The most straightforward and effective way that Wall Street rips off small investors is for them to lie about the products they are selling you. And it happens all the time. Every day, brokers tell clients that they have a great deal for them; don't worry, it's completely safe; it fits your long term objectives and you can't lose.

We have examined three of the biggest lies in the last three articles to this series (see below). Namely, #5- that putting your money in a money market fund is the same as holding cash (even though most of this money is going to insolvent banks in the US and Europe right now), #6- that bonds are safe investments that guarantee a fixed rate of return (but fail to mention that they could lose half their value if inflation returns as I expect it will), and #7- that equities always outperform bonds in the long run (except when they don't).

But, there are many more. Who hasn't heard a broker tell you that commodities are safer than stocks, that options are safe because there is a limit to how much you can lose, that margin debt allows you to use other people's money to leverage the upside with little to no mention of the downside of having your position closed out at the worst time? That they think a potential investment is a wonderful opportunity but fail to mention that their own trading desk is currently dumping the same security. That their research analyst loves the company, but fails to mention that their investment banking group is getting paid millions to advise the same company.

And the more obtuse the product, the greater the ability to prevaricate. One of the advantages of Wall Street creating complex products like CDO's, reverse mortgages and annuities is no one really knows how they work or how to value them freeing up the salespeople to pretty much say whatever they damn well please as it never will be able to be proven false if disputed. And with complex products, you always have to return to the firm who sold them to you if you want out as they pretty much have a monopoly in their trading and thus extract rather generous bid/ask profit margins for themselves.

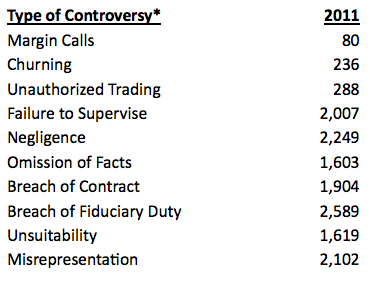

The Financial Industry Regulatory Authority (FINRA) is the largest independent regulator for all securities firms doing business in the United States. Here is FINRA's own compilation of the arbitrage complaints it received in 2011 by controversy involved.

*Each case can be coded to contain multiple controversy types. Therefore the columns in this table cannot be totaled to determine the number of cases served in a year.

Misrepresentation, breach of fiduciary duty and breach of contract are just what they sound like, lying. But, lying can take lots of other forms. Certainly omitting important facts is a form of lying, especially when the broker has a fiduciary responsibility to disclose all relevant facts an investor would need to know to make an informed decision. And the most important fact that is often omitted is how big are the fees going to be and what are the hidden expenses involved.

Failure to supervise and unauthorized trading could reflect an internal personnel management problem, but it could also be an intentional effort on behalf of brokerage firms to give a salesperson lots of leeway in deciding what they tell investing clients and then claim that the salesperson was acting solely on his own or had "gone rogue" if they get caught lying.

Unsuitability is an important area of deceit as it is always in the salesperson's interest to push the client into riskier products that carry higher sales commissions for the broker and higher profits for his bank. Why didn't more brokers move their clients into cash as the market began to tank in 2008? Because, they don't make much money if their clients hold their assets in cash. We will discuss in a later article in this series how brokers are motivated to move clients into high margin products like annuities and other hard to analyze insurance-type products regardless of how "suitable" these products are for their investing clients.

Of course, these deceptions occur because we allow them to occur. Individuals sign brokerage agreements when they open their accounts that say that any legal disagreements cannot be taken to court, that you can't sue the brokerage firm, but rather such disagreements must be settled by binding arbitration, and typically by industry-friendly groups like FINRA. You probably don't have any negotiating leverage in changing this standard language in a brokerage contract, but you can vote with your feet and refuse to deal with firms that ask you to sign such an agreement.

And if the fraud becomes large enough, the SEC and the Justice Department can get involved. But, because of the revolving door between these agencies and private practice, many of the lawyers working there have little incentive to get tough on the banks and brokerage outfits. Most lawyers at the SEC and Justice Department will rotate back to private practice after short stints in the public sector and the biggest client of most big name law firms in private practice are financial institutions. It is, I think, the prime reason that no banking executives have gone to jail during this entire banking and financial fiasco.

No, I believe the entire field of financial advice is badly broken and encourages lying. You would like your broker to have your best interests at heart, but in a system where they are rewarded for selling you things you may not need, lying is, if not encouraged, certainly overlooked as an effective method for these banks to add assets under management and to increase their profitability.

What can you do? I am a big believer in people getting more involved in their investing decisions. To retake control of their investments. To focus more on a few real assets that they understand rather than holding hundreds of paper financial securities they know little about.

Certainly, if people are making promises or guarantees to you, it would seem only sensible to get them in writing by asking them to send you a confirming email. I can tell you that brokerage firms tape record many of their employees' telephone conversations with you, that they hold onto all email and letter correspondence from you, and that if there is a dispute it is unlikely that you will ever see any of this evidence unless it hurts your argument and ends up supporting their position.

Finally, and this is incredibly self-serving so be careful, I think it makes sense to hire a fee-only advisor who can help you with your investments. By paying directly for your investment advice you at least have the opportunity to hear what a financial pro thinks you ought to be doing with your assets to achieve your investment objectives rather than doing things that just maximizes the compensation of some banker and the profitability of his or her bank. I am amazed at the number of investors who were burned in the latest crisis but continue to do things the same old way.

20 Ways Wall Street is Ripping Off Small Investors

- Providing nominal returns, not real returns.

- Encouraging too much diversification, if that's possible.

- Hiding fees and expenses.

- Turning you into a passive investor.

- Convincing you that money markets are the same as cash.

- Telling you that bonds are safer than equities.

- Explaining that in the long run equities outperform bonds.

- Simply by lying about their products.

- Convincing you that their bank is a large, stable, safe operation to deal with.

- Recommending products that have enormous sales commissions attached to them.

- Cheating you on bid/ask spreads.

- Selling you what they don't want.

- Measuring your success in dollars.

- Lending your securities to others.

- Ripping your eyes out if you ever try to close your account.

- Grabbing any slight positive real return for themselves.

- Sticking toxic waste to small investors.

- Pretending they can pick stocks.

- Acting like they are your best friend and they have your best interests at heart.

- Knowing next to nothing about the value of holding real assets like gold and real estate.

John R. Talbott is a bestselling author and financial consultant to families whose books predicted the housing crash, the banking crisis and the global economic collapse. You can read more about his books, the accuracy of his predictions and his financial consulting activities at www.stopthelying.com

Content concerning financial matters, trading or investments is for informational purposes only and should not be relied upon in making financial, trading or investment decisions.