As Republicans and Democrats look for areas where they can work together, they should be able to agree to make permanent three key provisions of two pro-work tax credits: the Child Tax Credit (CTC) and Earned Income Tax Credit (EITC). More than 16 million people in low- and modest-income working families, including 8 million children, would fall into -- or deeper into -- poverty in 2018 if these three provisions expire as they are currently scheduled to do after 2017, our new paper (with state-by-state data) shows. Some 50 million Americans, including 31 million children, would lose part or all of their credits.

The EITC and CTC encourage and reward work, and there is growing evidence that income from these credits leads to improved school performance, higher college enrollment, and increased work effort and earnings in adulthood.

Both credits have enjoyed bipartisan support, and their underlying provisions are permanent parts of the tax code. But several key features of the credits will expire at the end of 2017 unless lawmakers act.

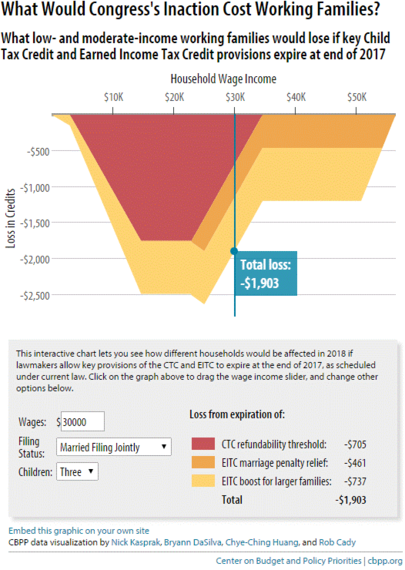

The stakes are high for millions of workers in low-wage jobs, from custodians to health care workers. If these provisions expire:

- Not one penny of earnings of a full-time, minimum-wage worker would count toward the CTC. For example, a single mother working full time at the minimum wage and earning $14,500 would thus lose her entire $1,725 CTC. That's because the earnings needed to qualify for even a tiny CTC would jump from $3,000 to $14,700. The earnings needed to qualify for the full CTC (of $1,000 per child) would jump from $16,330 to more than $28,000 for a married couple with two children, so many low-income working families that would still qualify for the CTC would see their credit cut dramatically.

- Many married couples would face higher tax-related marriage penalties due to a cut in their EITC. To reduce marriage penalties, the income level at which the EITC begins to phase out is now set $5,000 higher for married couples than for single filers. After 2017, it would be set $3,000 higher, which would shrink the EITC for many low-income married filers and increase the marriage penalty for many two-earner families.

- Larger families would face a cut in their EITC. After 2017, the maximum EITC for families with more than two children would fall more than $700 to match the maximum for families with two children.

Some 65 percent of the families that would lose part or all of their credits include at least one full-time, year-round worker. About 450,000 veteran and armed forces families with children would lose all or part of their CTC in 2018; a similar number would lose all or part of their EITC. Also, 15 percent of the families that would lose all or part of their credits include at least one member with a disability.

For more on the impact on specific types of families if the provisions expire, see this interactive calculator.

Related Posts: