hold gold, and accounts for nearly half of the global gold demand. Note here that price of a gold jewelry is directly proportional to its weight. So, the heavier the jewelry, the more expensive it will be.

Moreover, the karat number for most of these jewelries range from 24k in pure gold to 10k. This means that most of the jewelries actually contain about 41.7 percent gold.

Rising Gold Stocks

Gold is the investment of choice right now. Gold prices are on an upward trajectory, and for those who like a wild ride, now is a good time to invest your savings in gold.

Many large gold mining companies have done amazingly well since the start of the year with large price rises in their stock, but the long-term performance of gold stocks is questionable and unless you have a strong stomach for risk, it is probably better to stick to diversified gold ETFs instead.

The performance of gold is in direct opposition to other commodities, all of which have suffered in these uncertain economic times. However, the question for investors is: will gold prices continue to rise as investors seek a safe haven for their money, or will the price of gold take a tumble if the current economic woes turn out to be short-term and the markets bounce back?

Judging from history, you can see that gold is an investment that will remain a constant for many years to come. Very few commodities can compare to gold, and it remains one of the safest commodities to invest in.