A little-known company that specializes in protecting the public image and product identity of Fortune 500 companies is quietly buying up hundreds of domain names that could be used to host online criticism of the mammoth financial services outfit Bank of America.

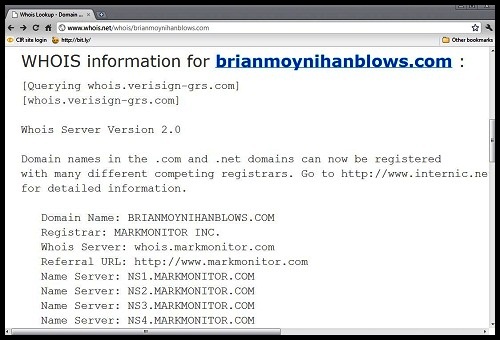

Tools like Whois.net allow the public to search web addresses and see who's paying to control them, unless the buyer used a go-between, which many corporations do. While Cironline.org, for instance, is clearly registered to the Center for Investigative Reporting, the site Nike.com is listed under MarkMonitor, Inc., rather than the apparel conglomerate's name.

MarkMonitor is a consultancy of sorts that helps multinational corporations safeguard their interests on the Internet by, among other things, "using defensive domain registration to block others from exploiting domain names associated with your brand," according to its website.

This is exactly what MarkMonitor appears to be doing for Bank of America, snapping up more than 400 domain names (such as brianmoynihansucks.com) in recent weeks that could feasibly be used as destinations for leveling hatred at the company. Notably the list of domains doesn't center on Bank of America as much as it does senior executives and board members, as the Wall Street Journal pointed out recently.

Why the sudden burst in apparent pre-emptive action? One theory is that Bank of America is bracing for a fresh release of documents from the anti-secrecy site WikiLeaks. Founder Julian Assange claims that a pile of confidential records from the computer hard drive of a top bank executive fell into his hands, and it's only a matter of time before they become public.

Assange told Forbes magazine in November that WikiLeaks "could take down a bank or two," and Computer World reported all the way back in 2009 that WikiLeaks had digital documents specifically from Bank of America, as much as five gigs worth.

While the bank's fingerprints don't appear directly on the newly registered domain names, it seems unlikely Bank of America had no role in the purchases. Take Brianmoynihanblows.com, Briantmoynihansucks.com, Catherinepbessantblows.org and Charleshollidayjrsucks.com. Brian T. Moynihan is Bank of America's CEO. Catherine P. Bessant is its global technology and operations executive. Charles Holliday is chairman of the bank's board. The unflattering domain names were registered by MarkMonitor on the same day, Dec. 17, 2010.

A BofA spokesman insisted to the New York Times recently that the domain registrations were not, in fact, associated with fears of a new document dump from Wikileaks. No other explanation for the timing was offered.

It's still not 100 percent clear that the pending release has to do with Bank of America, but the company isn't taking any chances. The mere possibility that leaked records could damage BofA has led to a dip in its share price. As a precaution, executives assembled an internal crew to prepare for potential fallout. Their efforts include examining records tied to Bank of America's $50 billion merger in 2008 with Merrill Lynch, a deal struck to save the latter from unprecedented market turmoil. The team's goal in part is to isolate "undisclosed documents that could embarrass the company," according to a Jan. 2 Times story:

In addition to the Merrill documents, the team is reviewing material on Bank of America's disastrous acquisition in 2008 of Countrywide Financial, the subprime mortgage specialist, [bank] officials said. The criticism of Bank of America's foreclosure procedures centers mostly on loans it acquired in the Countrywide deal, and one possibility is that the documents could show unscrupulous or fraudulent lending practices by Countrywide.

Domain Name Wire, an Internet trade publication, first discovered the purchases of embarrassing, anti-BofA domain names. A bank activist at the Center for Media and Democracy in Wisconsin, Mary Bottari, noticed that one major domain name had yet to be purchased: Breakupbankofamerica.com. So she bought it.

Bottari speculates that the potential document release could contain any number of things. Among them, she says, might be emails showing that executives knew they had endorsed toxic mortgage-backed securities for investors in past years.

Or there could be revelations about Bank of America's foreclosure practices, Bottari says, which have drawn criticism as families were ejected from their homes. They could also discuss questionably timed bonuses for Merrill executives awarded as Bank of America was receiving a massive loan from taxpayers to encourage the deal with Merrill.

It's not uncommon for major corporations to use "defensive domain registration" as a strategy for controlling online activity (Jcrewsucks.com and Xeroxsucks.com are both taken). Purchasing hundreds of such highly specific domain names, however, suggests Bank of America is concerned the company's image will fall under scrutiny soon. While the public waits for more news, Insidebankofamerica.com is still available.

G.W. Schulz joined the Center for Investigative Reporting in 2008 to launch its ongoing homeland security project. Read the project's blog, Elevated Risk, here.