This post is adapted from remarks delivered at the Pacific Pension Institute 2007 Summer Roundtable, at the Empress Hotel in Victoria, British Columbia, July 25-27, 2007.

Welcome and thank you for allowing me to share some of my views on climate change's influence on investing: most particularly, the opportunities which I believe it creates for economic gain.

How many of you take climate change into consideration in your investment decisions?

My goal, today, is to convince you that climate change needs to be considered. And to show that investment decisions should be driven by science, and the basic needs of life.

My talk will first speak to climate change; give you some examples of why science should drive investment decision making; then point out why the basic needs of life should be considered; concluding with some specific examples of potential investments.

John Doerr, a leading silicon valley venture capitalist, has called climate change "one of the most pressing global challenges." He's also said that the resulting demand for innovation would create the "mother of all markets."

We can take a fatalistic view of the changing climate from a passenger's seat and just let it happen to us. Or, we can attempt to stimulate some of that innovative spirit to steer this ship in a course which creates both hope and opportunity for the future.

You, as a collection of some of the greatest pools of capital on the planet, are in a unique position to positively impact this outcome.

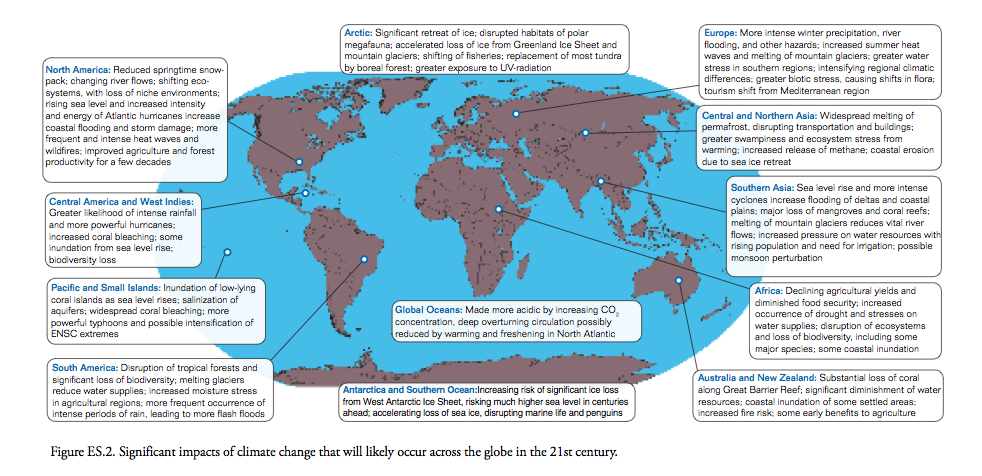

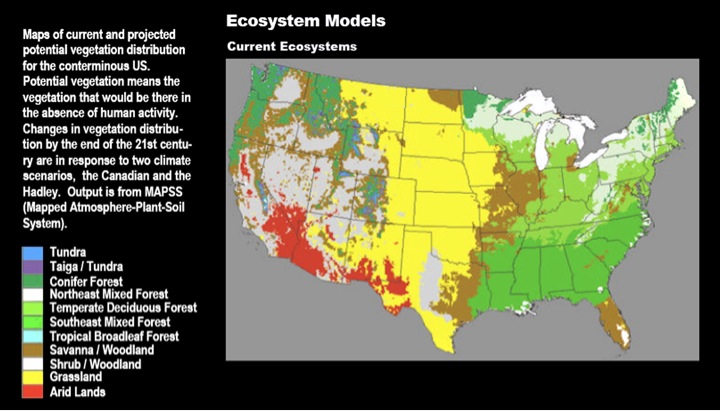

I'm assuming that you have some familiarity with the changes that the climate is having on the planet. And hopefully some of my recommended readings will have provided you with a greater understanding. I could spend the entire hour explaining many of the scientific dimensions of climate change but I won't. Let me just say that climate change doesn't mean that the planet is only getting warmer. Impacts vary considerably. Some areas will see higher temperatures, some will see more precipitation; some less. As was pointed out in the report released two weeks ago by the Union of Concerned Scientists entitled "Confronting Climate Change in the U.S. Northeast," we'll see tremendous variation in changes, even within small geographic areas.

