So you have a great idea, some early customers on your new app, and what you think is "product-market fit." Good for you! Now, your goal should be scale your company as fast as possible, acquire as many customers, own your category, exit, and buy a beach home.

Sounds simple right? It's not.

While some businesses can scale astronomically through organic growth and investment, most of us mere mortal entrepreneurs will need to raise outside capital or venture capital to scale.

We spoke to leading investors and entrepreneurs in Silicon Valley who have raised capital and provide the key highlights here in 10 simple tips.

1) Keep It Simple Stupid (KISS)

Cliche and overused but true. Most investors read through hundreds of pitches a week and do not have the time or memory to understand anything more than broad brushstrokes and big ideas. As leading investor Dave McClure would say, keep your pitch to "idea, traction, market size." All investors really care about is a high level overview of what you are doing, the rate at which people are buying into it, and how many more people can buy into it. Leave the large business plans at home.

2) Understand What Matters to Investors

If you think that investors care about your novel idea you're wrong. What investors really care about is the metric they're judged upon: Internal Rate of Return (IRR). This is the rate of return of their overall fund expressed as a percentage of total investment. Investors raise capital also and their funders (called Limited Partners) use IRR to decide who to invest in. If your business has potential to create a large multiple for investors, they'll care. You're life changing idea comes second.

3) Recognize Different Types of Investors and Don't Waste Your Time

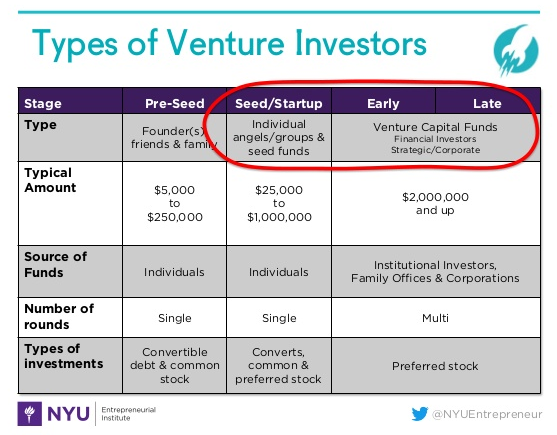

There are different kinds of investors for different life stages of your company. The first stage is Friends and Family. These are the people closest to you who will fund you because they believe in you. The second stage are "angel investors" or "seed funds." These investors place capital in companies that show early traction, early product-market fit, and have lower valuations. Usually these companies come out of an accelerator program like Y Combinator. The last stage are venture investors who lead A, B, C and so forth rounds. Speaking to a venture investor at the seed stage will usually be a waste of time, so know your stages.

4) Potential Is Everything: Paint the Biggest Picture Possible

Because of the nature of venture investment, one or two investments (of a fund that can make hundreds of investments) that become billion dollar "Unicorn" companies can return entire funds many times over. This is why it is absolutely essential to create the narrative that your company will be the "market leader" or "absolute last" company in your space. Investors want to know that your startup will own a market and crush the competition.

5) Warm Intros Matter

Cold pitching an investor rarely works. Instead, get an introduction through an existing investor, advisor who has invested in your company, or venture firm partner. According to Ken Zi Wang, Co-Founder of Traction, a fast growing company in the marketing space, this can be challenging at first. "After some time, I realized that what matters is the introduction from an investor who has a highly prized reputation, has invested in your company, and is willing to invest again. This matters more than anything else."

6) Leave Your Co-Founder at Home

This may sound counterintuitive but it's not. Your job as a founder and fundraiser is to portray your entire team as a group of knife-wielding vigilante ninjas who create and #win without even trying. A suggestive description that lets investors imagine endless possibilities accomplishes this. This tactic may not work as well at later fundraising stages but is effective when raising your first million.

7) Be Clear in Follow ups

You just had a great investor meeting. They loved the idea, the traction, the market size, and most importantly, you! Now it's time seize the moment. Immediately follow up with requested information and have your own follow up packet or presentation ready. Suggest a specific time to meet and talk next. You'd be surprised how often this works.

8) Have a Third Party Verified Closing Deadline

So you have a deal in the bubble and you are about to close but your investor keeps stalling. What you need isn't your own deadline but one that's third party verified. set by End of Tax Season, end of the year, or an upcoming Demo Day all work. Investors will know you cannot control these deadlines and will close just as it hits...sometimes in the last few seconds.

9) Momentum: It's Everything

For closing investors, what matters perhaps more than anything else is momentum. This means that once you have started closing investors and getting checks, it behooves you to move as fast as possible and close as many as you can. No investor wants to be the first money in; they all want to be the last money in out of FOMO. Therefore, if you start closing fast, keep going. Investors always follow.

10) Beware of Info-Fishing

Almost all investors genuinely care about your business and want to help you succeed. But be wary of the minority that don't. These are info fishing investors who are looking to suck you dry of as much competitively relevant information as possible and feed it to competitors who they know personally or are already invested in, unbeknownst to you.

Here are some telltale signs to watch out for: 1) they request more information on your product than on your growth metrics or plans; 2) they refuse to discuss clear details of their investment thesis or strategy; 3) they cannot recall information about your company after multiple meetings; and 4) they request information repeatedly on a few single product issues in different ways. This happens to nearly every entrepreneur (and has even been featured on the HBO program Silicon Valley) so watch out.