It looks like Halloween has come early this year for Wall Street Democrats. Costume season is months away, but the trend of Third Way types disguising their plans to gut Social Security as "progressive" is hotter than ever. Exhibit A: financial executive Robert Pozen, whose 2005 Social Security proposal was so "progressive" it earned the support of none other than George W. Bush.

Pozen recently took to the pages of the Washington Post to admonish progressives to "lead the charge" on Social Security "reform" (read: cuts). Pozen is certainly not the first pseudo-Democrat to champion benefit cuts under the progressive banner. But what makes Pozen's approach so novel is why he thinks progressives should get behind Social Security "reform." Unlike his colleagues at Third Way, who erroneously took progressives to task in January for not even recognizing that in 27 years Social Security will have a modest financial shortfall, Pozen hardly even mentions the solvency question.

No, Pozen's main argument for reform is that Social Security is "no longer progressive." Thus, progressives should warm to the idea of overhauling the program in order to restore it to progressivity. Pozen then offers a vague outline for "progressive reform" that is nearly identical to the Bowles-Simpson plan and various other extreme center-right reform proposals floating around: raise the retirement age, dramatically scale back benefits for the middle class, turn Social Security into a hated welfare program, and throw Democrats a bone with one minor revenue increase. Pozen's reform plan is at best two-thirds cuts, one-third revenue increases.

Many experts have already dissected the provisions of his plan in greater depth, so I'll save my breath.

Instead, I want to take down Pozen's mischaracterization of Social Security as "regressive" -- the claim upon which his entire case for reform is based. Because Social Security provides benefits to middle class people, and not just the poor like other programs, the myth that Social Security is no longer progressive is one falsehood in Pozen's column that could have sticking power.

Social Security was, and is still, progressive. Here's why:

- The lower your lifetime wages, the more you get out of Social Security. The key figure to look at in assessing Social Security's progressivity is the extent to which Social Security benefits substitute your annual pre-retirement earnings, because it is the best indicator of whether Social Security accomplishes its goal of preserving Americans' pre-retirement standard of living, and preventing poverty in old-age (as well as disability, or death). This figure, aka the program's "replacement rate," is decidedly progressive and was specifically engineered to be that way. The lower your pre-retirement earnings, the higher the program's replacement rate. For low-wage workers, Social Security replaces as much 90% of their pre-retirement annual wages; for upper-income workers the replacement rate is often closer to 15%.

- Flat tax rate, progressive benefit formula. One of the reasons people are so often under the impression that Social Security is a regressive program is that it has a flat tax rate. Unlike income taxes, which are paid in progressively higher rates, every worker pays the same 6.2% of their earnings in payroll taxes to finance Social Security. But in fact, the flat tax conceals the progressive nature of the benefit formula, which allows for a higher replacement rate the lower down on the earnings distribution you are. The revenue from the contributions of higher earners partially subsidizes the benefits of the low and moderate-income workers, allowing them to enjoy a larger replacement rate. Call it redistribution by stealth.

- The link between earnings and benefits. Benefits are earnings-based, so even though the replacement rate is higher for lower earners, higher earners still receive higher benefits in absolute terms. But that's what keeps the system fair and popular. Social Security was intended as a wage insurance program that workers purchase through their payroll contributions to safeguard against the "vicissitudes of life," as FDR put it. There are, no doubt, a small number of wealthy individuals who could support themselves and their families very well in retirement, disability, or death, without Social Security's help. But FDR knew what some politicians have apparently forgotten: the support of the rich and powerful is essential for the financing of any government program. Since Social Security benefits are universal, the rich have a financial stake in its survival, and do not feel that they are simply underwriting other people's lifestyles. As a result, the program has been inoculated from the funding cuts that the upper middle class and the rich have successfully fought for in numerous other government programs.

- Benefits are already capped for the rich. Since Social Security's inception, benefits have been capped for wages above a certain level. Right now that means wealthy Americans do not receive Social Security benefits on earnings above $106,800. So whatever check we send to Warren Buffett, as the Pozens of the world love to remind us, it is no more than around $27,000 -- hardly a windfall for him, and financially insignificant for the program. It is true that having the cap in place also means wealthier Americans are not taxed on earnings above that amount, but that is a reason to consider increasing the cap, while continuing to keep replacement rates low or non-existent on earnings above it--not a reason to lament how "regressive" Social Security is. (For more details on a plan that does just that, see Rep. Deutch's "Preserving Our Promise to Seniors Act.")

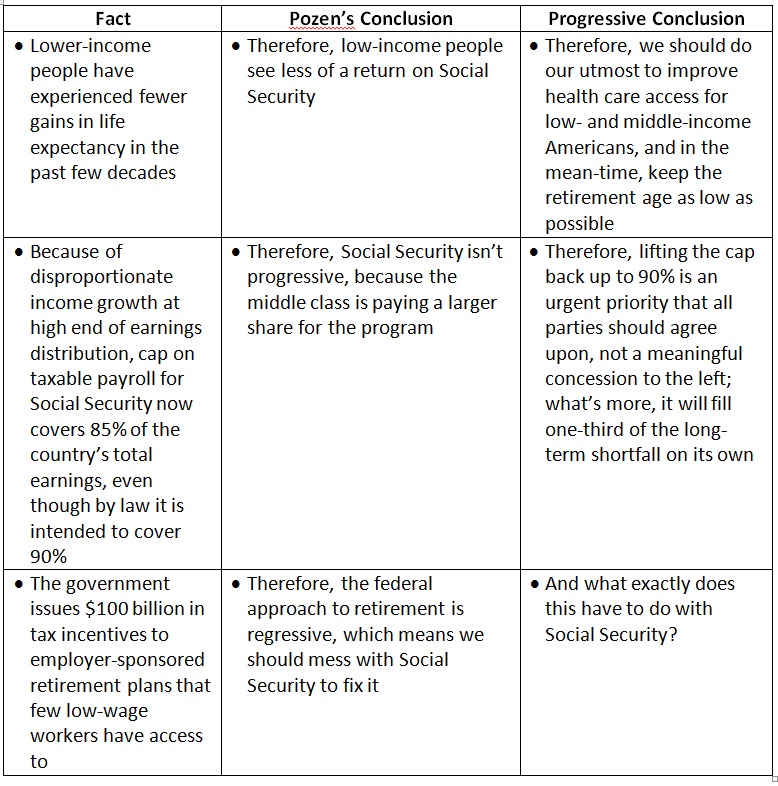

Pozen claims that Social Security is "no longer progressive" for three reasons that have nothing to do with Social Security's progressivity as a program.

Social Security is the most successful, progressive antipoverty program in American history. In 2009 alone, Social Security lifted 20 million people out of poverty, and lessened the poverty of millions more. (Does that sound progressive to you?) That's why if there's any lesson to take away from Pozen's article, it is that we must be skeptical of center-right Democrats whose primary reason for "reforming" Social Security is that it is somehow "no longer progressive."

The truth is, progressives have already been leading the charge on progressive reform. For evidence of that, one need only look here, here, and here. It's just that Pozen's idea of "reform" isn't progressive at all.