To cite some examples, globally, starting now and continuing into the future, we'll see a change in crop yields, mostly falling. There will be significant changes in water availability, brought on, in part, by the disappearance of many glaciers and winter snow packs. Depending upon the degree of temperature change, we'll experience sea level rise through the irreversible melting of the Greenland and Antarctic ice, which threatens major cities throughout the world. Based on increased ocean acidification, we'll see dramatic changes in the calcium based life under the sea, inclusive of coral reefs. It is possible that between 20 and 50 percent of all species on the planet face extinction. We'll see a rising intensity of storms, forest fires, droughts, flooding and heat waves. And, most significantly, we'll potentially see these changes in a very abrupt, unpredictable manner.

So, scientists will argue, as they've done in the 2007 report prepared for the UN Commission on Sustainable Development, we need "an immediate and major acceleration of efforts on two fronts: mitigation and adaptation measures. Mitigation measures are those aimed at reducing the causes of global climate change, primarily eminating from greenhouse gases like C02 and methane. Adaptation measures take aim at reducing the damage caused by these global changes, primarily, as the word states, through adapting.

Mitigation occurs only if there is a strong political will to change and/or if it is accompanied by strong economic incentives. Many of the dimensions of mitigation don't have a real economic incentive behind them and therefore require externalities (i.e. policy) to have them make sense to the market. Policy can take the form of incentives (such as a cap and trade system) or disincentives (such as carbon taxes) but still requires a government body to create a framework in which they will operate. Many regions, including the EU, California, the Northeastern States in the US and China, have mobilized mitigative approaches. Yet, since climate change knows no geographic boundaries, it needs to take place equally throughout the world in order to be truly effective. Adaptation, on the other hand, is not wed to policy initiatives. As long as methods are within the laws established, the free market will either put into place existing technologies or innovate with new ones to fill a market opportunity.

So, then, how should one invest, understanding the impact that climate change will have on the planet? Mitigation would imply that, if the government constructs are in place, market niches will become available that need to be filled. With or without mitigation, however, human ingenuity will create and drive investment opportunities in the realm of adaptation.

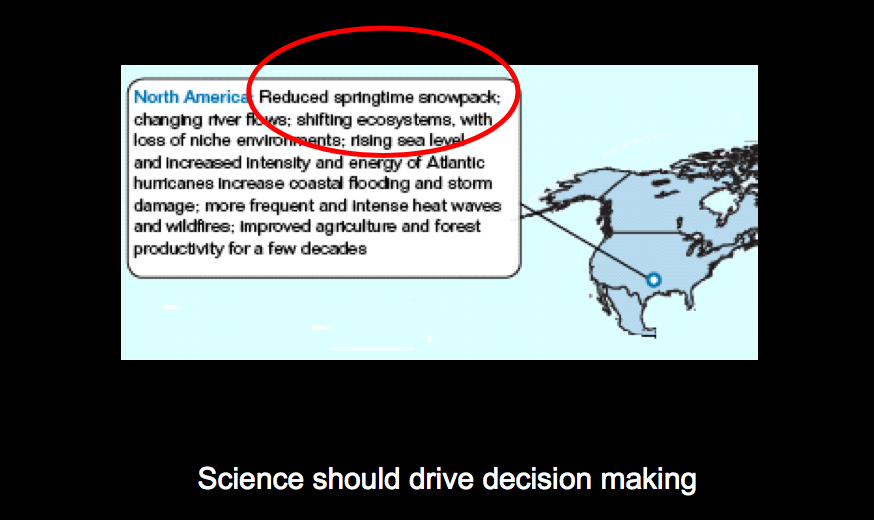

Yet in order to practice either mitigation or adaptation techniques, the base of scientific knowledge should be the underlying driver. True science is the pursuit of truth. And while human understanding of science is still limited, and only as good as our exploration of this reality, it is the most solid information that we have at any point in time. And since we do make investment decisions based on the amount of knowledge we have, we need to place science as a root input into these decisions; not solely as an historic frame but as a predictive model of what is expected to happen in the future. Science should drive our decision making when investing in areas susceptible to a changing climate.

