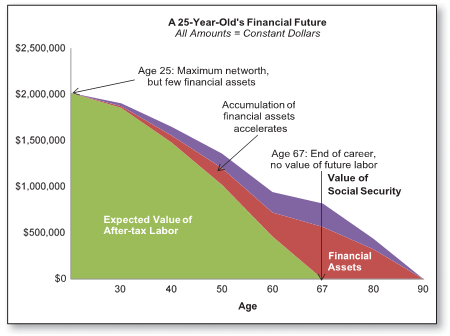

If a picture is worth a thousand words, the chart below is worth several million dollars. It shows that the largest source of wealth is not your money, but your labor - your skills, energy and time that you "sell" in the labor market, whether you work for someone else or run your own business. On this Labor Day, take a moment to examine and celebrate your labor wealth and the implications for your financial security.

The Financial Game of Life

The chart above describes the basic financial game of life we all play. As young adults, we are cash poor, but each of us has significant wealth in the form of our labor potential - our ability to "sell" our skills, time and energy as either employees or entrepreneurs - throughout our working years. The value of this wealth, $2,000,000 in this example, is determined by a person's remaining working life, natural aptitude and skills, education and career choices. Regardless of the type of career a person pursues, we all have the same financial objective: convert our labor potential into financial assets and social security benefits so we can support ourselves and our family during retirement when we have exhausted our labor potential. The example above represents an expected outcome for a 25-year-old college graduate. Early in his career, he has few financial assets, but significant wealth in the form of labor potential. As he progresses in his career, he is able to save progressively more and his financial wealth is likely to increase exponentially later in life through more savings and compounding investment returns. Finally, by age 67 when he has exhausted his labor assets, he has accumulated approximately $1,000,000 in financial assets in the form of retirement savings and social security. During the remainder of his life he will use these assets to support his consumption and if fortunate have some assets left over to give to his legacy.

The exact progression or outcome of this financial game of life is sure to be different than depicted above and this chart is rife with assumptions that cannot be determined with accuracy today such as lifetime earnings, future tax rates, saving rates, investment returns, retirement age, and life expectancy to name a few. In spite of these significant shortcomings, the chart makes one thing clear: labor is the greatest source of wealth for most people, and the greatest opportunity to create significant wealth results from effectively managing your labor.

With this premise in mind, here are six important insights that are worth remembering this Labor Day:

1. Play defense before offense: Given that your labor is your largest asset, the first and most important investment is to protect this asset through insurance. Disability insurance, life insurance and liability insurance protects the family from the "going out of business" scenario.

2. Maximize lifetime compensation over annual compensation: Your journey to financial security is not achieved by maximizing income this year, but rather maximizing income over your entire career. Make decisions that increase compensation, employability and longevity to maximize your career earnings. Take the long view!

3. Improve your labor value through investment: Investments in yourself in the form of education dramatically increase the lifetime value of your labor by increasing average income, employability and the ability to work later in life. Invest in yourself early and often to maximize the value of your labor. These investments likely offer far higher returns than other alternatives such as stocks or bonds.

4. Keep your eye on the prize: Throughout life you will face a myriad of financial decisions related to home purchases, saving, investing, insurance and retirement. Financial advisors often myopically focus on these is issues to the detriment of the big picture. The foundation for financial security must begin with effective labor asset management. By maximizing your labor value, you will maximize your financial security.

5. Your labor asset must be actively managed: Think like an investor when managing your labor. As in investor you must allocate your labor to the opportunities that offer the greatest compensation in a variety of form to include cash, bonuses, stock, valuable experiences and personal brand development. Not all jobs and industries offer the same quality of opportunities. Financial success isn't just the product of hard work and talent - it's also the result of the industries and employment you choose.

6. Use your capital to hire yourself: Buy combining your own money with your highly developed labor resulting from the recommendations above, you are well-positioned to become your own boss as a small business owner. This choice often offers the best return on both your labor and capital, a great sense of accomplishment and more autonomy.

These six principles provide a valuable framework for navigating the important financial decisions in the financial game of life and highlight that the most important decisions for achieving financial security often relate to your labor, not your money. By focusing on these high-impact choices to maximize your labor assets AND your financial assets, not only can you play the financial game of life, you are likely to win!

Douglas P. McCormick (@doug_mccormick) is the author of FAMILY INC.: Using Business Principles to Maximize Your Family's Wealth (Wiley; www.familyinc.com). As Co-founder and Managing Partner at HCI Equity, McCormick has spent two decades as a professional investor working with entrepreneurs to help them grow their businesses to create sustainable long-term value.