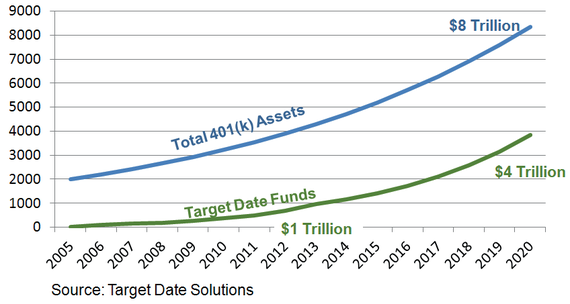

Target date funds are on a growth trajectory that will take them to $4 trillion by 2020, from their current level of $800 billion. That's 30% per year growth over the next 6 years. On a percentage basis, TDFs will increase from 25% of all 401(k) assets to about half.

Target date funds are on a growth trajectory that will take them to $4 trillion by 2020, from their current level of $800 billion. That's 30% per year growth over the next 6 years. On a percentage basis, TDFs will increase from 25% of all 401(k) assets to about half.

Why are TDFs growing so quickly and where are their growing pains?

Target Date Funds (TDFs) are the most popular choice of Qualified Default Investment Alternative (QDIA). Fiduciaries choose TDFs rather than plan participants, so they are employer-directed, or more precisely they are advisor-directed because employers rely on their financial advisers for this choice. Advisers like TDFs for their simplicity, and the fact that everyone else is using them, although some have steered clear of TDFs. TDFs are a one-size-fits-all-set-it-and-forget-it approach to investing for the masses. There are currently 20 million participants in TDFs across 100,000 401(k) plans, and new subscribers default into TDFs every day.

No surprise, there are growing pains.

This $trillion train is speeding down a rickety track. You may want to get off the train, or you could help us fix the track. To learn more about the Hidden Risks in Target Date Funds download our Free eBook. For example, 60% of TDF assets have been entrusted to just 3 firms -- T. Rowe Price, Vanguard and Fidelity -- so they control the industry. On an AUM (Assets Under Management) basis, the Big 3 manage $160 billion each on average, versus $5.5 billion for their 57 competitors, so they're 30 times bigger. These are fine firms, but the problem is that fiduciaries are not vetting their selection, opting instead to select their bundled service provider out of convenience and familiarity. This decision exposes beneficiaries to more risk at the target date today than there was in 2008 when those near retirement lost 25-35%. It's a time bomb waiting to explode.

Fiduciaries seem oblivious to this risk. Fiduciaries mistakenly believe that the Big 3 are prudent because:

1.Properly structured TDFs are Qualified Default Investment Alternatives (QDIAs) under the Pension Protection Act of 2006. Form over substance.

2.There is safety in numbers, so choosing one of the most popular TDF providers is prudent. You can't go wrong with Fidelity, T. Rowe Price and Vanguard. Or can you? Is common practice necessarily prudent?

There is more to selecting TDFs than these two simple rules. Reliance on these trifling shields can lead to breaches of fiduciary duty that will bring lawsuits (loss-suits) when we experience the next 2008.

In addition to this absence of due diligence, there's a lot of confusion surrounding TDFs, like the importance of demographics and the distinction between "to" and "through." These growing pains will eventually be corrected, but it might not happen soon enough.

Warning: When well-intentioned, but misinformed financial advisers damage participants, restitution is warranted because advisers are fiduciaries who should know better. In this case, the defenseless are millions of "little guys" with average account balance of $80,000 at retirement, paying 100 basis points each to be in TDFs. No one likes to see the little guy get hurt. The fiduciary Duty of Care necessitates safeguarding against foreseeable harm; it's like our duty to protect our children.

This article was originally published on Paladin Registry and has been updated for Huffington Post.

About the Author: Ron Surz is president of PPCA Inc and its wholly owned subsidiary Target Date Solutions. He is a pension consulting veteran, having started with A.G. Becker in the 1970's. He holds a CIMA (Certified Investment Management Analyst) designation. He has published regularly in such publications as The Journal of Wealth Management, The Journal of Investing, Journal of Portfolio Management, Pensions & Investments, Senior Consultant, HorsesMouth and the IMCA Monitor, as well as contributed to and edited several books. Ron's most recent co-authored book is the "Fiduciary Handbook for Understanding and Selecting Target Date Funds."

Follow Ron on Twitter @RonSurz.