So let's look at some examples as to how this thinking might apply. Drilling down on a previous slide I've shown you, we see that in North America, in the 2007 report [prepared for the UN Commission on Sustainable Development], there is a reduced springtime snow pack.

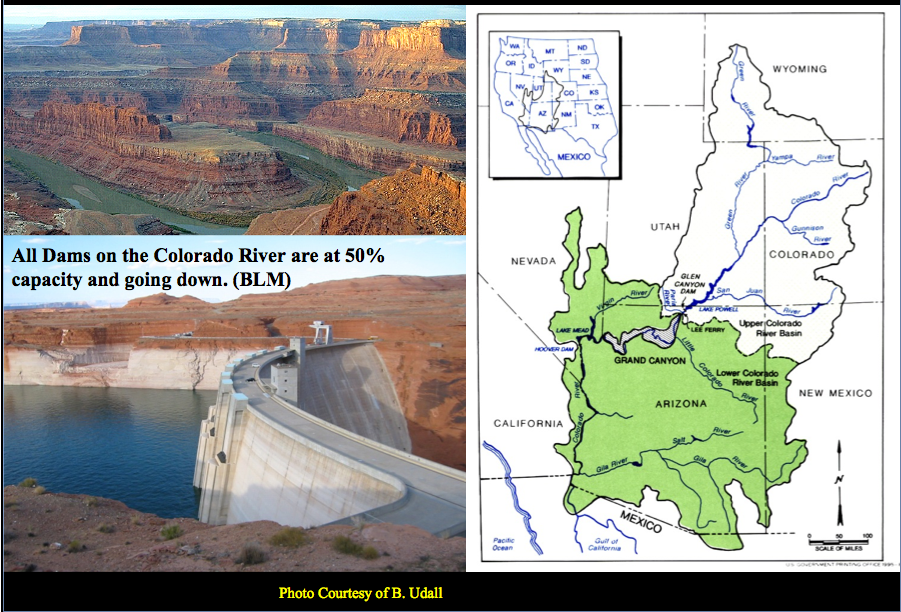

The effect, today, of a reduced springtime snow pack in the Colorado Rockies is shown here in the Bureau of Land Management's (BLM) findings. All dams on the Colorado River are at 50% of capacity and going down. Consequently, less water is flowing into the entire Colorado River aquifer. And less water is flowing downstream to Arizona, southern California and Mexico.

Throughout the next century, 47 of 49 different model climate projections indicate substantial drought for the southwest regions of the United States, with no improvement envisioned. The impact on all species will be enormous.

The only work around--an adaptive measure--is desalination. And while there are arguments that desalination isn't presently cost effective and does create some environmental problems, over the long term, it will have to play a large role in the equation.

