In stark contrast to previous decades, starting a new venture can be accomplished on a shoestring budget. This is due to the diminishing cost of information and tools combined with the relatively high value of knowledge, skills and experience that founders bring to the equation. Bootstrapping is now often possible up to Round A Financing. This is where capital is required for marketing to scale rapidly and New Product Development is required to deliver high quality offerings.

Starting a design driven entrepreneurial venture requires a passionate belief, risk-attitude, adaptability, human and social capital as well as true grit ("never, never give up"). However, with most entrepreneurial endeavors failing, there most likely will come a point when, despite pivoting the business model multiple times and accumulating sunk cost, the best course of action is simply to leave the table and pursue other opportunities.

A Harvard Study of Venture Capital funded startups show that eighteen percent of first time startups fail. Serial entrepreneurs do somewhat better; with first time failing firms succeeding twenty percent of the time and successful firms succeeding thirty percent of the time, the second time around.

Setting out to predict startup performance and the likelihood of success, we joined forces with Stanford's Studio for Venture Design, Art Center College of Design -- The Design Accelerator and Innovate Pasadena. Observing over sixty startups in Silicon Valley and San Gabriel Valley, as well as, fifty entrepreneurial teams at Hanyang University in Seoul, Korea, and Cal State University, Long Beach, California, we found three reliable predictors for Design Execution performance:

- Supporting Philosophy

- Design Expression

- Technology Risk

These three parameters were found to capture sixty-five percent of the variability in the observed performance.

From an investor point of view, assessing design execution performance, in turn, allows these investors to determine the combined market risk, technology risk and design execution risk. Multiplying these individual risks will help to optimize a portfolio of potential ventures.

From a startup perspective, knowing the design execution performance risk and the market technology risk, enables startups to adjust their market - technology position. It also can assist them to pivot or to systematically improve their design execution process.

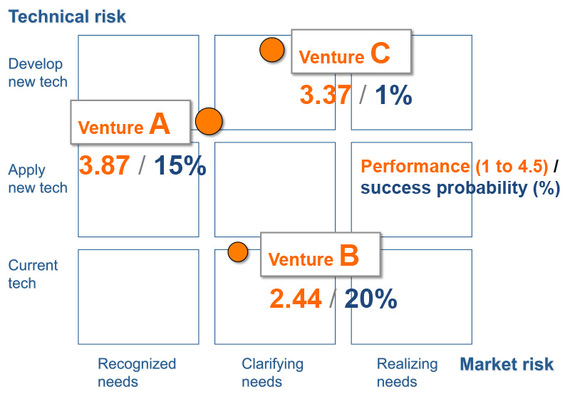

There are three ventures situations highlighted within the introduction map to this article:

Venture "A" is positioned in low market risk and high technology risk, combined with a strong Design Execution (3.87 or 84% proficiency). The strategy could be to keep up the performance and secure sufficient investment to finance the expensive and often long term development process.

Venture "B" is positioned in low market risk and low technology risk, however displays a weak Design Execution (2.44 or 53% proficiency). The strategy could be to take on additional technology risk by exploring alternative technologies while improving design execution performance.

Venture "C" is positioned in medium market risk and high technology risk, displaying a medium Design Execution (3.37 or 74% proficiency). The strategy could be to improve design execution performance and reassess the extreme technology risk.

Of course, there is much more to a startups success than market, technology and design execution, including team dynamics, the competitive field, surrounding ecosystem and the intellectual property conditions.

Still, with failure rates hovering between seventy to eighty-two percent of startups who received VC funding, knowing where one is from a Market, Technology and Design Execution perspective goes a long way toward deciding whether to fold one's tent or to mitigate the inherent risk and improve the performance deficiencies.