I don't think you need a crystal ball to predict that whoever runs for president in 2016 will have some sort of tax cut at the heart of their platform, probably targeted at the middle class, and I'm talking both Democrats and Republicans. It will likely be pitched as a response to middle-class wage and income stagnation, and as such, I certainly understand the motivation. The disconnect between growth and middle-class prosperity is the motivation for my own new book, The Reconnection Agenda: Reuniting Growth and Prosperity, hopefully out within the next few months.

But I actually say little about tax cuts as a solution to the fundamental disconnect, for reasons Larry Mishel articulated effectively in an NYT op-ed yesterday: "What has hurt workers' paychecks is not what the government takes out, but what their employers no longer put in -- a dynamic that tax cuts cannot eliminate."

No question that some of the tax cuts we've been hearing about lately, such as those in the president's budget to help pay for childcare or college, could help strapped families. The fact that a policy is palliative versus curative doesn't mean it's a bad idea.

But to get to root of the disconnect, we need measures that strengthen workers' bargaining power, from full employment supported by the Fed and investment-oriented fiscal policy, to improved labor standards and collective bargaining, to more balanced trade, and (I'd add) direct job creation and fair-hiring practices to reach the hardest to employ (each one of which gets a chapter in the forthcoming book).

One point I'd add to Larry's excellent op-ed, and I think it's important. This issue of wage and income stagnation is not quite the duality that our rhetoric suggests. That is, there's no firewall between the primary distribution, or market outcomes, and the after-tax and transfer distribution. They're related.

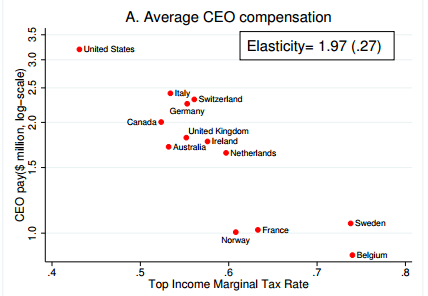

For example, this paper shows strong negative correlations between top tax rates and before-tax high-end compensation or income shares (see figure). One reason is that as top marginal tax rates go up, high earners have less incentive to push for super high salaries. E.G., a top rate of say, 70 percent, on income over some very high threshold disincentivizes the kind of super-numerary CEO pay packages we've seen evolve as top rates have come down. Of course, this result is conditional on few avenues for tax avoidance, which unfortunately does not describe our current tax code at all.

So sure, more progressive taxation is warranted, but to rely wholly or even mostly on that solution is to both further reduce our revenue base-very bad move-and to require annual trips back to the redistribution well... not, shall we say given current and probably at least near-term future politics, a promising strategy.

Source: Piketty et al (see text for link)

This post originally appeared at Jared Bernstein's On The Economy blog.