The incredibly wealthy CEOs pushing to cut the future Social Security benefits of millions of American retirees are pretty much guaranteed to stay incredibly wealthy throughout their own retirement. (Story continues below the chart.)

Infographic by Alissa Scheller for the Huffington Post.

The roughly 200 CEOs who collectively make up Business Roundtable, a business lobbying group that often pushes conservative views, including Social Security cuts, have average retirement savings of $14.5 million, according to a new report by the Institute for Policy Studies and the Center for Effective Government.

That is about 1,200 times bigger than what the median American worker has saved for retirement a decade before the end of his or her career, according to the study. That paltry amount is just $12,000, by the way, according to a separate report from October.

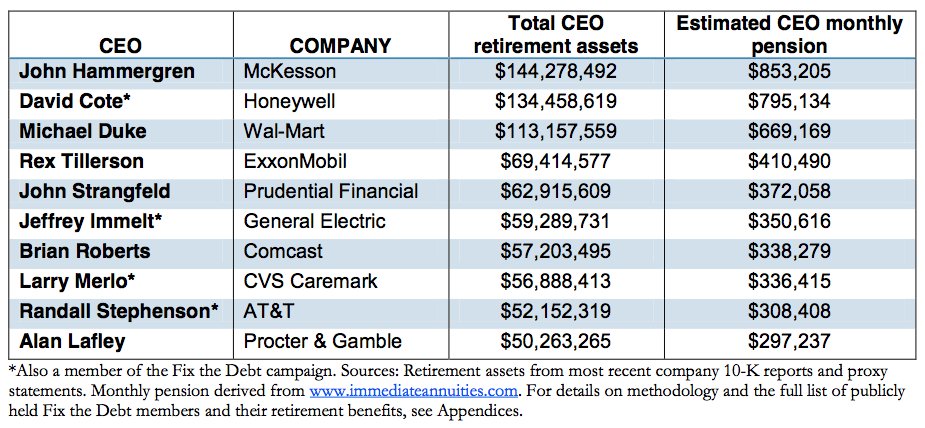

Three of these CEOs have nest eggs of more than $100 million, and 10 have socked away $50 million or more. Here are the Business Roundtable's biggest retirement funds:

Once Social Security payments are factored in, the typical Business Roundtable CEO can expect a monthly retirement budget of around $88,576, or more than 68 times that of the typical retiree, according to the report.

“As Congress heads toward another budget showdown, the loudest calls for cutting Grandma’s benefits are coming from CEOs who will never have to worry about their own retirement security,” co-author Sarah Anderson, who is the Global Economy Director at the Institute for Policy Studies, said in a release.

Business Roundtable’s plan for Social Security, first proposed in January, advocates raising the full retirement age to 70 (right now it’s somewhere between 65 and 67, depending on when you were born) and adopting a new measure of inflation, known as "chained CPI," which would reduce the system's annual benefit increases.

“The [Institute for Policy Studies] report is more notable for what it doesn’t say, than for what it does," Fix the Debt, a separate association named in the report, said in a statement Wednesday. "The authors criticize advocates of Social Security reform, but fail to mention the very serious consequences of inaction.

“Americans understand that Social Security must be reformed to remain solvent," the statement continues. "And the majority of Americans support a gradual phase-in of reforms to strengthen the program’s viability."

The use of chained CPI would cut Social Security spending by more than $100 billion over 10 years, according to estimates by the Congressional Budget Office.

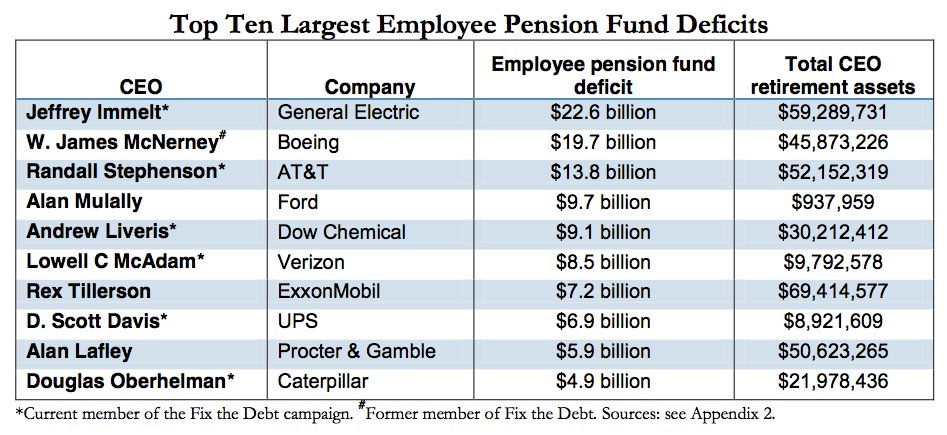

Business Roundtable claims that such pain is necessary to get Social Security's finances under control. Ironically, according to the report, some of these CEOs run companies with pension deficits of their own. Ten Business Roundtable CEOs' companies have deficits in their employee pension funds of at least $4.9 billion. General Electric CEO Jeffrey Immelt, who has a $59.3 million retirement fund, runs the company with the biggest pension fund deficit, at $22.6 billion:

For a full understanding of the report’s methodology, you can click here to read the report.

Copy the code below to embed this infographic on your site:

This post has been updated to include a statement by the Fix the Debt campaign.