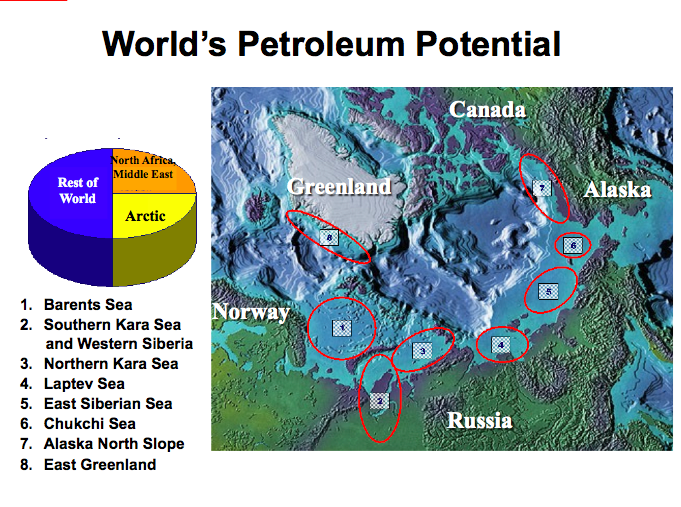

Now let's turn to the Arctic region. The 2007 report [prepared for the UN Commission on Sustainable Development] shows that there will be a significant retreat of ice in the Arctic. How significant?

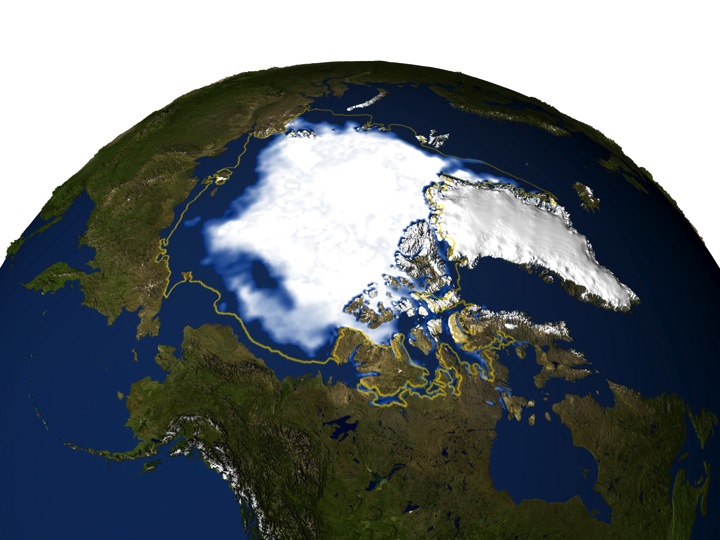

Here we see that since 1979, more than 20% of the polar ice cap has melted away.

