Sprint, T-Mobile Again Increase Share of Net Customer Activations

Consumer Intelligence Research Partners (CIRP) released analysis of the results from its research on US mobile phone carriers for the calendar quarter that ended June 30, 2015. This analysis features findings about consumer trends in mobile phone activations from April-June, 2015 for AT&T (T), Verizon (VZ), Sprint (S), and T-Mobile (TMUS).

CIRP finds that among major mobile phone companies, T-Mobile (including MetroPCS) and Sprint (including Boost Mobile) again had the best quarter, gaining new customers to a much greater extent than they lost existing customers. T-Mobile outperformed Sprint, with both adding a significantly greater percentage of net customers than AT&T and Verizon.

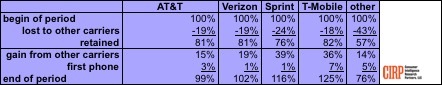

This analysis shows that among customers that activated a phone in the quarter, T-Mobile grew its customer base 24%, and Sprint grew its customer base 16%, relative to the number of customers that started the quarter as their respective customers. CIRP analyzes carrier gains and losses among customers who activated a mobile phone during the quarter. Using quarterly activations as a base, CIRP measures each carrier's relative performance (Table 1).

T-Mobile's retention rate actually beat the leaders this quarter, with 82% of existing T-Mobile customers who activated a new phone staying with T-Mobile, while AT&T and Verizon both retained 81% by the same measure. T-Mobile achieved a comparable retention rate to the two leaders, AT&T and Verizon, for the first time since we started measuring loyalty. Its 'Un-carrier' strategy of shaking up the US mobile phone market began about two years ago, so this first round of renewals of two-year contracts that they began to attract in mid-2013 is an indication of the long-term impact of that strategy.

As we have seen in the past few quarters, in the battle to attract new customers, Sprint and T-Mobile also lead the way. Relative to their base at the beginning of the quarter, Sprint attracted 39% and T-Mobile 35% of their quarterly base from other carriers. This is twice the rate of AT&T and Verizon. In addition, T-Mobile gained another 7% in first time phone buyers.

CIRP bases its findings on a survey of 500 US subjects, from July 1-3, 2015, that activated a new or used phone in the April-June 2015 period. For additional information, please contact CIRP.