Tuesday marks the 84th anniversary of the stock market crash of 1929, also known as Black Tuesday.

Despite the many decades that have passed, one big lesson of that terrible day is as vital as ever: Our financial system needs strong regulation to survive and thrive.

Here's a refresher on what happened:

On October 24th, 1929, after several weeks of falling stock prices that marked the end of a speculative bubble, investors started to panic. Nearly 13 million shares were traded that day, a record at the time, as the trading slowly built into a frenzy. That left a mountain of ticker tape to sweep up at the end of that day.

Despite attempts to stabilize the market, investors kept freaking out. On October 29th, investors traded more than 16 million shares, losing billions and crashing the stock market in the process. Wall Street workers flooded the streets in front of the exchange amid the panic.

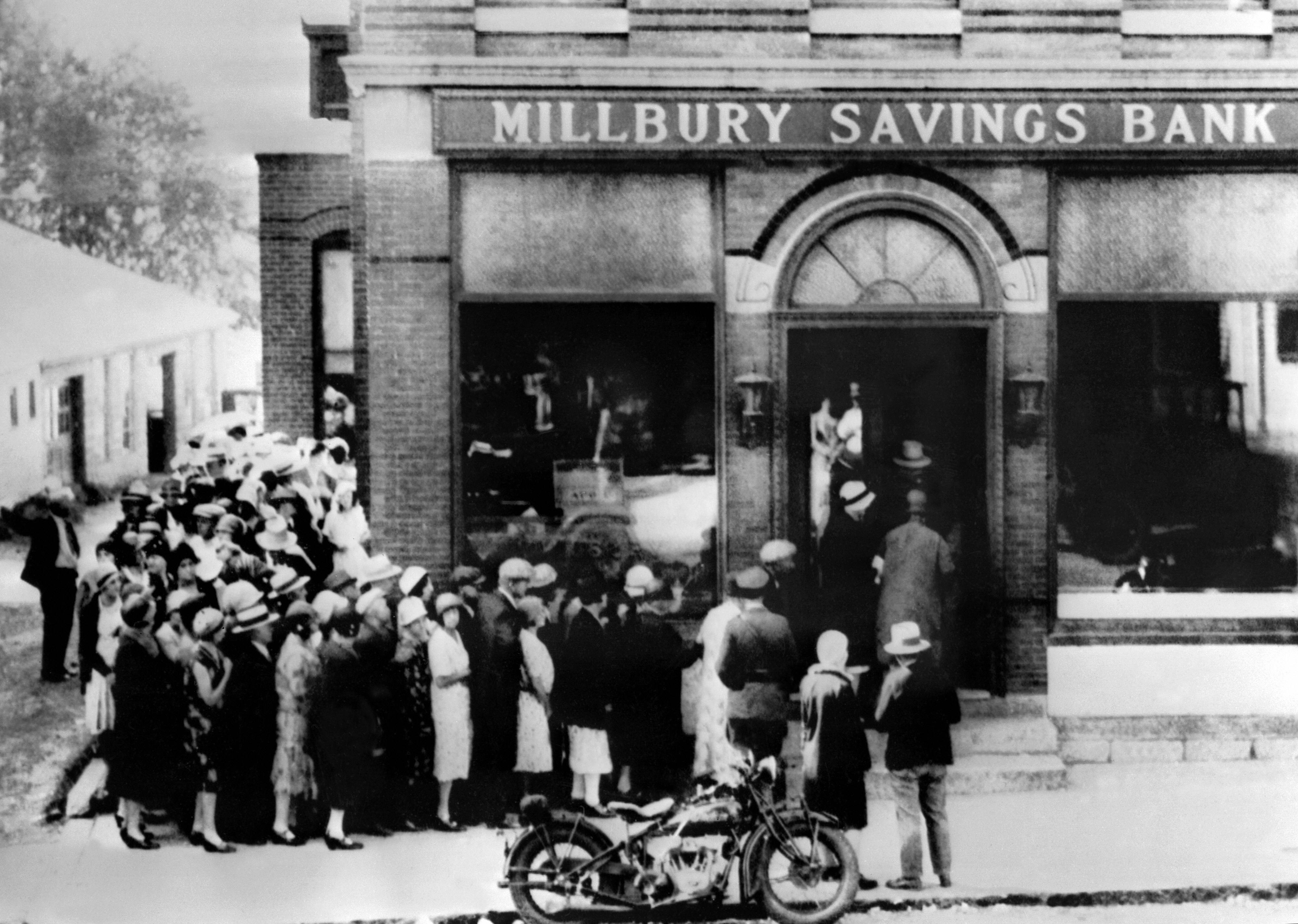

The crash helped launch the country into the Great Depression, an economic collapse that drove unemployment to a peak of 24.9 percent.

The depression saddled the country with poverty and slow economic growth until the end of World War II in 1945.

What made these awful things possible? Well, a lack of financial regulation in the years leading to the crash is largely to blame. Unregulated banks lent freely to speculators, who puffed up the stock market to unsustainable heights. When it all came crashing down, there were no government protections for investors or the unemployed, worsening the economic collapse.

The disasters of Black Tuesday and the Great Depression inspired policy makers to build many of the regulations that still protect the economy today, including curbs on speculation, bank-deposit insurance and the social safety net. But memories fade, and a de-regulatory fervor in the 1980s and 1990s helped set the stage for the financial crisis we suffered in 2008.

The regulations put in place after the Great Depression helped limit the damage of the 2008 crisis, leaving us only with a Great Recession.

Despite these lessons, many on Wall Street and in Washington still are skeptical of the need for regulation. They have resisted financial reforms since the 2008 crisis, and some are working to deregulate our financial system even more.