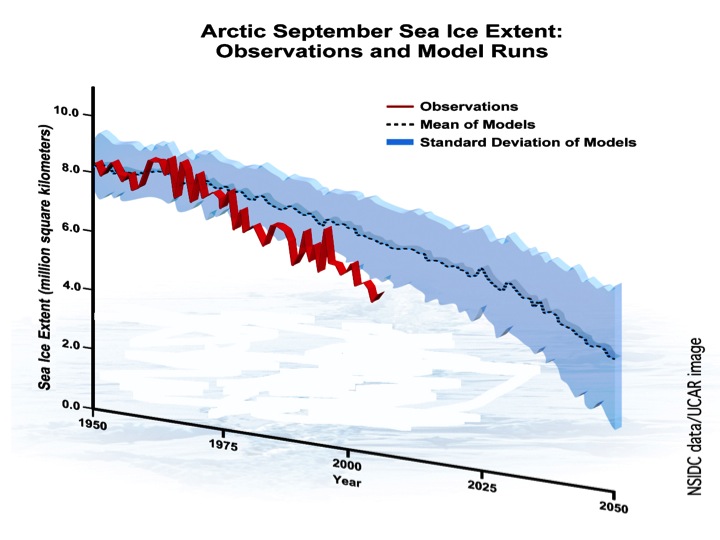

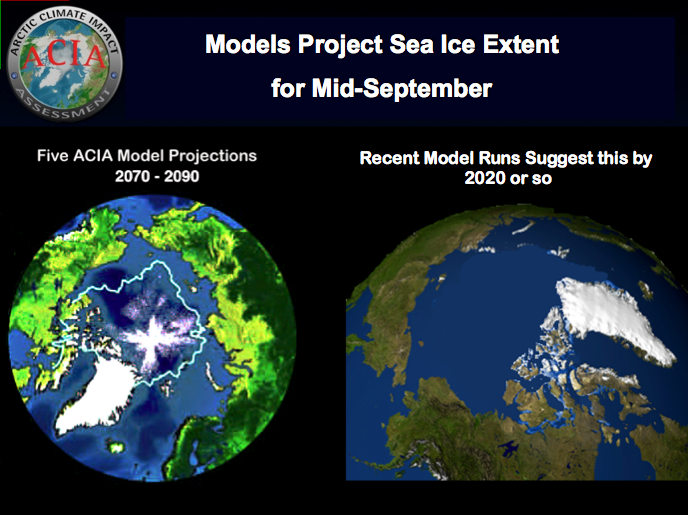

And the most recent scientific model [published on 1 May 2007 in the Geophysical Research letters] is predicting that by about 2020 the September sea ice will look like:

this. Obviously, the people of the world should be very concerned with this large melt as it impacts the eco-systems and drives sea level rise throughout the planet.

Yet, we can't ignore the market opportunity that will also be created. While we'd like to burn less fossil fuel because of its greenhouse gas effect, most scientists and economists agree that by 2030 we will still be using a host of fossil fuels for our energy needs. Carbon sequestration will present a potentially huge business opportunity. The melting of the ice cap, however, also reveals 25% of the world's known petroleum reserves which just happen to be there.

While there are many territorial issues to be negotiated, it is apparent that this presents another tremendous investment opportunity.

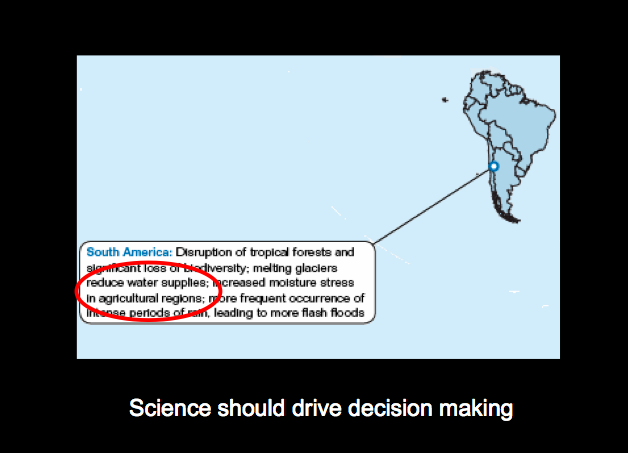

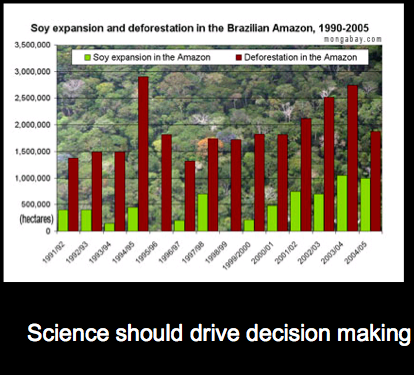

In South America, we can expect to see reduced water supplies in agricultural regions. The Amazon region will be affected. The 2005 drought caused by changes in the circulation of the Atlantic Ocean could be a preview of what climate change will bring.

The Brazilian rainforest has faced deforestation with the expansion of soy bean production. Using experimental plots, a team of scientists from the Federal University of Viçosa in Brazil found that clearing for soybeans increases the reflectivity of land, reducing rainfall by as much as four times relative to clearing for pasture land. And even though the Brazilian soybean crop was a record 1.91 billion bushels in 2003, production for 2004 and 2005 was well below potential due to extensive drought conditions in southern Brazil, with a prognosis for long term continuation of those drought conditions.

So are soybeans in Brazil a good long term investment? I ask your opinion.

