This article was written by Adam Cecil of PolicyGenius.

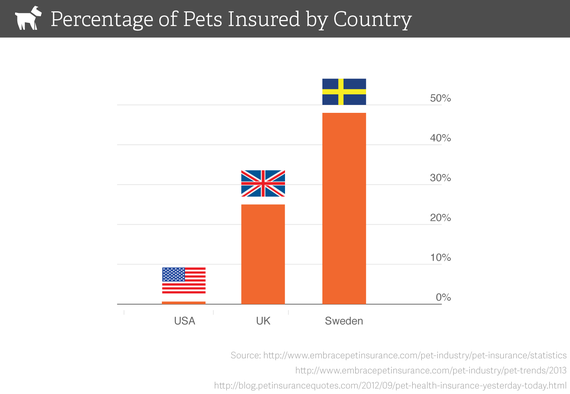

You've just brought your new pal home for the first time. You remembered the essentials: food and water bowls, a comfy bed, plenty of toys and a toolkit of grooming tools. But over 99 percent of pet owners are forgetting one of the most important products you need for your pet: insurance.

Pet insurance? What's that?

Pet insurance is easy to understand. Humans have health insurance to cover the costs to treat their aches, pains and illnesses, and pet insurance does the same for their animal companions.

There are two major types of pet insurance: accident plans and comprehensive plans. Accident plans can help cover the silly things your pet does -- a swallowed sock or corn cob -- or human mistakes, like a car accident. But it doesn't cover illnesses like cancer, a disease that accounts for over 50 percent of all disease-related pet deaths every year.

We consider comprehensive plans to be the better value, and consumers agree - over 95 percent of pets with insurance have a comprehensive plan.

There are also wellness plans, like Banfield Pet Hospital's Optimum Wellness Plan, but don't be confused: these are not insurance plans. Wellness plans usually cover regular pet visits and preventative care, with some small discounts on other procedures. Unlike pet insurance, wellness plans are limited to specific vets.

How does pet insurance work?

The biggest difference between pet health insurance and human health insurance is that pet insurance will reimburse you directly. You pay the vet bill upfront at the time of treatment, submit a claim and the pet insurance company sends you a check shortly afterward.

The premium that you'll pay every month is based on a number of factors, including your animal's breed and age and the policy features you select. Like human health insurance, pet insurance can range from basic, no-frills coverage to generous comprehensive plans that even cover alternative treatments like acupuncture. You can control your premium by changing the size of the deductible you're willing to pay or opting for a lower reimbursement rate.

PolicyGenius' pet insurance quote comparison tool lets you compare prices across multiple providers by plugging in a few key pieces of information. Check it out now to get an instant pet insurance quote and exclusive discounts.

Is pet insurance actually worth the cost?

Short answer: Yes.

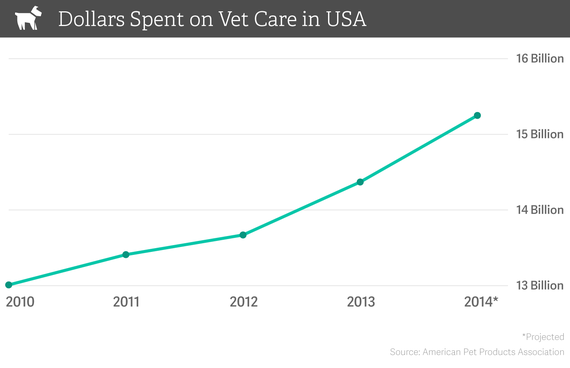

Long answer: Pets are more than just an animal -- David Grimm, deputy news editor at Science and author of Citizen Canine, told us that most pet owners treat them like members of the family. And like members of your family, they deserve proper health care. We already spend a lot of money at the vet (over $15 billion in 2014 alone). Why wouldn't you spend a little extra every month to make sure the worst-case scenario will be covered?

Unfortunately for a lot of pets, there's a lot of misguided thinking about pet insurance out there. Some people and outlets are thinking about the economics of insurance all wrong. They're trying to answer "What do I get out of it?" by thinking about whether the payouts will exceed the premiums you pay in.

