Most eyes are watching Janet Yellen and the Fed's Jackson Hole conference. She hinted at a possible raise in short term rates this September. Higher rates are really not needed. Nothing she says in Jackson Hole can affect longer term economic growth, which is the real problem. The record low interest rates engineered by the Fed have barely raised inflation since the Great Recession, and done almost nothing to increase investment and future growth.

Marketwatch economist Rex Nutting highlighted the low investment climate of today. We are still in an investment recession. The record low amount of investment (capital expenditure) spending by the private sector, local, and national governments as a percentage of GDP since the Great Recession has meant we are using up what we have invested to date in public and private productive capacity without replacing it.

The result is a record low productivity rate and low-paying jobs in the service sector that mostly cater to domestic demand. "Who's preparing the United States for the 21st century?" writes Nutting. "Nobody, really. Not the 22 million private businesses, not the 118 million households, and not the 90,000 state, local or federal government agencies. Most troubling, there's still very little investment in the buildings, equipment and intellectual property that we ought to be putting into place today as the foundation of our prosperity tomorrow."

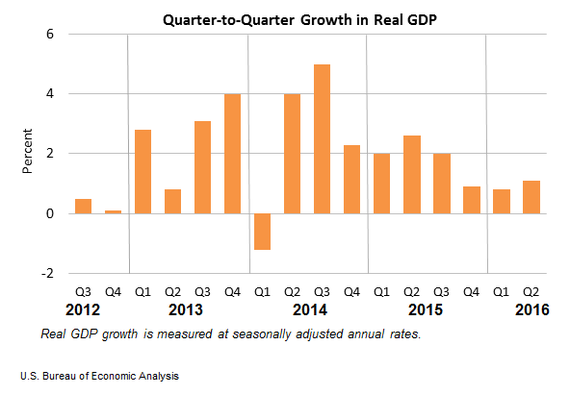

We see as evidence the lackluster growth in this morning's second revision to Q2 GDP growth at only a plus 1.1 percent annualized rate following even softer rates in the prior two quarters of 0.8 and 0.9 percent. Yet consumer spending increased 4.2 percent in Q2. So what are consumers buying? Mostly imported foreign products produced overseas.

Much of that is due to the flight of manufacturing jobs overseas that Bernie Sanders and Donald Trump have been railing about. But the flood of cheaper imports is also because of our low productivity rate due to the obsolescence of things that increase productivity, which means better transportation, power transmission, education and R&D investments that would enable Americans to produce more efficiently, and so compete with cheaper foreign products.

Labor productivity is at a historic post WWII low, increasing just 1.3 percent since the Great Recession. It is calculated at output per hour of work. In Q2 2016, for instance, output increased 1.2 percent while hours needed to produce that amount increased 1.8 percent. Normally, productivity should also surge after such a downturn for production to catch up with depleted inventories, but it hasn't this time.

This is one area in which both Republicans and Democrats seem to be in agreement. Both advocate increased spending on public and other productivity enhancing projects, but not who should pay for them. It has to be taxpayer funded if private industry won't step up. And Hillary, for one, is proposing to penalize those corporations that spend their profits on stock buybacks that enhance CEO incomes, rather that projects that would enhance their long term growth. Such 'inducements' seem to be the only way to keep US competitive in what is now a global economy.

Harlan Green © 2016

Follow Harlan Green on Twitter: https://twitter.com/HarlanGreen