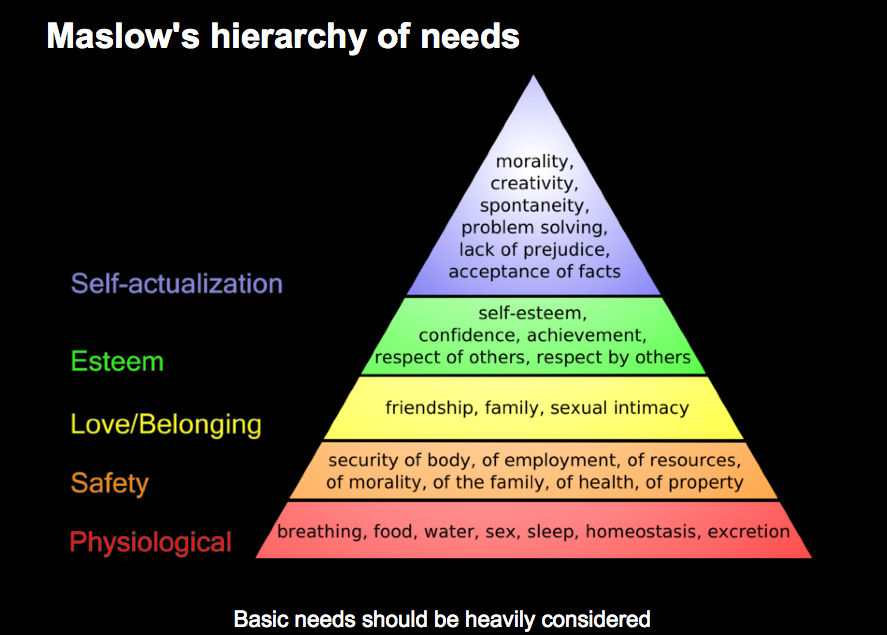

In these last three examples, I have shown you how science can influence investment decision making. Now, let's combine the science with another critical dimension: The basic needs of life. I contend that climate change is directly, and will more dramatically, impact those basic needs. Therefore those needs, in concert with the science, should drive investment decisions.

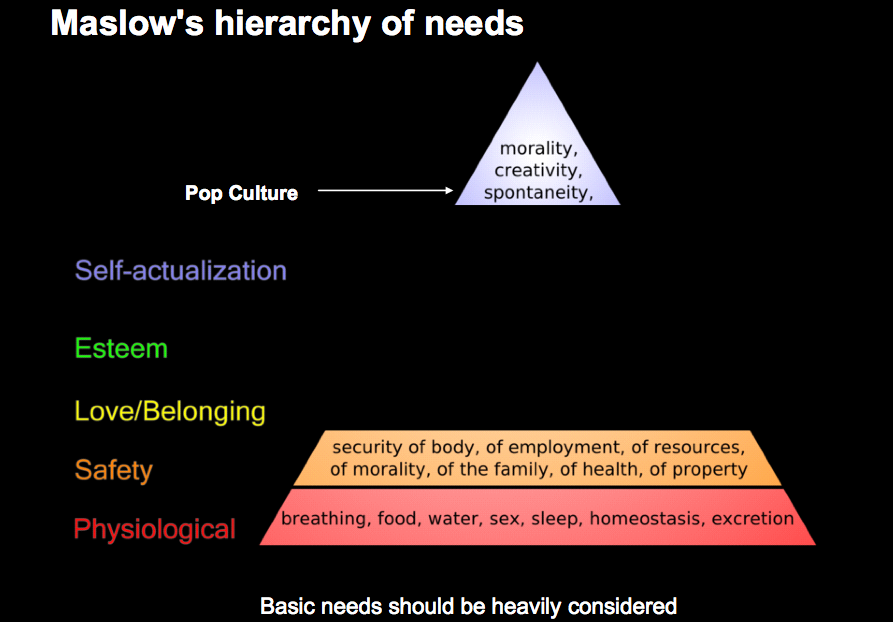

I'm sure you're all familiar with Maslow's hierarchy of needs. "Abraham Maslow contended that as humans meet 'basic needs', they seek to satisfy successively 'higher needs' that occupy a set hierarchy. The basic concept is that the higher needs in this hierarchy only come into focus once all the needs that are lower down in the pyramid are mainly or entirely satisfied."

