We've all heard the abysmal stats about kids and money (the latest: only a quarter of young adults have even the most basic financial literacy skills, according to a study from George Washington University and PwC).

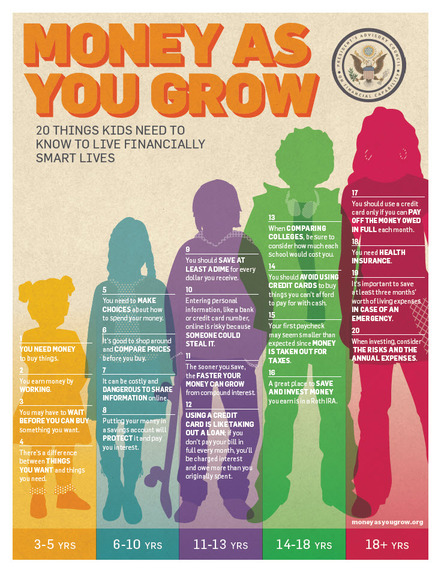

That's why, as a member of President Obama's Advisory Council on Financial Capability, I spearheaded the creation of Money as You Grow. Launched in 2012, MoneyAsYouGrow.org offered families 20 essential, age-appropriate financial lessons with corresponding activities. Upon its launch, it quickly became clear that parents badly needed this information: This little site that could went viral, attracting nearly 1.4 million unique visitors to date.

To continue sharing the site--and its lessons--with American families, the Consumer Financial Protection Bureau (CFPB) adopted Money as You Grow and launched a new version of the site on March 17, where it will continue to grow and serve parents and caregivers. Money as You Grow is now fully updated to reflect the CFPB's recent research reported in "Foundations of Financial Well-Being," which examines the most effective ways to teach kids about money from ages 3 through 21. I can think of no better home for the site than our country's vigilant consumer watchdog.

I encourage you to visit the site at consumerfinance.gov/MoneyAsYouGrow

Here are just a few of the new lessons and activities you'll find:

- Early Childhood: Play pretend Help your child go on a pretend shopping trip, visit a bank, open a new store, or even invent a new country with new types of money. Through pretend play and everyday activities young children can develop thoughts, attitudes, and behaviors that will lay the foundation for their later financial well-being.

Before you spend money, have a plan in mind. Practice making a list before you go to a store or on a shopping trip. Ask your child to set a goal for something she wants, and talk about the steps it would take to get it. Play strategy games like Chinese checkers and mancala to strengthen your child's focus on planning ahead.

Of course, none of this could have happened without the tireless work of the President's Advisory Council on Financial Capability and our remarkable colleagues at the CFPB, not to mention the enthusiasm of the million-plus families who visited MoneyAsYouGrow.org. I hope children and parents will continue to turn to Money as You Grow as a valuable resource, as well as download/print the free Money as You Grow posters.

Beth Kobliner is the author of the New York Times bestseller Get a Financial Life: Personal Finance in Your Twenties and Thirties, and is currently writing a new book for parents, Make Your Kid a Money Genius (Even If You're Not), to be published by Simon & Schuster. Visit her at bethkobliner.com, follow her on Twitter, and like her on Facebook.