A recent New York Times story posed the question: Is life too hard for millennials?

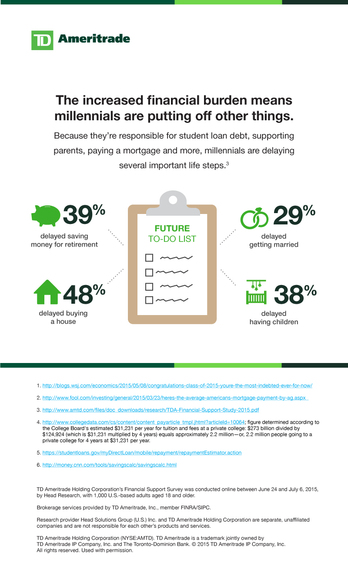

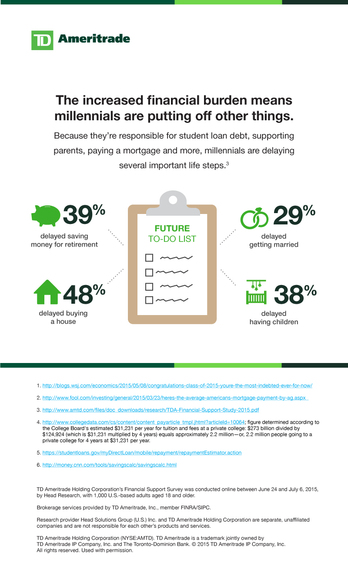

Millennials are the most educated generation, yet they're earning less, their median net worth is down, and many face decades of student loan payments. Pair that with the uncertainty surrounding their retirement, and they appear to be facing a less-than-bright future. Not to mention that one in five millennials is also providing financial support to aging parents to the tune of $18,250 a year - taking a huge chunk out of their budgets. It's no wonder they're pushing off having families, starting businesses or buying houses.

Some people are pretty tired of hearing about the millennial generation and understandably so (a quick search of Google News pulls up more than 2 million results). But there's a big reason we must understand them and their habits. In the first quarter of 2015, they surpassed Generation X as the largest chunk of the workforce. This means they are going to start to drive the U.S. economy as they enter wealth accumulation years. They are also expected to have a huge impact on the U.S. economy - spending $200 billion annually starting in 2017.

So it's concerning that a recent TD Ameritrade survey revealed that younger generations are not necessarily making the wisest financial decisions:

- 76 percent of young millennials (ages 15-24) said they know little or nothing about how to invest

- Nearly half (47 percent) of Americans this age believe that a savings account, earning minimal interest, is the best way to prepare for retirement

- Only 17 percent of those ages 15-24 said they feel that the stock market is the best way to grow their money

Knowing the basics on investing, which will hopefully make your money grow, is as important as understanding how to earn it and to spend it. If you didn't grow up learning how to save, budget, and invest, chances are you'll be behind the curve when you start earning decent paychecks and accumulating wealth. That same survey also showed that only 10 percent of students reported learning financial lessons from a teacher or course at school. Where are millennials going to get this investing education? Well, it takes a village.

Millennials and the younger generations are going to have to do the hard work, but as a village, we can provide guidance and tools. Parents are still the No. 1 resource for teaching kids about finance, but as financial professionals and business leaders, we can also inspire this next generation and propel them toward financial education and independence.

It is important that millennials wake up and smell the coffee, but I do have high hopes for this generation. They've seen a lot of turbulence early in their financial lives. But as history teaches, hardships we experience can also eventually make us wiser and hardier. Until that day comes, there are a few ways we can help this generation usher in a better plan for their financial future. So whether you are a parent, an educator or a millennial yourself, here are some tips to keep in mind that will help inspire and educate:

- Experience passion. You can't learn passion. You have to experience it. Often learning about the markets is basically a data dump of information from a professor who has experience in investing or a cursory explanation from a parent. It's often very much a one-way conversation. How can young people feel confident contributing to a discussion about a topic when they know very little? Programs like the thinkorswim® Challenge through TD Ameritrade U are working to bridge the gap between the classroom and real-world investing. By serving as a much-needed resource for colleges and their students through a virtual trading competition, we can educate students of all majors about the markets and inspire them to become the next generation of investors.

Speak up. A 2014 study from North Carolina State University and the University of Texas found that children pay close attention to issues related to money but that some subjects were "off-limits," like family finances, parental income, investments and debt. It's important to convey the importance of saving and budgeting, but it's equally important to discuss investing and debt topics within families so that young people know how to grow their money and safeguard it from debt.

Spark inspiration. Young adults today want to be inspired, and they are eager to give back and make positive contributions to society. Find what it is that makes your child, student or yourself tick and explore careers or investment strategies related to topics or industries that have already sparked curiosity and passion. So my call to action for millennials is this: Life is a series of choices no matter how good or bad your starting point. No matter where your starting point, you can learn key personal finance and investment strategies now, perhaps alleviate some of the financial pressure, and start to create the life you want.

TD Ameritrade, Inc., member FINRA/SIPC. Stock investing is subject to risks, including risk of loss. Commentary provided for educational purposes only. Past performance of a security, strategy, or index is no guarantee of future results or investment success.

Support HuffPost

Our 2024 Coverage Needs You

Your Loyalty Means The World To Us

At HuffPost, we believe that everyone needs high-quality journalism, but we understand that not everyone can afford to pay for expensive news subscriptions. That is why we are committed to providing deeply reported, carefully fact-checked news that is freely accessible to everyone.

Whether you come to HuffPost for updates on the 2024 presidential race, hard-hitting investigations into critical issues facing our country today, or trending stories that make you laugh, we appreciate you. The truth is, news costs money to produce, and we are proud that we have never put our stories behind an expensive paywall.

Would you join us to help keep our stories free for all? Your contribution of as little as $2 will go a long way.

Can't afford to donate? Support HuffPost by creating a free account and log in while you read.

As Americans head to the polls in 2024, the very future of our country is at stake. At HuffPost, we believe that a free press is critical to creating well-informed voters. That's why our journalism is free for everyone, even though other newsrooms retreat behind expensive paywalls.

Our journalists will continue to cover the twists and turns during this historic presidential election. With your help, we'll bring you hard-hitting investigations, well-researched analysis and timely takes you can't find elsewhere. Reporting in this current political climate is a responsibility we do not take lightly, and we thank you for your support.

Contribute as little as $2 to keep our news free for all.

Can't afford to donate? Support HuffPost by creating a free account and log in while you read.

Dear HuffPost Reader

Thank you for your past contribution to HuffPost. We are sincerely grateful for readers like you who help us ensure that we can keep our journalism free for everyone.

The stakes are high this year, and our 2024 coverage could use continued support. Would you consider becoming a regular HuffPost contributor?

Dear HuffPost Reader

Thank you for your past contribution to HuffPost. We are sincerely grateful for readers like you who help us ensure that we can keep our journalism free for everyone.

The stakes are high this year, and our 2024 coverage could use continued support. If circumstances have changed since you last contributed, we hope you’ll consider contributing to HuffPost once more.

Already contributed? Log in to hide these messages.