Why do we use cash? Why do we use banks? The basic premise is that banks are necessary to create a flow of cash and enable commerce, with built in protections. Secondly, they can hang on to our money securely, and although we don't get much interest these days, we do generally have the protection of the FDIC or some other mechanism to ensure we never lose our deposit. However, these days when we deposit money it just generally sits on some computer as ones and zeros, we don't physically (or vary rarely) go down the the bank and actually deposit cash over the counter. In fact, I can't remember the last time I ever deposited or withdrew cash from a bank branch. I know I go to the ATM to get cash out, but all my deposits these days are generally electronic.

Banking is just not in your face anymore, it's simply a utility we make use of day to day. The banks are the wires, the FED is the generator, and while the banks have traditionally owned the 'meter' (e.g. the branch, ATM) we're seeing a rapid disintermediation of banks from the retail coal face. We are about to see the end of retail banking channel strategy as we know it.

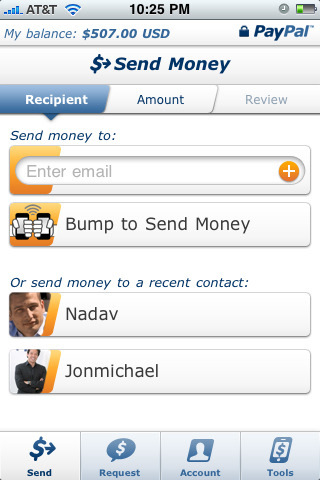

Today I downloaded the new Bump enabled PayPal application for my iPhone. The app was launched at the SXSW event (South by Southwest) and on the iTunes platform yesterday, and it is a retail banking killer! We knew this was in the pipeline, but the launch of the app is something that we'll look back on as one of those defining moments of this decade.

When PayPal launched none of the banks really took it seriously. In fact, most banks to this day don't really interface with PayPal at all. Yet, for sites like eBay and Amazon approximately half of the payments made are done through PayPal today. Banks totally missed out on the opportunity to capture the online payments space, as did Visa, Mastercard and Amex largely - they took their time worrying about security, fraud prevention, and such things and in the meantime PayPal took truckloads of market share off them.

The same thing is happening in the mobile payments space right now. PayPal, POPMoney, Square, Verifone and others are making a play for the mobile payments space in earnest. Apple has a patent for integration of NFC (Near-Field Contactless or Near-Field Communications) payments into their next generation or 4G iPhone. Bankers are sitting back wondering what all the fuss is about...

Bump your phone to pay with PayPal

When PayPal came along bankers I knew said "no one would trust these guys enough to use them for online payments..." - they were so wrong. Now with mobile payments being discussed I'm hearing "no one will abandon cash for mobile payments, that's not realistic...". I'm not saying it will happen in the space of a few months, but over the next 5-7 years in developed economies I expect this to have a huge impact on the viability of ATM networks.

The problem with pervasive mobile payments is that the value proposition for my bank just got cut in half. In a very short period of time, I may never even have to use my bank's ATM at all. I certainly won't be using checks. In fact, the last check I wrote was more than a year ago - so I won't miss them.

My phone becomes my debit and credit card. I can pay the plumber who comes to my house by just bumping phones with him. I can pay at McDonalds, Bloombingdales, Sears, Wall Mart or Marks and Spencer by swiping my phone across the top of a point-of-sale unit. When exactly would I need cash? Taxi cabs maybe? Nope, I can already pay for those with my contactless debit card - so my phone will work with that too. Buses and trains? Nope, in cities like Hong Kong, London and elsewhere I just use a contactless card (in HK it's the Octopus, and London the Oyster). I'm guessing my NFC will work with those conventions too.

So where is the value of my bank in this equation? Remember the electricity network analogy? It's not in the meter because banks aren't pervasive enough. Banks have let card issuers (Visa, Mastercard, Amex, etc) become pervasive at the point-of-sale, and they've relied on branches and ATMs to be pervasive. But branches and ATMs are based on our need to physically deal in cash or checks. Those days are quickly disappearing.

The only solution for banks is to become more pervasive with their solutions and services. I won't be going down to the branch to apply for a personal loan or a mortgage, my bank needs to be ready to provide me that product when and where I need it. Point-of-impact is what I call this concept. When I'm online booking my next holiday, my bank should offer me a great personal travel loan built into the online experience. When I am walking into my favorite retailer, they should offer me a cheap line of credit instead of me using my credit card, or offer me a discount for using your bank's debit card - they could use location based messaging or point-of-sale technology to deliver the message. Put bankers out on the road at property shows with the ability to sign me up for a mortgage there on the spot, instant approval.

Banks, go where I need you - don't wait for me to come to you. Chances are, I'll bump you off...