Four years after Hurricane Katrina tore through the

Mississippi Gulf Coast, rebuilding homes and communities continues at a snail’s

pace. The protection we thought was there to ensure our speedy recovery is the

obstacle that stands in our way: homeowner insurance—both its cost and its

payment, or the lack thereof.

Skyrocketing

cost of homeowner protection

Along the Mississippi Gulf Coast’s three counties—Hancock,

Harrison, and Jackson, the residential real estate market demonstrates the

ripple effect this insurance crisis is having in our economy and recovery. One

large coastal real estate firm recently informed my office that the number of

residential contracts that fall through at closing has risen dramatically.

Before Katrina, the number was less than 10%. Today, that number has more than

tripled to nearly 1/3 of all contracts. The reason? The skyrocketing cost of

homeowner’s insurance.

When the bank includes the exorbitant insurance premiums

into the debt-ratio equation for the mortgage loan, an increasing number of

prospective buyers no longer qualify for the loan. This is so prevalent that

coastal realtors are advising potential buyers to shop for insurance before they begin to look for a home.

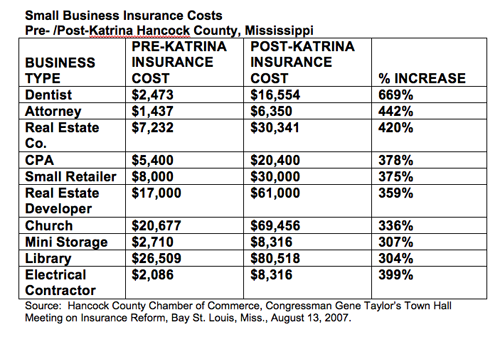

Commercial insurance rates have also soared for small

business owners. In 2007, the Hancock County Chamber of Commerce reported that

its members had seen an average increase in premiums of 346 percent with the

range between 300 to nearly 670 percent.

Throughout Mississippi’s six most southern counties, major

insurance companies refuse to write new policies. This dumps folks into the

insurer of last resort—the state government wind pool, which has been

subsidized lately with federal taxpayer dollars. Even so, those premiums are

out of reach for many. Local Habitat for Humanity chapters report the cost of

homeowner insurance is more than the mortgage. Often, qualified applicants

become unable to pay for an otherwise affordable home.

The Crisis

is National

From the Gulf Coast state of Texas

to Florida

to New

Jersey, and New

York, the ever-escalating costs and accessibility of protection have home

and business owners facing daunting prospects for protecting their piece of the

American Dream. The crisis is national.

Were affordability and access to homeowner insurance the

only two problems that would be enough. However, our experience after Katrina

taught us that insurance companies betray our trust to provide the protection

we need after a natural disaster, protection for which we pay those

increasingly skyrocketing premiums.

Insurers “wouldn’t

pay a dime”

Though United States Navy storm modeling reported Hurricane Katrina’s 150 mph winds blew through the Gulf Coast damaging and destroying our

homes for 3-4 hours before water came ashore, insurance companies simply

refused to pay for wind damage.

In a recent case before the Mississippi State Supreme Court,a lawyer for Nationwide Insurance informed the court that if 95% of a home weredestroyed by wind and hours later water destroyed the remaining 5%, Nationwide“wouldn’tpay a dime.” Companies like State Farm sent out memosinstructing adjusters to blame all the property damage onwater and to send the bills to the National Flood Insurance Program (NFIP),which the American taxpayer subsidizes.

Homeowners were forced to resort to hiring lawyers and

engineers to take legal action against their insurance companies who had

deliberately delayed paying homeowner wind claims—sometimes by years—before

cutting checks that should have been cut within days.

Billion

Dollar Homeowner Insurance Industry Bailout

When insurance companies denied homeowner property claims,

they also refused to pay for the cost-of-living expenses like rent that come

with homeowner policies. Instead, the American taxpayers picked up these costs

that the insurance industry should have paid. FEMA trailers alone cost $1.3

billion. Taxpayers also shelled out money for homeowner grants, SBA loans,

rental assistance, and tax credits.

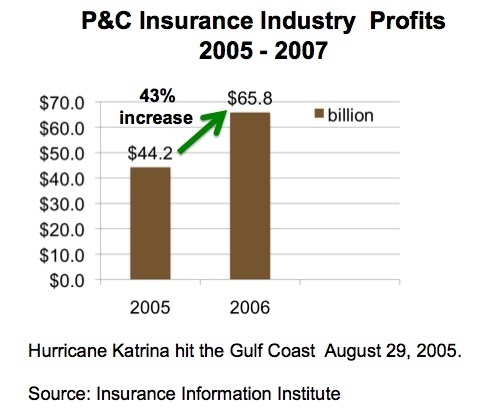

By shifting their corporate costs to the American taxpayers,

insurance companies essentially gave themselves a government bailout to the

tune of billions of dollars while simultaneously posting billions in profits.

The industry posted $44 billion in

2005 and $66 billion in 2006.

Protecting

The American Homeowner

Private insurance companies leverage our dollars to find

ways to deny us the protection for which we pay good American money. It’s now

time to admit the obvious. Insurance companies fail to protect America’s homeowners.

We can protect American homeowners and do so without cost to

the American taxpayer.

All we have to do is permit homeowners to have the choice of adding wind protection to their federal flood insurance policy. The Congressional Budget

Office has already said we can do this without cost to the American

taxpayer.

Through permitting Americans the option of purchasing one

policy for both types of property insurance coverage—wind and water, we protect

American homeowners and remove the opportunity for insurance companies to

defraud the federal taxpayers.

Protecting the 55% of Americans who live within 50 miles of our nation’s beautiful coastlines is the right

course of action.

For more information, visit taylor.house.gov/insurancereform.