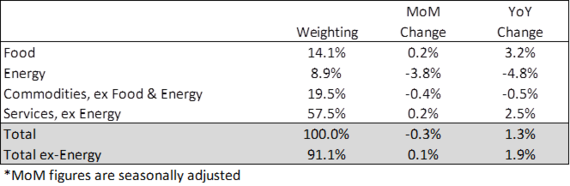

The Labor Department reported Consumer Price Index (CPI) figures for November this morning. The sequential headline drop of 0.3% compared to October was the biggest decline since the 0.8% decline reported for December, 2008. As the table below shows, the MoM drop was largely due to a 3.8% decrease in energy prices during the month. Prices for commodities, excluding food & energy, fell by a much smaller percentage. This category includes a host of both discretionary and non-discretionary consumer products. Finally, prices for food and services (excluding energy), which together comprise 71.6% of the index, rose at a rather robust pace both sequentially and year-over-year.

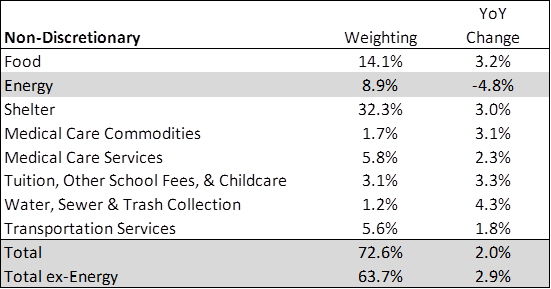

Our contention has been, and continues to be, that the CPI and the various other inflation metrics are understating the amount of inflation that ordinary Americans are facing. Because the Fed is using these metrics to assess inflation and formulate monetary policy, the central bank is also underestimating the level of inflation. We say this because a close analysis of the CPI's components reveals that the overwhelming amount of consumer non-discretionary expenses are actually rising at a pace well above the Fed's stated target of 2%. The table below shows the YoY growth rate in prices for a number of non-discretionary consumer expenses. With the exception of energy prices, almost all other categories grew at a pace in excess of the Fed's 2% target. On an aggregate basis, these expense grew right at the Fed's target pace of 2% if we include the 4.8% YoY drop in energy prices. If we exclude energy, prices for the remaining non-discretionary categories actually grew 2.9%. Why is this important? Because these items, which account for 63.7% of the CPI, represent expenses that consumers generally cannot avoid. Moreover, they make up a much larger percentage of the total budget for lower- and moderate-income consumers. In other words, the large majority of consumers are actually experiencing pretty robust inflation for the things they NEED to buy each month. At the same time, these same consumers are not seeing much, if any, income growth.

Source: Department of Labor

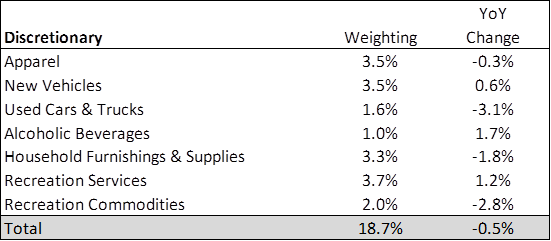

In the next table, we show expense categories within the CPI that are more discretionary in nature. Taken as a group, prices for these categories actually fell 0.5% YoY. Unfortunately, lower prices for these more discretionary categories are not much help to the low- to moderate-income consumer that is struggling to make ends meet and therefore has very little money left over for discretionary purchases.

Source: Department of Labor

Finally, we would yet again note that there is one expense that is not considered at all in the Labor Department's Consumer Price Index. This expense is the cost of saving for retirement. How much of your monthly income goes to retirement savings? If you're like most Americans, you're woefully unprepared for the day you punch out for good (even after the near 200% increase in stock prices). As asset prices have risen dramatically over the past several years (think stocks, bonds, real estate, etc.), we think it is safe to assume that expected future returns on these same assets should go down. Think about it this way. If I buy stocks at the relatively full valuation of 15.5x forward EPS estimates when corporate margins are running 50% above historical levels, I should not expect to enjoy historical average returns on stocks. In fact, returns are likely to be much lower than history given the starting valuation level.

This decrease in expected returns represents a very real and sizable cost to the ordinary American who is unprepared to retire. If I am 55 and I expect to earn only a 6% return on my retirement account over the next ten years, I will have to put aside more money each month compared to a scenario in which my assets are expected to grow 10%. As the Fed continues along this path of using asset prices to prime the economic pump, we think they should account for the fact that retirement savings are likely to be a larger-than-expected drag on consumer spending in the years to come. And for an economy heavily dependent on consumer spending, this is not a trivial consideration.