Yet, today, we frequently find ourselves in a world where the lower level needs are being ignored in deference to pop culture, that which I've labeled spontaneity. We all know that a house without a foundation won't last very long.

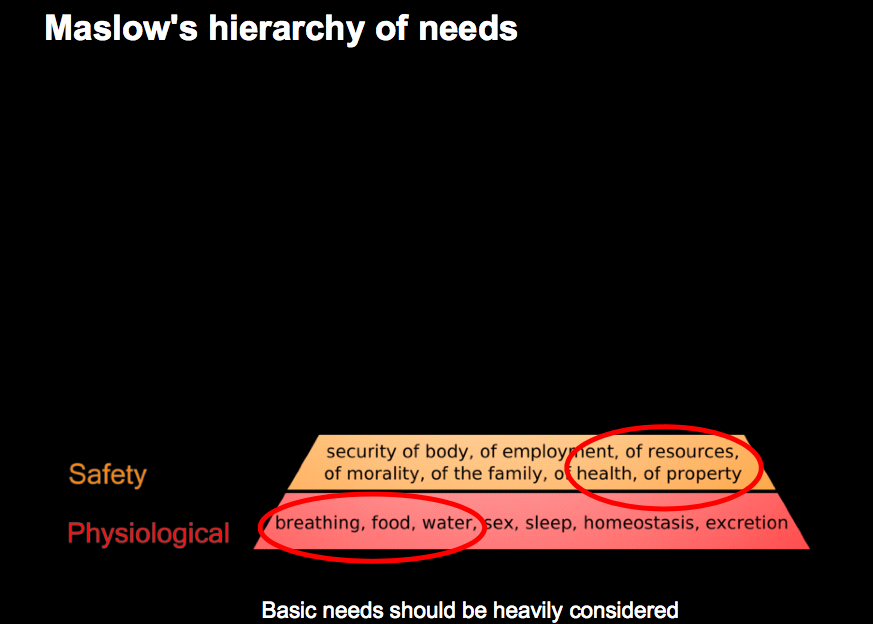

And thus we need to understand the foundation structure on which life is based--shown here as the physiological and safety layers of the hierarchy. They include breathing, food and water--critical to our survival as a species, and, in fact many species' survival. We can then move up a layer to see our needs for security of resources, health and property.

Let's translate those basic needs into areas of potential investment. Breathing is air; food is food and water is water. Security of resources includes energy, material resources, health and shelter.

Now, the fun part. Some specific examples of investment opportunities, all driven by both science and the basic needs of life.

Let's start with the air market. Opportunities abound in the market for clean air; a novel thought.

•As more greenhouse gases enter our atmosphere, we see an opportunity to remediate them; either through lower carbon or zero-carbon fuels and/or increasing the efficiency of fuel use.

•Existing or novel technologies to clean up the air is a growth market. China is experiencing such economic growth that its air pollution is out of control. Technology to cut down GHGs and other polluting forces should certainly sell in China.

•Dealing with the health effects of that not-so-clean air like asthma, chronic bronchitis and other related illnesses as well as premature death, is a burgeoning enterprise. Again, China is a prime target for these health treatments.

Food

With changing precipitation and temperature, what is grown today in many places will need to change. In some instances, we'll see longer growing seasons, increasing crop yields, but most areas will experience declines. So what are some of the opportunities in food:

•Contained fish farming, or aquaculture, like those found in Costa Rica for Tilapia

•Climate resistent crops such as those being developed by the Consultative Group on International Agricultural Research that can better withstand heat, salt, submergence or waterlogging, and drought;

•New farming techniques like hydroponics (which you can even find at Disney's Land Pavilion at Epcot Center in Orlando, Florida);

•Migration of farming areas northward, changing the use of that real estate. A seaward example is that lobstermen in Maine are expected to prosper due to northward migration of lobsters because of elevated temperatures in the southern regions.

