The damn shutdown means no jobs report today, totally screwing up my monthly circadian rhythm. And depriving the markets, the Federal Reserve, and everyone else an important monthly snapshot of the job market at a sensitive moment. That last bit is especially relevant for the data-driven Fed, as they use the monthly payroll and jobless numbers as inputs into their when-to-start-the-taper analysis.

Now, I know I've always said that most everyone reads too much into these monthly jobs reports, given their relatively large confidence intervals and later revisions. (Truth be told, I usually say that right before I start reading stuff into it.) That's why I always average a few months together to smooth out some of the noise. By a moving average can't move if you don't have the next data point.

So I officially declare that this sucks. It's not kids being put on hold for a cancer protocol at NIH, nor is it millions of federal workers either furloughed without pay or actually working without pay (the latter group must get paid post-shutdown; the former has been paid retroactively in the past, but we'll have to wait and see). But it's an especially unfortunate time to not get our monthly look, even if it is fuzzy in a standard-error sense, at the entrails of the job market.

One must also note that while this is a serious bug in the shutdown plan, it's a feature for those who'd just as soon not give everyone a look at the economic impact of their obstructionist actions.

There are alternatives, though to me, it's like having the Bud Light instead of the Belgian Premium brew. The industrious Cathy Rampell provides the list here:

- Announced layoffs released by Challenger, Gray & Christmas

- NFIB Small Business Jobs Report

- Jobless claims (released by the Labor Department despite the shutdown, as they were collected earlier)

- SHRM Leading Indicators of National Employment

- The Conference Board Help Wanted OnLine data series

- ADP National Employment Report

- Gallup's Payroll to Population ratio

- Non-Manufacturing ISM Report On Business - employment index

- Manufacturing ISM Report on Business - employment index

I think most analysts would say that the most relevant entry on the list is the ADP report, a private payroll-administration service that tracks private sector payrolls in a way that mimics the BLS. That report, which came out on Wednesday with the September payroll numbers showed a lackluster 166,000 jobs last month and a downward revision of 54,000 for the prior two months. Not a strong showing and largely on track with a job market that appears to have slightly downshifted from a 200K monthly trend on payrolls to something a bit south of that.

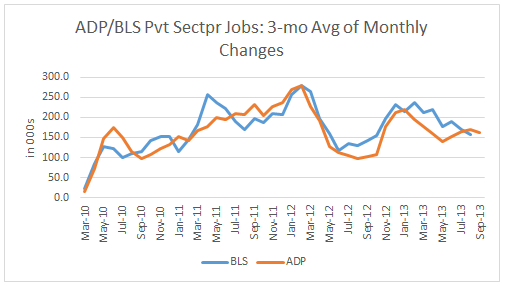

But the ADP only loosely matches the BLS results on a monthly basis so you can't easily go from the one to the other. The figure below plots three-month moving averages in monthly changes for both series, the ADP and the BLS private payrolls.

As you see, they track each other but with fairly sizable gaps (though again, those gaps are within the confidence intervals of each survey, I think). Most notable is the recent deceleration in both series, especially the BLS one, from monthly gains closer to 200,000 to those closer to 150,000.

I did manage to collect the data I needed for my own forecast on the September payroll number. For the private sector, I predict 170,000 for September, which is below the consensus estimate of 184,000. I've been consistently below the consensus in recent months, and I'm sorry to say I've been generally right.

All of which is to say that the last thing this economy needs right now are more self-inflicted wounds. The shutdown is a small wound; failing to raise the debt ceiling could easily be enough to take fragile recovery to robust downturn.

I've long stopped asking Congress to do anything to help the economy; I just want them to stop hurting it. It seems crazy to admit, but apparently that's too much to ask.

Sources: ADP, BLS

This post originally appeared at Jared Bernstein's On The Economy blog.