Last week we ranted a bit on the market reaction to the February employment data. The assumption being that equity traders had another temper tantrum over a perceived Fed move in the future. We noted that there was already a high likelihood that the Fed is targeting its June meeting for the long awaited first increase in Fed fund rates in nine years. It was the June 29, 2006 Federal Open Markets Committee (FOMC) meeting when the Fed last increase the Fed funds rate, moving it from 5 percent to 5.25 percent.

Think of that number and it seems silly that the market would again react negatively on good news. One because the Fed has proven over many years that they are not going to turn into hawks overnight and increase rates a full point and two because a mid-2015 tightening is already in the cards and, regardless, will be minor.

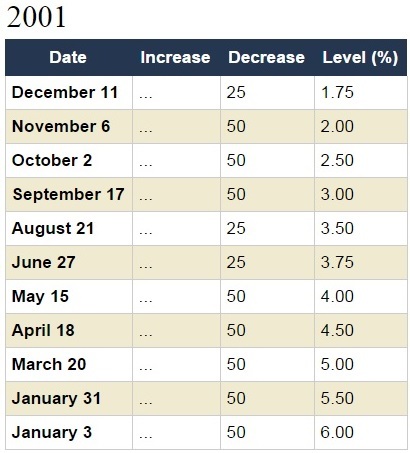

Just take a look at Fed activity in 2001 (see table below). The fed cut rates from 6.5 percent to 1.75 percent in one year. The vast majority of which happened prior to 9/11. Yes, the market was in a massive bear market -- one long overdue -- but it makes us seem ridiculous to be panicking over a potential 25 basis-point increase several months in the future.The Fed has not adjusted rates for six years and has not increased rates in almost nine years. We have been in a near-constant state of panic contemplating when, over the next year or so, the Fed would raise the Fed funds rate by 25 basis points!

So perhaps there is more to the negative reaction to the news than meets the eye. Perhaps we are making an assumption that we shouldn't,i.e. the market is worried rates will rise in June rather than in September. Just as the markets can climb a wall of worry -- discount negative news and buy stocks on a bullish long-term outlook -- it is possible that the market can ignore good news based on a longer-term bearish outlook.

Market technician Jeff Greenblatt (aka Fibonacciman) acknowledged that the sell-off was most likely due to worry the strong jobs number would hasten a Fed tightening but noted, "Taking this from a pure stock market view, it should be viewed as better news than not. If [the market] is not going up on better news that means the market is likely priced to perfection and it is in some kind of transition."

A market in transition can mean only one thing in our current environment. A potential top and the beginning of a bear market or longer-term correction. In a sense the market has been in transition for a year. Moving from an easy money generated bull to one that has to stand on its own fundamentals. The idea of that though, is that it could and perhaps should be able to rally on good news. If, however, the only good news -- from the market's perspective -- is maintaining a zero-interest-rate policy (ZIRP), then there can be no good news because ZIRP can't last forever.

It seems that the market should have learned this by now and perhaps it has and there is more to this sell-off -- as this week's market action may indicate -- than meets the eye.