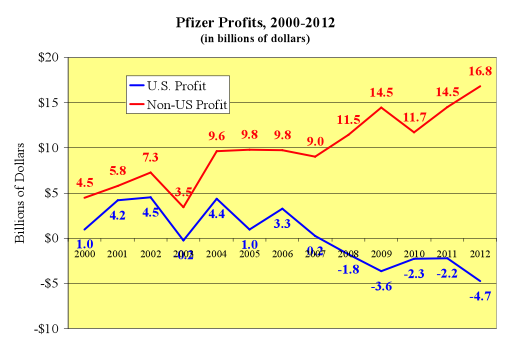

Over the last five years American pharmaceutical giant Pfizer earned on average over $10 billion of annual worldwide pre-tax profits. How much of this profit was attributable to its U.S. operations? Answer: none. In fact, according to annual reports filed with the Securities and Exchange Commission, Pfizer had losses in the United States in every year since 2007. The figure below illustrates the situation.

We also know from Pfizer's annual reports that the company has substantial operations in low-tax Ireland, Singapore, and Puerto Rico. So, it is only natural to ask if Pfizer is shifting profit out of the United States to shrink its tax bill.

In 2012 Pfizer reported its worldwide effective tax rate was 21.2 percent. That is considerably lower than the U.S. statutory rate of 35 percent, but it is far above the single digit rate you might expect if Pfizer shifted most of its profits into tax havens.

Well, it turns out that the reported rate includes a lot of tax liability Pfizer has booked but has not actually paid to tax authorities. Its 2012 annual report (p. 193) states that its tax expense includes "approximately $2.2 billion as a result of providing U.S. deferred income taxes on certain current-year funds earned outside the U.S. that will not be indefinitely reinvested overseas." In English, Pfizer is booking U.S. tax expense due on foreign profits it has not paid to the IRS. It has not paid those U.S. taxes because tax is not due until those profits are repatriated to the United States, if ever. This accounting practice, also employed by Apple, raises reported effective tax rates without any actual increase in current taxes actually paid. Pfizer's total tax expense in 2012 was approximately $2.6 billion. If Pfizer had not booked the additional $2.2 billion U.S. tax expense, its reported effective tax rate would be 3.0 percent.

There is absolutely no reason to believe Pfizer has done anything illegal. It engages in tax planning and it does a good job at it. But as a matter of policy we have to inquire as to how a profitable company with lots of employees, sales, assets, and research in the United States only books losses in the United States over an extended period of time. It is not as though the IRS has not noticed. It is constantly auditing Pfizer. Even the SEC has formally inquired.

The arm's length standard, which is the guiding principle of profit allocation, treats Pfizer's U.S. operations as if it were a stand-alone company. If Pfizer U.S. was a stand-alone company with billions in losses over five consecutive years, would it still be in business? Many commentators, including Apple CEO Tim Cook, have suggested that profits should be allocated according to the location of sales. Under that approach, 38 percent of Pfizer's profit would be taxed in the United States. What theory would only generate losses for the United States?

Sullivan is chief economist at Tax Analysts. He also blogs at TaxAnalysts.com.