Some time ago the President of Kiva, Premal Shah, posted a thoughtful response to my article Zidisha vs. Kiva Zip. (His comment was originally posted here and is reproduced in full below.)

Zidisha is a nonprofit website that I founded as an alternative to traditional microlending platforms such as Kiva, whose loans must be passed on to borrowers at high interest rates (~35%) to cover field partners' administrative costs. Zidisha reduces the cost of microloans by eliminating field partners and allowing today's internet-capable borrowers to transact directly with lenders via an international person-to-person lending platform.

If Zidisha has created something of value, it's because we stand on the shoulders of giants: Kiva was a main source of inspiration for Zidisha, and one of my earliest exposures to microfinance was through work with a Kiva field partner in 2006. Kiva has done immense good by supplying microfinance organizations with much-needed lending capital, and its vision of human connection across geographic barriers has fired the imaginations of people worldwide.

It would be a shame if this vision were to grow static and atrophy through failure to adapt to changing technology. The world is so different now from a decade ago; many microfinance borrowers are online and can be served in new and better ways. It's why I've dedicated my life to building Zidisha, and is why I disagree with any dismissal of innovations that disrupt the "classic" Kiva model.

Mr. Shah seems to be contending that the "tried and true" traditional approach to microfinance is more worthy of support than disruptive models such as Zidisha. This argument rests on two flawed assumptions, and one debatable value judgment. The flawed assumptions are 1) the use of field partners results in high repayment rates at the borrower level, and 2) direct person-to-person models like Zidisha cannot offer financial sustainability to lenders. The debatable value judgment is that philanthropic microlending platforms like Kiva and Zidisha should optimize predictable returns for lenders, rather than higher profits for borrowers.

I think these three myths are shared by many thoughtful people who care deeply about the future of microfinance, and I'd like to address them here.

Myth #1: Over 98% of Kiva borrowers repay their loans

Mr. Shah cited a figure of "4% loans at risk on 'classic' Kiva.org," and I see that 98.85% of loans made through Kiva.org have been repaid to lenders. However, my understanding from analyses such as this one is that the repayment rate at the borrower level is probably far lower than 98%. The reason is that the field partners typically cover borrower defaults unless the partners themselves go out of business. The field partners do this to preserve their ability to raise funds through Kiva. The cost is borne by borrowers, who pay hefty interest and fees to cover the partners' operating costs.

Myth #2: Zidisha cannot offer financial sustainability to lenders

Mr. Shah cited a figure of "41.9% loans at risk on new Zidisha.org." He does not indicate how that figure was calculated, but it is inaccurate by the traditional PAR>30 measure (the percentage of outstanding principal held by borrowers over 30 days past due on repayments). I assume that the 41% loans at risk figure includes loans that have been rescheduled.

At Zidisha, though, rescheduling a loan means something different from rescheduling at traditional microfinance institutions. Rescheduling a loan at Zidisha is simply an option for borrowers to adjust their weekly repayment installment amounts up or down to accommodate changing financial circumstances. We allow this because household incomes in the informal sector in developing countries are often very erratic. It is common at Zidisha for borrowers to take advantage of our rescheduling option to reduce installment amounts for a few weeks to accommodate school fees or medical bills, then to increase installment amounts again once disposable income returns to normal. Such loans are termed "rescheduled" at Zidisha, but are not any more at risk than loans that have not been rescheduled.

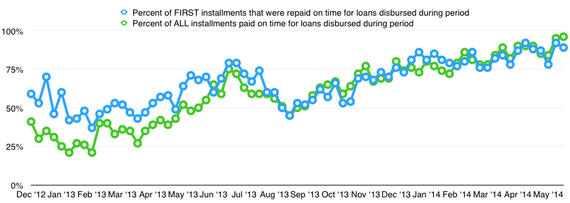

Zidisha's repayment performance today is substantially better than in the past. The following graph illustrates how the on-time repayment rate has evolved since early 2013, when we first began lending at substantial volumes:

Loans issued in early 2013 did have lower repayment rates: between 70% and 85% is our best estimate. Since then, we've focused on continuously improving our lending model in response to lessons learned. If we assume that the ultimate repayment rate will continue to improve in proportion to the timeliness of early repayment installments, an ultimate repayment rate of between 85% and 95% would be a reasonable prediction for today's loans.

