Many entrepreneurs and business owners will ask our financial planning firm, "What's the best financial advice you can give to a business owner?" The truth is, there are so many ways a business can waste money without realizing it.

Most people are shocked when we tell them the most common mistake we see businesses make is not knowing what they are paying for their company 401(k) plan. When we say pay for, we don't just mean price. However, we have found that almost every company that asks us to review their retirement plan pays 25-50% more than what they should be paying for their plan, which I will get more into at the end of this article...

Ok, so paying too much for your 401(k) may be tolerable for the average person, but once they learn what services they are paying for and not receiving, they're shocked.

What Most Business Owners Don't Know

If I asked you, the reader, what the term "fiduciary" means, would you be able to answer? Congratulations if you can, because we find that most people cannot. In short, a fiduciary is someone who is responsible or accountable for putting the participant's interest ahead of their own. Many business owners (or the plan sponsor who is the person in charge of the company retirement plan) don't know that they are a fiduciary to their plan and are liable for the decisions they make when choosing and setting up their company's retirement plan.

This includes a lot of responsibility, such as the "responsibility for selecting and monitoring the investment alternatives that are made available under the plan." In other words, the fiduciary is not liable for the performance of the investments, but they are liable for selecting and monitoring those investments made available to their employees. Yes, you heard that right. A business owner can be responsible for monitoring the investments in a 401k plan even though most don't know the first thing about it.

This topic is gaining ground in recent events. President Obama has even put forward a new proposal that could possibly require an adviser to be a fiduciary to any retirement account. The White House has acknowledged it's a problem and that it's is costing Americans with retirement accounts billions each year.

This happens quite often, but the good news is, the business owner or plan sponsor does not have to be the fiduciary. If you have an investment manager that manages your retirement plan assets, they have to assume the role of investment fiduciary to your plan. So how do you know if you are working with an investment manager fiduciary? More importantly, how can this potentially save your business a LOT of money?

How Much Money Are They Taking From Your Retirement?

So, what is it really costing your company to retire?

Generally, the owners of a small business have more assets invested into their retirement plan than anyone else in the company. They don't realize that fees can be one of the biggest hinderers of investment growth over a long period of time. Many times, this means losing out on millions of dollars by the time they are ready to retire. Yes, millions.

I'll get into the exact amount in a second, but let me first explain a retirement plan investment adviser and financial adviser fees. Most advisers charge an upfront fee and disclose it to you as the amount of money you are paying them directly. Many do not realize there are other costs you have to pay for, the costs of administration and the cost of purchasing investments.

You may be saying, "Well of course, but aren't those costs insignificant?" The answer is no. In fact, we have seen investment fees exceed the amount you are paying directly to the adviser. On top of it, just because you aren't paying those investment fees directly to the adviser, doesn't mean they aren't getting a piece of the pie. Some advisers may also make commissions off of the investment choices they provide to you. The more expensive the investments they suggest, the more they may be compensated for placing you in them.

These fees are harder to detect in the fine print and are rarely provided to you in a way you can understand. The best way to avoid them is to ask the adviser if they are a fee-only fiduciary. If they are not fee-only, they can make commissions. If they are not a fiduciary, they have no incentive to place your interests above their own. Don't get tricked though, some advisers will say they are "fee-based" but that term is sometimes used to mask their true commission-based fee.

The Grand Finale: How Much Can You Actually Save?

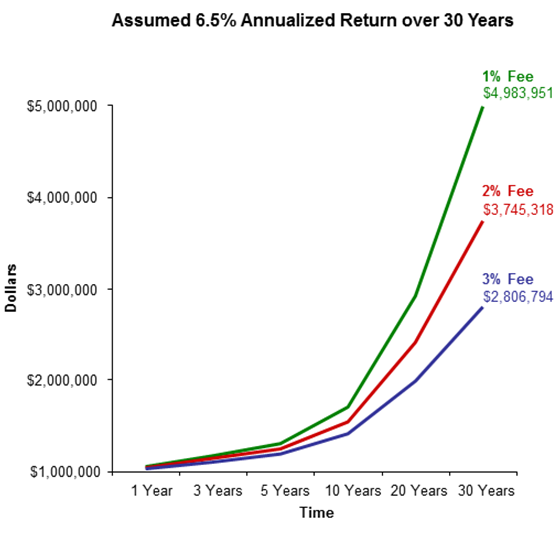

At HIGHLAND Financial Advisors, a fee-only fiduciary advisor in NJ, we like to show the chart below (provided by Dimensional Fund Advisors) when explaining why a fee-only, fiduciary, investment adviser should manage your company retirement plan.

The chart shows how a $1 million investment would grow in a span of 30 years, assuming an average investment return of 6.5% annually. If you change one factor, the fee, and leave all factors exactly the same, you can see how much your bottom line is affected after 30 years. By finding low fees, you can potentially have millions of dollars more saved for retirement than you would have if you were paying high fees. The difference between a 1% and 3% fee, is a potential savings of $2,177,157.

The most alarming thing about this chart is that it only accounts for 30 years, and many of us are participating in a company 401(k) plan for longer than that.

So what's a reasonable price to pay an investment adviser?

If the advisor is a fee-only fiduciary, a fair price is generally anything below 0.80%. If they are not a fee-only fiduciary, anything over 0.25% sounds too high (if they make commissions). Use this general rule of thumb if you're searching for a personal financial adviser/ financial planner as well.

It doesn't hurt to ask what other fees are associated with your retirement plan. See what administration (TPA) costs are associated. Get the overall cost before making your final decision.

When's the last time you reviewed your business retirement plan? Find a fiduciary investment adviser who can go over your current company plan and give you a second opinion. It may just save you millions.