Suddenly the headlines are filled with talk of an impending "fiscal cliff," a series of tax and budget changes which the news pages say is an impending catastrophe and which the editorial pages are urging Washington lawmakers to prevent.

How would they do that? Why, with the same "Grand Bargain" we keep hearing about, an economically destructive plan in which Democrats betray their principles by imposing benefit cuts to Social Security and Medicare in return for the Republicans' grand concession of raising taxes on - you.

It's a nearly surreal situation: Democrats acting like Republicans, and Republicans acting like Visigoths about to sack every city on the continent. All this surreality raises all sorts of Zen-like questions.

The bottom line is that there has been a determined, thirty-year strategy to co-opt leading Democrats into agreements that would undo or downsize their party's signature achievements while convincing the public that these highly unpopular moves were unavoidable or that the alternative would have been worse.

That's where the "fiscal cliff" comes in.

Big Deal

A lot of Democrats in the White House, on Capitol Hill, and elsewhere have been pushing a package of spending and tax cuts for a long time. The current codename for that package is "Simpson Bowles," but it was being developed long before those two gentlemen failed to guide their Deficit Commission to an agreement and packaged it under their own names instead.

If you're a Washington power player, what's not to like about this kind of deal? Republicans would get 90 percent of what they want, and would score yet another massive rhetorical victory against the idea that government serves a useful social purpose - something Democrats have been decidedly reluctant to defend lately.

Democrats would be able to pursue wealthy campaign contributors and foundation owners (like billionaire Pete Peterson), and would get another talking point for their misguided argument that voters want them to "do something," even if the "something" in question hurts voters.

A a deal like that has got something for everybody - everybody, that is, except you.

Schools, roads, bridges and other infrastructure would suffer. There would be fewer police, firefighters, and teachers. It would become harder and harder to find Medicare providers. And the economy would contract, leaving us all worse off - all, that is, except for the extremely wealthy.

How do you pass a program like that? First, create a plausible outside threat. That's the "Fiscal cliff." Second, convince yourselves and your progressive supporters that this is a masterful political strategy. That's the "long game."

it's too bad that neither the "fiscal cliff" or the "long game" actually exist.

Cliff Notes

The "fiscal cliff" is the Washington term some clever polemicist dreamed up to denote what happens at the end of 2012: That's when the Bush Tax cuts expire. And unless Congress votes otherwise, that's hen the "automatic" across-the-board spending cuts passed during last year's debt ceiling crisis are supposed to take effect.

Newspapers across the country are taking up the cry: Save us from the fiscal cliff! Lawmakers from both parties are pushing for a "Grand Bargain" along the lines of the right-wing Simpson Bowles proposal. That proposal would cut Social Security, encourages caps to Medicare funding, and pushes tax increases that target the middle class while actually lowering tax rates for the highest earners and for corporations.

Politicians in both parties are following their lead. Many of them are citing a Congressional Budget Office report which says that the "fiscal cliff" will have a disastrous impact on our already-wounded economy. They're arguing for deficit reduction, an issue that shouldn't be addressed until we get our economy moving.

House on Fire

(I've used this analogy before, but I'll use it again: Deficit reduction, like water conservation, is a good idea. But if your house is on fire your douse the flames before you start worrying about the water bill. Our economic house is on fire.)

It's bad enough that Democrats aren't pushing back against this misguided focus on deficits. Worse, by using the Simpson Bowles framework they're all making the argument on right-wing terms, since that plan has far more in spending cuts than it does in tax increases (and those increases target the middle class).

Not that any of this is a surprise. Something like this became inevitable when top Democrats, following President Obama's lead, stopped talking about government's important role in the best of times - and its critical role in times like these, which aren't so good at all. Democrats surrendered on the most important political fight of our time: the fight to defend government's role in building and preserving a humane, just, and economically healthy society for everyone.

First question: Since when has it become a faux pas in the nation's Capital to remind people about all the good things government does for them?

Trigger Happy

Everybody acts as if the "fiscal cliff" is an unavoidable emergency, like an asteroid heading toward the Earth. That's the kind of thing that always brings humanity together in the movies, as warring nations collaborate on eliminating their common threat.

But the fiscal cliff was created by the very people who are now using it as an excuse for pushing unwise and unpopular ideas. It's an outgrowth of the "trigger" idea that suddenly became popular in Washington a couple of years ago. "Triggers" are policy changes that are passed into law well in advance of when they're scheduled to take effect - and only then if other, equally extravagant and unpopular policy goals aren't met.

