Since the late 1970s, economic forces have enabled the privileged few to take home more and more in the form of income and profits, while the wages of average workers have stagnated. Rather than combat this trend, public policies have strongly reinforced it. This has both hurt Social Security's finances and created a retirement income crisis looming for today's workers.

In response to the highly unequal 21st century economy, Congress should reform Social Security by asking high earners to contribute to Social Security on all of their income at the same rate as other Americans. Such reforms do not amount to 'soaking the rich', who would indeed receive higher Social Security benefits as a result; rather, they are part of a necessary rebalancing of our public policy framework after decades of upward redistribution.

Income Inequality Has Hurt Social Security's Finances

Social Security payroll taxes are levied only on wages up to the Social Security tax cap, currently $118,500. Yet from 1979-2012 all aggregate income growth has gone to the top 10 percent of the income hierarchy. With nearly all aggregate income growth occurring outside of the Social Security system, it is unsurprising that Social Security's finances have suffered. Indeed, slow and unequal wage growth has caused a significant share - at least one-third and probably more - of the currently projected long-term shortfall in Social Security which has emerged since the 1983 reforms.

Income, Capital-Gains and Estate-Tax Cuts Have Increased Inequality

U.S. tax policy reforms - far from reducing market income inequality - have increased it. Top marginal income-tax rates, as well as taxes on unearned income paid primarily by the wealthy, have been dramatically reduced since 1980. Among the 32 OECD countries for which data are available, the U.S. now ranks 28th in terms of the effectiveness of its policies in reducing income inequality.

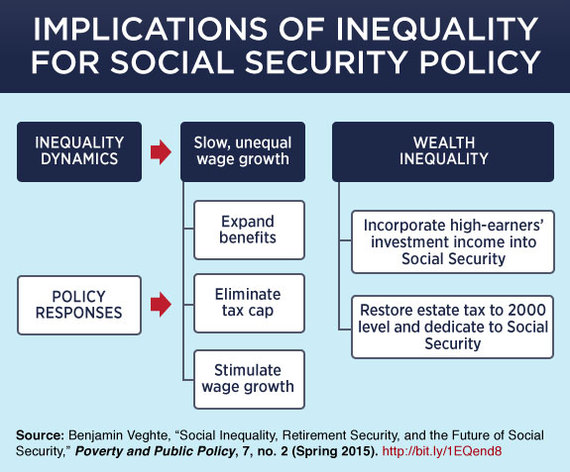

Implications of Inequality for Social Security Policy

There are several implications of rising inequality for Social Security policy. First, in response to slow and unequal wage growth, Congress should:

Expand Social Security benefits

While Social Security benefits may have been adequate in the 1980s, slow and unequal wage growth, cuts to Social Security benefits, and the collapse of the other two legs of the retirement stool make benefits inadequate today and in the future, indicating a strong need to expand Social Security beyond its current average benefit of $15,640/year.

Eliminate the Social Security tax cap

Social Security's revenue base should be broadened to encompass high incomes. The payroll tax cap was already eliminated for Medicare Part A (hospital) insurance in 1994, without any clearly discernable impact on the economy. Sen. Sherrod Brown's (D-OH) "Strengthening Social Security Act" is one of several proposals in Congress that would scrap the Social Security tax cap to fund expanded benefits and extend the system's solvency until late into this century.

Stimulate wage growth

Stronger long-term real wage growth - 1.76 percent per year, rather than the currently projected 1.13 percent - would reduce Social Security's long-term shortfall by over one-third (35 percent). Congress should invest in infrastructure and in education and training, raise the minimum wage, and make it easier for workers to bargain for fair wages. Each of these measures would lessen inequality and thereby improve Social Security's finances.

In response to rising wealth inequality, Congress should:

Incorporate high-earners' investment income into Social Security

The Affordable Care Act has already set the precedent for subjecting investment income to social insurance contributions with its new Medicare Net Investment Income Tax (NIIT). Starting in 2013, it levies a 3.8 percent tax on the unearned income of those with modified adjusted gross income (MAGI) above $200,000 ($250,000 for couples). Both to reduce income inequality, and to keep pace with overall income growth, Social Security should also incorporate the investment income of high earners into its contribution and benefit base.

Restore the estate tax to its 2000 level and dedicate it to Social Security

From the late 1930s through the 1970s, the top federal estate tax rate in the United States was always 70 percent or above, with a low exemption amount. The exemption amount in 2015 is $5,430,000 ($10,860,000 per couple). At such a high exemption amount, fewer than 2 of every 1,000 estates - less than 1/50th of one percent of estates - now owe any estate tax. Earmarking these revenues for Social Security is supported by both the history of the Social Security program and the particular nature of the estate tax (a fuller account of this can be found here).

The combined effect of scrapping the cap and incorporating capital income into Social Security would simply be that high earners would contribute to Social Security on all of their income at the same rate as the typical worker does. Strengthening Social Security to better reflect changes in our economy and society would make it the cornerstone for middle class retirement security in the 21st century.