If all of those angry customers really do flee Netflix in a rage over the recent price hike, will the big winner be Redbox? Or will some of the cash flowing through Netflix disappear -- POOF! -- as Americans cut back on watching home movies, all alternatives being too expensive or unappetizing?

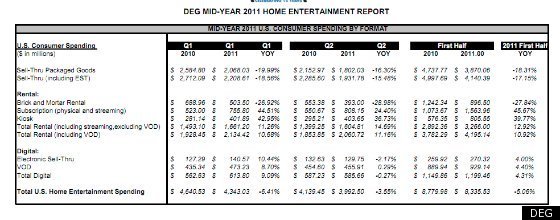

The Digital Entertainment Group, an industry-funded non-profit that advocates for the purchase and rental of all home entertainment, has released its 2011 mid-year financial figures (PDF), and it appears that buying movies may be going the way of Betamax. OK, that's an overstatement. DVD and Blu-Ray sales ($4.14 billion in the first half of 2011) are still about on par with rentals ($4.195 billion) in terms of total revenue, and Blu-Ray sales actually rose slightly from the year before; but overall sales of physical media have plummeted over 18 percent from last year, while digital sales growth increased a meager 4 percent.

Rentals, however, are booming: Streaming-and-rental services like Netflix and kiosk machines like Redbox have leapfrogged movie sales in terms of total dollars spent, as the new data on how consumers watch movies at home shows:

Now, a couple of caveats about the huge drop in sales of physical media. First, according to DEG, Blu-Ray sales are up 10 percent, and digital sales (like those through iTunes) are up 4 percent from last year; it is DVD sales that are lagging so badly. DEG attributes this plunge to an "Avatar" effect: That movie sold so well, says the DEG report, that sales were bound to be worse this year by comparison. "Avatar," which was physically released in April 2010, sold more than 12 million units alone in the second quarter of 2010. That's a whole lot of Na'vi, and a whole lot of money, too.

With rentals from brick-and-mortar stores like Blockbuster also down over 28 percent, as the former movie giant begins to shut down its physical locations, non-traditional movie rentals are ruling the day: The services provided by Netflix and Redbox surged upward, with revenue from "physical and rental streaming" rising 45 percent, and rentals from kiosks (like Redbox) increasing almost 40 percent from the same period last year.

Though DEG declined to divulge a company-by-company breakdown of these figures, it is fair to assume that Netflix (which claimed over 60 percent of the streaming market as of March 2011) and Redbox (which accounted for 35 percent of all DVD rentals in January 2011, beating out both Netflix and the brick-and-mortar stores) have been significant drivers contributing to growth in these areas of the market.

As Netflix rakes in money to its own coffers, a good deal of that money is going out again to Hollywood studios. Viacom recently released its Q2 numbers, and it saw an almost 40 percent increase in profits. According to the Wall Street Journal, Viacom said that "at least half of its 20 percent growth in U.S. subscription-fee revenue was attributable" to its new digital-licensing deals, including the one it recently negotiated with Netflix.

This Netflix payout came after the company spent almost $1 billion to secure the rights to serve up content from Paramount, Lions Gate and MGM films in August 2010, and the tens of millions of dollars Netflix pays annually for the rights to distribute films from the Starz channel.

Netflix, then, is making everyone -- Hollywood, movie studios and, yes, themselves -- a lot of money. Sure, the revenue that Netflix brings in is not the sum of all the dollars spent on home entertainment each year; but, given that it is a pretty significant hunk of money, and that Netflix perhaps aids sales of movies by allowing its users to "watch before they buy," it is worth keeping an eye on how the subscriber price hike affects their user base.

Subscription-based movie streaming is incredibly valuable to the movie industry. It makes up over 35 percent of the total revenue from rentals, and it appears to be what viewers will want in the future, if its growth this past year is any indication. Whether or not this streaming continues to be done through the movie mammoth Netflix depends on a few factors: First, whether there really will be a "Netflixodus," with significant numbers of angry users abandoning the service for alternatives like Redbox; second, what kind of price increase the studios are going to demand from Netflix when contract renegotiations for content-streaming begin next year (one analyst suggested in an interview with CNN Money that the studios could seek ten times as much moolah this time around); third, whether Netflix will be able to get content its customers actually want to watch, as a March 2011 CNET report claimed that studio heads wanted to make Netflix's streaming site "a good outlet for the least-valuable material ... where only the most dated and least popular titles are available"; and finally, whether an honest-to-goodness streaming competitor arises to challenge Netflix.

As I wrote earlier, the real alternatives to Netflix are slim, and with some studios "spooked" at the prospect of making their product available for streaming online, they should remain that way. Sony has recently been pumping up Crackle, its own subscription-free streaming movie site, but otherwise, the studios seem happy to disseminate their content through more traditional media streams: at the dying movie stores, over stagnating digital purchase models like iTunes and Walmart's Vudu and, most progressively, at Redbox and Blockbuster kiosks around the country. Only time -- and money -- will tell if Netflix can remain the popular rental and streaming giant it is today. Popular Sony movies like "The Social Network" and "Salt" disappeared from Netflix streaming in late June; could blockbusters from the other studios be far behind?