AT&T and Verizon Post Similar Share Gains, With Varying Loyalty, Switching

Consumer Intelligence Research Partners (CIRP) released analysis of the results from its research on US mobile phone carriers for the calendar quarter that ended December 31, 2016. This analysis features findings about consumer trends in mobile phone activations from October-December, 2016 for AT&T (T), Verizon (VZ), Sprint (S), and T-Mobile (TMUS).

CIRP finds that among major mobile phone companies, T-Mobile (including MetroPCS) had a superior quarter, with both good customer retention and strong new customer gains. Verizon and AT&T (including Cricket) had similar results, gaining new customers to a greater extent than they lost existing customers. Sprint lost market share in the quarter, with a greater percentage of customers switching away from Sprint to other carriers than those who switched from other carriers to Sprint.

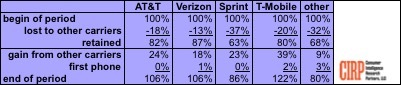

This analysis shows that among customers that activated a phone in the quarter (approximately 12% of the US market), T-Mobile grew its customer base 22% and AT&T and Verizon each grew their customer base by 6% (Table 1). In contrast, Sprint saw its customer base decline by 14%. These figures are relative to the number of customers that activated a new phone and that started the quarter as a customer of each carrier. CIRP analyzes carrier gains and losses among customers who activated a mobile phone during the quarter. Using quarterly activations as a base, CIRP measures each carrier's relative performance.

T-Mobile continues to win the carrier switching challenge in the market, though it does not yet have the same scale as the two larger carriers, AT&T and Verizon. T-Mobile has loyalty rates that are somewhat close to those of AT&T and Verizon, with 80% of existing T-Mobile customers that activated a phone in the quarter remaining with T-Mobile. Yet, T-Mobile also continues to attract a higher percentage of customers that switch from other carriers. Its innovative plans continue to draw attention, and with improved network quality advertising, it now is closer in overall market presence to AT&T and Verizon than it is to Sprint.

In stark contrast, Sprint experienced much greater customer losses and lower loyalty. Sprint gained new customers to a similar extent as AT&T and Verizon, but could not offset the customer losses in the quarter. Consequently, it was the only one of the four largest carriers to lose customers relative to its customer base at the beginning of the quarter.

AT&T and Verizon experienced the least change, positive or negative. Verizon had both the greatest customer loyalty at 87%, but also the smallest gain in new customers. AT&T has slightly lower loyalty but also higher customer gains, so both ended up in the same place, with a 6% gain relative to customers at the start of the quarter. They both continue to grow mostly at the expense of Sprint and other regional and pre-paid carriers.

Finally, regional and pre-paid carriers continue to lose significant ground to the leaders. The retention rate of 68% in the quarter is far below the 80-87% for AT&T, T-Mobile, and Verizon, but actually exceeded that of Sprint. They also attracted far fewer switchers from other carriers, and could not make up the losses with the increasingly smaller base of first-time phone buyers.

CIRP bases its findings on a survey of 500 US subjects, from January 1-12, 2017, that activated a new or used phone in the October-December 2016 period. For additional information, please contact CIRP.