The number of opportunities created for global demand for water are seemingly endless. They include:

•Investments in the infrastructure for water distribution; water's conveyance and storage;

•Desalination (as I've previously mentioned) and water transfer.

•With increased scarcity, water management will become more critical. This includes automation systems, water metering and management systems for home and industrial use.

•Increased pollution will cause growth in water treatment areas such as monitoring and testing equipment; large scale as well as residential water and wastewater treatment and filtration.

•Scarcity will also demand methods for dealing with efficient use of water in irrigation systems and equipment, residential uses such as washing machines, dishwashers and toilets as well as many farming applications.

•Capture of rain water through roof cisterns as well as grey water for re-use are other areas of market potential.

Energy

One of the key areas of focus is renewable sources. These include:

•Wind and wind farms (such as the wind farm being erected off the coast of Delaware in the United States),

•Solar companies such as China-based JA Solar, Solarfun Power Holdings and Suntech Power and solar farms (like the heat capture technology being employed in the Nevada Solar One project near Boulder City, Nevada),

•Geothermal (as is found throughout Iceland),

•Other energy examples include hydroelectric, hydrogen and bio-based fuels

•Additionally, more efficient, less wasteful energy approaches are a key opportunity as we won't always be able to transition completely from fossil fuels. So, there will be potential in:

•More and more efficient air conditioners

•Better building insulation (such as icynene),

•Increased fuel economy in automobiles (take the Toyota Prius or Tesla Motors' electric vehicle, code named "Darkstar" and planes (such as those being developed jointly between Virgin Airlines and Boeing)).

•As I've shown, we'll find new places to drill for oil, such as the Arctic.

•With the warming of western Siberia which is occurring at a faster rate than any other place on the planet over the last forty years, the permafrost is melting, thus causing the release of methane, a GHG that is 20 times as potent as CO2. Yet, if we can harness this methane, we'll both be mitigating a problem and capturing a valuable source of energy.

Material resources

•We have a discrete amount of material resources on the planet, even though some of them are renewable. Yet, we waste so many materials through short-term single use. We need to get better at designing products which harness their materials more than once by designing products in the first place for their next use.

•Intelligent use of materials (put anther way, using them for their highest and best use) is an area with tremendous potential. We can take wood as an example. It can be sold for firewood at the lowest price (plus it will be burned and cause ghg); wood for construction at a higher price or sold for furniture at the highest price. In looking at all materials, we can find their highest and best uses, by maximizing their selling price.

Health

With so many changes in climate, we will see the wide spread of disease, be it the rise in the deer tick population leading to increased incidence of Lyme disease, or the rise of sea level in areas with open sewers, causing the rapid spread of malaria and other vector born diseases. Opportunities already abound and will only grow as the climate changes more. Pinpointing health potential will be driven greatly by an understanding of the underlying science of a given geographic area.

Shelter

While I could go on for quite a while, I'll finish with three examples of investment potential in the shelter arena.

•The first area is, as I've touched upon before, opportunities in energy efficient buildings. The LEED certification of green buildings in the commercial sector will be extended to the residential buildings, creating a huge global market.

• Using the "quake proof" technology approach we see in buildings in earthquake zones, we can see a boom coming in creating buildings that are weather tolerant; those that will be able to endure the increased intensity of storms which scientists are predicting.

• Finally, let's look at all of those pictures which we've been shown where the sea level rises and floods out a city. We, as a species, won't allow that to happen, especially if there is great economic value to those structures, infrastructures and all they represent. The solution: a global market in seawalls and other technology which will protect some of our most valuable assets.

I've hardly touched upon the opportunities which arise because of global climate change. Suffice it to say that the dynamics of the change are such that markets will be created rapidly and broadly. Underlying all of this, though, we should be mindful of the fact that science and scientific models should guide our judgment and decision-making. And the opportunities identified by the basic needs of life will be our investment focus more than they have ever been in recent times.