Student loan debt is eating up a sizable chunk of recent college graduates’ paychecks, according to a new Congressional report. And that's putting it mildly.

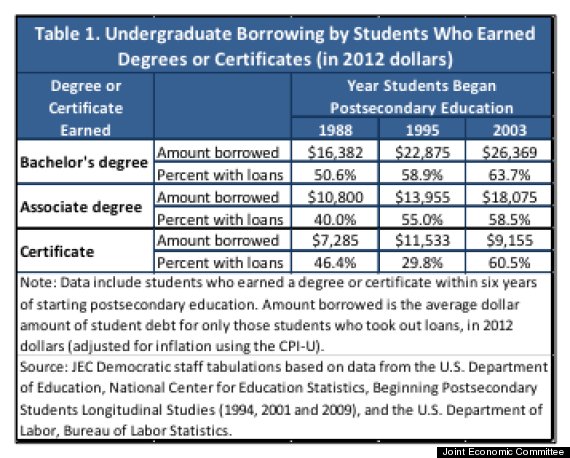

About two-thirds of graduates of the class of 2011 have college debt, and those students have an outstanding balance equivalent to about 60 percent of their annual income on average, according to a report from Congress’ Joint Economic Committee.

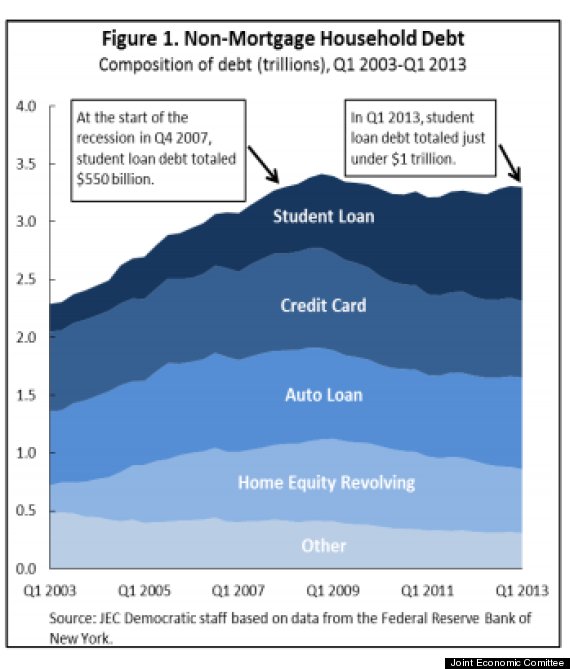

Though some students have always taken out loans to fund their education, the report notes that college debt has become a larger burden for more students in recent decades. In fact, since the recession, student loan debt has been the only kind of consumer debt to rise, soaring to $1 trillion by the beginning of this year, from $550 billion at the beginning of the recession, the report notes.

The report comes just weeks before interest rates on some government-backed student loans are set to double, assuming Congress does nothing to stop the increase. The findings, many of which have been reported before, highlight the tough choices increasing levels of student loan debt force many young people to make.

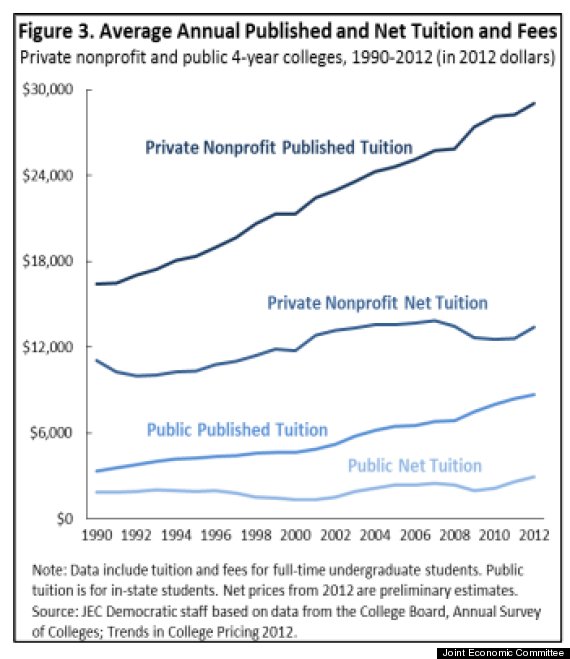

As the report notes, the employment rate of college graduates is much higher than for those without a degree, but rising tuition costs and less government help has pushed more students to saddle themselves with debt in order to obtain a degree.

It’s not only recent college graduates and their parents who will suffer as a result of ballooning student debt, though. College debt has made young people less likely to take out mortgage and auto loans, a worrisome sign for the economy, researchers at the New York Federal Reserve found earlier this year.

Check out these three charts from the report, illustrating the problem: