A healthy national economy requires long term planning so that it can invest in its future while maintaining a manageable level of debt. Revenues must be enhanced when necessary; expenses must be prioritized and sometimes reduced or eliminated.

But while there is plenty of fat and waste in government, it's important to emphasize that government operations cannot always be assessed on a simple profit and loss basis; there are many critical cases where the government steps in precisely because the free market can't or won't -- for example Medicaid, the military, or critical infrastructure investment. Expenses like these aren't optional -- they go to the very heart of the purpose of government.

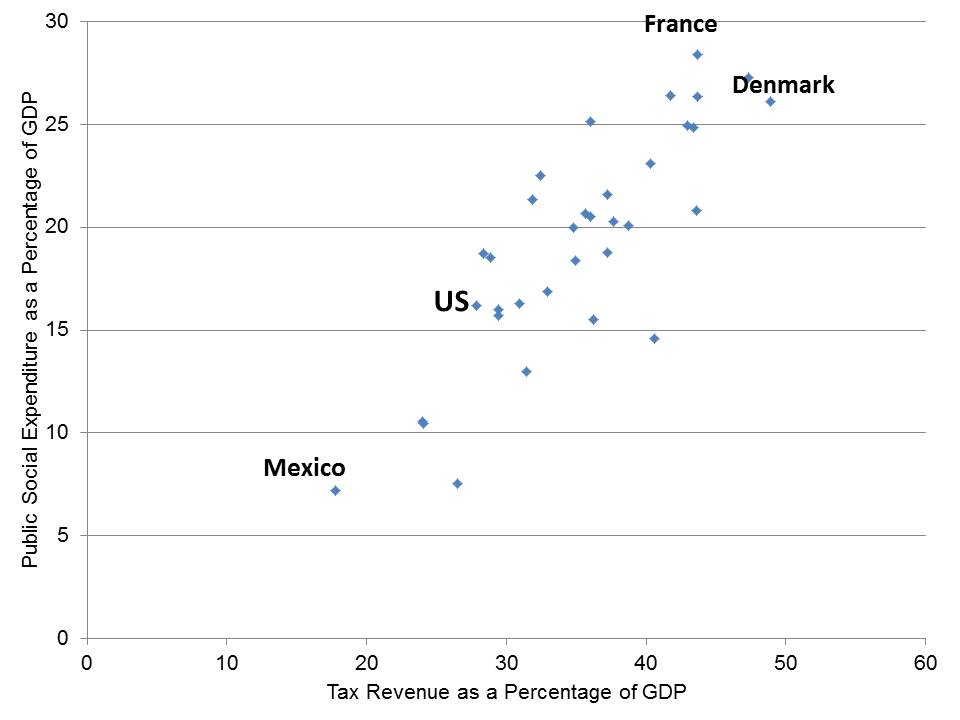

This balance between taxes and spending is graphically presented below, in this scatterplot of the Organisation for Economic Co-operation and Development (OECD) countries.

The Organisation for Economic Co-operation and Development (OECD) is comprised of 34 of the wealthier countries in the world, including North American countries (Canada, Mexico and the U.S.), much of Western Europe, as well as New Zealand, Australia, Chile, Israel, Japan and South Korea. The chart shows the strong correlation between each country's rate of taxation and its expenditures on welfare, services, utilities and defense. Countries with larger roles for government, like France and Denmark, collect more taxes than countries with comparatively smaller roles for government, like Mexico and the United States.

It's rather basic: if you expect the government to play a larger role, then you have to provide it with the funds to do so. As you can see, the U.S. has both a comparatively low rate of taxation and a low rate of public expenditure. Even so, its expenditures, also called outlays, have outpaced its revenues.

How does America's level of debt compare with other countries? Of the 34 OECD countries, the United States had the 11th largest ratio of public debt to GDP in 2010. This is in contrast to America's previous tendency to be a comparatively low debt leveraged country. America's debt had declined from 108 percent of GDP in 1946 to 24 percent in 1974, as the country's economy expanded more rapidly than its debt

What has happened on the revenue side during that same period? On an absolute scale, the federal government's revenue has grown sharply, with its 2012 revenue roughly 12 times what it was 40 years earlier. Of course, everything else has grown during that period as well, including the total population, total economy, and federal expenses. What is highly relevant for this discussion is the fact that the federal revenue ranged between 19.5 percent and 20.6 percent of GDP in 1998-2001, the years of surplus, but has ranged between 15.1 to 15.8 percent from 2009 to 2012. As revenue as a percent of GDP declined, debt as a percentage of GDP rose.

Over the period of 2007 to 2010, the only OECD countries that showed a larger increase in the ratio of public debt to GDP than America were, in order, Iceland, the United Kingdom, Greece and Ireland, with Spain and Portugal just behind.

This is an excerpt from the recently released, A Modest Proposal for America: Taxes, Entitlements, and the Manufactured Crisis of Federal Finance.

Follow Howard Steven Friedman's Facebook Fan Page