But pet insurance is not about saving money, it's about covering unexpected costs. It's about creating a safety net you hope you never have to use. Pet insurance is protection for a worst case scenario, not a discount plan or vet care coupon. You may have heard of something called "economic euthanasia." While euthanasia is the best way to end a pet's life when the disease is no longer treatable, economic euthanasia refers to ending a pet's life because an owner cannot afford treatment. It's heartbreaking, and it can be avoided by getting a comprehensive pet insurance policy.

But my pet is healthy! Do I really need pet insurance?

In an ideal world, your pet stays healthy until they reach the end of their natural life. Unfortunately, this isn't taking into account reality. Approximately 25 percent of all dogs will develop a tumor at some point in their life. About 1 in 10 cats will develop Feline Lower Urinary Tract Diseases. You can expect more trouble if you're coming in with a specific breed of dog -- bulldogs, the 5th most popular dog breed in the US, have a 71 percent chance of developing hip dysplasia.

We don't mention these statistics to scare you or make you sad. We do it because the saddest thing is an animal that can't be taken care of because of a lack of funds. And don't think you can get insurance once your pet is already sick -- insurance companies don't cover pre-existing conditions (which was also the case for human health insurance until the Affordable Care Act changed that).

Couldn't I just put money aside for emergencies?

The Consumer Reports article tells readers to open up a dedicated savings account for pet health emergencies instead of buying insurance. Consumer Reports suggests adding "a couple hundred dollars" every year, but is that really a sound financial plan for a pet health emergency?

Dog owners with pet insurance pay, on average, a little over $38 per month in premiums, coming in at $457 annually. Even if you put that much money in a bank account every year, you still wouldn't be able to afford many common pet health emergencies.

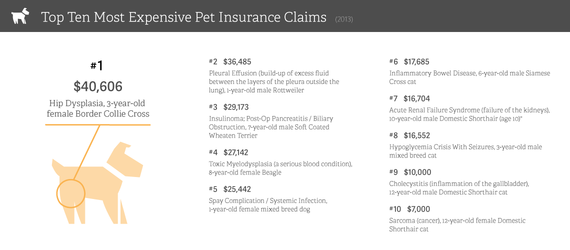

Emergency surgeries or lifesaving cancer treatments can easily run thousands of dollars, and with veterinary costs rising every year, those numbers are only going to get higher. Even now, people can spend small fortunes on emergency vet bills -- the most expensive pet claim last year was over $40,000. Not only that, but it's impossible to plan for unexpected illnesses or injuries. Disaster doesn't always strike late into your pet's life -- emergency medical care can be needed at any time. Saving a few hundred dollars every year just isn't going to cut it.

According to data from Trupanion, one of our pet insurance providers, the average insurance claim for cats with cancer is $450. That would wipe out a year's contribution to your vet care fund. Not only that, but there are usually multiple claims per condition, meaning you can easily spend thousands of dollars on average. Even simple and common conditions, like vomiting and diarrhea in a dog, can cost more than expected. The average insurance claim for that condition is $170. For extremely unlucky dogs and cats, costs will soar into the tens of thousands.

"I think insurance is amazing and everyone should have it for their pet," Dr. Jacqueline Wahl, an emergency veterinarian at the Emergency Animal Hospital of Northwest Austin, told us. She constantly sees vet bills run into the thousands of dollars.

Of course, not every animal is going to end up costing you a fortune in vet care. We all hope that our pet will lead a long, lucky and healthy life. But you never know if or when a medical emergency will happen, and having a savings account with a few hundred dollars in it just isn't going to cut it if you don't want to confront the choice between your pet or your wallet.

Alright, you've convinced me. What do I do next?

PolicyGenius offers free instant pet insurance quotes from the top pet insurance companies. If you get a quote from this easy to use tool, you can also get a discount of up to 15 percent on your premium.

If you still have questions, you should check out PolicyGenius' Pet Insurance Guide, an in-depth explanation of all the ins and outs of pet insurance.