Today, Liberty Interactive announced they would acquire Zulily for $2.4 billion. That's $18.75 per share, which represents a 49% premium to the previous day's close of $12.57. Keep in mind, the company went public less than two years ago at $22.

What Went Wrong at Zulily?

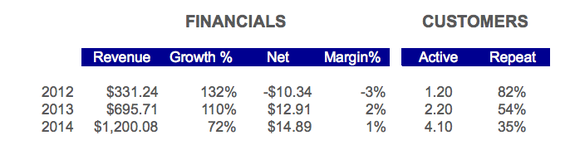

If we merely look at the top layer of Zulily, we see a promising company. Strong revenue growth. Increase in profitability. Active customers doubling each year. That's why we always need to look at the thing behind the thing. We want to understand what was driving their customer and revenue growth.

The last column below is telling. Despite an increase in active customers, the retention rate was dropping. I believe it had a lot to do with the type of deals it used to lure customers onto their platform. Does this story sound familiar? If you've been around for a while, you may recall Groupon's dilemma with attracting the wrong customers.

All Customers Are Not Created Equal

The customer is not always right. In fact, some customers are always wrong. Wrong for your brand that is. By deploying an excessive number of deep discount promotions, you attract the wrong customer. In fact, you tarnish your brand. People begin to associate your brand with a bargain.

As much as we hate to calculate lifetime value (LTV), let's do some basic math. Wrong customer is attracted to your 90% off baby sunglasses promotion. You paid $100 for the sunglasses, but will let them go for $10 because you are focused on customer acquisition. You hope to sell this customer a baby bikini down the road and make up for your loss. The problem is this customer snagged your $10 sunglasses and purchased a $10 baby bikini at Target, America's favorite discount store. Sadly, wrong customer never came back. The LTV for this customer was $10. Next, let's factor in your customer acquisition cost. If it was over $10, you just lost time and money luring the wrong customer.

Flashers vs Fans

I like to refer to people who are attracted to flash sales as flashers. They want to get in, get a thrill, and get out. As an entrepreneur building a company, you don't want flashers, you want fans. Apple is the epitome of a fan building company. People don't come to Apple for a deal, they come to Apple because their products are interwoven into their lives. They come to Apple for the way Apple makes them feel.

All is not lost. If you are running a site similar to Zulily, focus on creating a unique experience with your customers. You can implement deep discount deals from time to time, but make sure you have a way to turn flashers into fans.