Finally, Mr. Shah's comparison of repayment performance at Kiva and Zidisha left out a relevant fact: at Zidisha, lenders can offset credit risk with interest earnings. For loans issued through Zidisha during the past six months, interest income has often exceeded expected default losses - so there is a reasonable likelihood that lenders today will preserve the value of their funds over time.

Of course, lending through Zidisha is still risky, and we haven't been around long enough to predict credit risk with certainty. We recommend it for philanthropy only, and do our best to ensure that nobody lends amounts they cannot afford to lose. But it is misleading to imply that Zidisha's lending model inherently results in losses for lenders.

Myth #3: Optimizing for the wrong thing

Kiva's field partners must charge high interest rates to the borrowers to cover their operating costs. In return, they offer stability to lenders by covering most borrower defaults. I would question whether this high-cost (to borrowers), low-risk (for lenders) model is really optimal for a philanthropic service.

Platforms like Kiva and Zidisha are not meant to be used as savings or financial vehicles. Lenders participate primarily because they wish to help borrowers. It seems counterproductive to prefer a model that charges excessive interest to the borrowers for that assistance, in order to have a near certainty of receiving the full $25 lent back. I think the classic Kiva model is optimized for the wrong thing: it does a good job of minimizing risk to lenders, but at the cost of undermining social impact by making borrowers pay dearly for that risk mitigation.

At Zidisha, lenders assume more risk: $100 worth of loans might return something less neat, like $96.85 or $103.15 after currency fluctuations and credit risk, depending on the interest rate the lender has chosen. The lender sacrifices the comfort of getting back the precise amount lent, but can personally ensure that the end borrower is not paying excessive interest rates and is therefore more likely to profit from the loan. And isn't that the whole point?

Disruptive innovations like Zidisha are inherently risky because of their novelty: unlike traditional microfinance models, there is no established roadmap to follow. But it is short-sighted to write them off because their risk structures look different from the traditional microfinance programs we are used to. Zidisha is achieving financial sustainability at far lower cost to the borrower than traditional microlending programs. Developing unpredictable, disruptive innovations like ours is one of the best philanthropic investments one can make.

Premal Shah (Premal_Shah)

258 Fans

I help lead Kiva and want to add perspective.In 2011, we launched a similar program to Zidisha called KivaZip.org. It allows for direct lending at 0% interest to entrepreneurs in Africa and the U.S. Kiva Zip levers trust networks & payment technologies like PayPal and M-Pesa to drive down the cost vs. "classic" microfinance.

One key challenge in new models is maintaining high repayment rates, an area where classic microfinance excels.

Consider % of active loans currently at risk of default by website:

-- 12.8% loans at risk on new KivaZip.org

vs.

-- 41.9% loans at risk on new Zidisha.org

vs.

-- 4% loans at risk on "classic" Kiva.org

High repayment rates are essential to creating a sustainable, scalable model. 2.5 billion people still lack access to formal financial services, including loans. Their best option is often the local money lender (+100% interest rates).

Classic microfinance offers a cheaper alternative (~35% interest rates) while maintaining high repayments which enables true scale (+150M people reached to date).

Innovations that dramatically lower the interest rates in microfinance are sexy, but high repayment rates are crucial for impact at scale. We love early support of new models like Kiva Zip and Zidisha -- despite high repayment risk -- to find breakthroughs. But until this point, let's also honor the role of classic microfinance as cheaper alternative that can reliably scale.

6 MAR 4:27 AM