24 Million iPhone 6 and 6 Plus Units Fulfill Expected Customer Needs

72 percent of US iPhones in Use Released in Past 17 Months

Consumer Intelligence Research Partners (CIRP) analyzed the successful launch of the new iPhone 6 and 6 Plus in September 2014 to assess whether the results represent a one-time response to an outstanding new product, or a permanent change in how consumers buy iPhones.

Apple had relied on a steady stream of first-time smartphone buyers and the standard two-year purchase cycle, facilitated by carrier contracts and purchase subsidies. Some fear that the incredibly popular iPhone 6 and 6 Plus accelerated the normal upgrade schedule and will leave fewer US buyers in coming quarters.

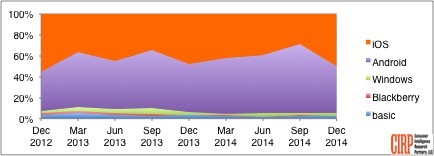

Smartphone penetration in the US market, calculated as smartphones as percent of all phones sold, has approached 100 percent for the past several quarters (Chart 1).

Chart 1: Quarterly US Mobile Phone Sales by Operating System

Going forward, consumers who buy a new iPhone will necessarily either own an earlier iPhone, or own an Android and choose to switch platforms.

Over the past several quarters, this market maturation is seen in the mix of mobile phones that buyers retire in favor of a new iPhone. CIRP analysis shows in the October-December 2014 quarter, after the launch of the iPhone 6 and 6 Plus, only 5 percent of customers upgraded from a basic phone, compared to more than 25 percent of customers upgrading from a basic phone following the launch of the iPhone 5 two years earlier.

Further, smartphone owners have strengthened their operating system loyalty. In the most recent quarter, 86 percent of iOS users and 72 percent of Android users remained with their previous operating system.

Given these market realities, more new iPhone buyers come from among existing iPhone owners. This loyalty bodes well for the iPhone's US prospects, but with the market divided between iOS and Android, there is potential for a ceiling on US iPhone sales.

CIRP analysis shows the strength of the iPhone 6 and 6 Plus launch. CIRP estimates that a combined 24 million of these flagship phones sold in the US from the September 2014 launch through the end of 2014. For comparison, the iPhone 5S sold about 11 million units in the US in the same period in 2013. Further, CIRP data suggests that 72 percent of current iPhone owners have a phone that was released in the past 17 months, and owners of older models may not want to upgrade.

The lifecycle of an iPhone model is long. Ongoing sales of legacy models at reduced prices extend the selling period of some phone model up to three years. Though originally released in 2011, there are still more than 10 million iPhone 4S phones in use in the US. While they are ripe for upgrade, many of these consumers have owned their iPhone 4S for only a fraction of its three and a half years on the market.

CIRP bases this analysis on nine quarterly surveys of 500 US subjects who activated a mobile phone with a US mobile phone carrier in the 90 days preceding the survey. For additional information, please contact CIRP.