Think of them as political IEDs, set to blow up after the perpetrators have left the scene. Or like that scene in Blazing Saddles (with inappropriate language, or I'd link to it) where Cleavon Little takes himself hostage and threatens to kill himself if his own demands aren't met.

The strategy seems to be working. Everybody's saying we have to pass these terrible bills or even more terrible things will happen. But nobody's arguing for right policies, the ones that would get our country back on track.

Cliffhanger

Somebody got what they paid for. Billions have been spent to convince Americans that austerity - reductions in government's size and spending levels - is good for the economy.

We're told that the "fiscal cliff" would provide dramatic deficit reduction. The CBO says that if the spending portion of the "cliff" takes effect, "the deficit will drop by $560 billion between fiscal years 2012 and 2013."

But then it hits the fan. "Under those fiscal conditions," says the CBO, '' ... growth in real (inflation-adjusted) GDP in calendar year 2013 will be just 0.5 percent, CBO expects--with the economy projected to contract at an annual rate of 1.3 percent in the first half of the year and expand at an annual rate of 2.3 percent in the second half.

The CBO concludes that "such a contraction in output in the first half of 2013 would probably be judged to be a recession."

Second question: If deficit reduction is supposed to be good for the economy, why is the deficit-reducing fiscal cliff so bad?

Over a Barrel

So what happens if nothing is done and, like somebody riding Niagara Falls in a barrel, we go over the "cliff"?

First, taxes go up - for everybody. Even the lower tax brackets would be affected, and the struggling middle class would feel the pinch.

On the spending side, the fiscal restraint deal mandates a number of cuts to non-war-related defense spending. (Quick show of hands: Does anybody really believe that Congress won't pass a law increasing defense spending anyway, or that Democrats won't back it and the President won't sign it? Didn't think so. Me neither.)

There will two percent cuts in Medicare provider payments, which will reduce the number of providers who accept Medicare. That will lead in turn to problems with access to medical care for people with Medicare coverage.Other programs that will be cut include farm prices; other affected programs include student loans, vocational rehabilitation, mineral leasing payments, the Social Services Block Grant, and dozens of smaller programs.

Here are the programs that won't be cut because they've specifically been exempted (thanks to Democrats for at least winning these exemptions): Social Security, Medicaid, the Children's Health Insurance Program (CHIP), SNAP (f"food stamps")), child nutrition, Supplemental Security Income (SSI), the Child Tax Credit and the Earned Income Tax Credit, veterans' compensation and benefits, and federal retirement.[2]

Third question: If Democrats replace a deal that doesn't cut Social Security and these other programs for one that does, why do they think people will celebrate?

The "Long Game" Game

This gets us to what's often called the "long game," that mythical vision of a grand and secret Democratic strategy in which doing a series of bad things will lead to a good outcome.

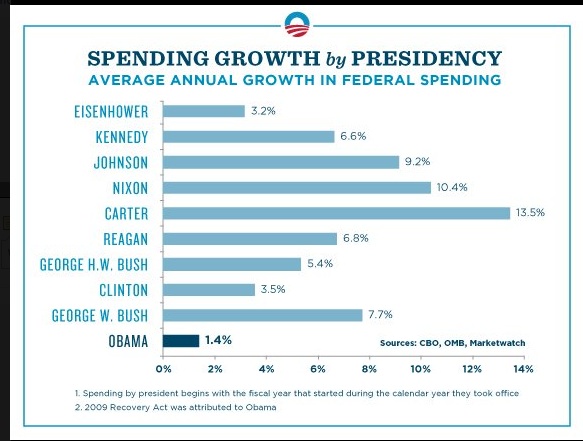

As the Obama team often does, it's running around these days reinforced the economically misguided rhetoric of the right by boasting that the President has slowed growth more than his Republican and Democratic predecessors did. Take this chart, from the Facebook page of something called the "Obama Truth Team":

That's not something to brag about. Obama increased government spending by an average annual rate of only 1.4 percent, less than the average GDP growth of slightly over 2 percent, during exactly the kind of crisis that calls for more government spending rather than less.

When the President Obama amplifies the anti-government, anti-spending rhetoric of the right, he makes it harder for those around him (and those who will follow him) to press for needed government spending. And he makes urgently-needed government spending much harder to win politically.

The same is true when Dick Gephardt co-authors an editorial with Denny Hastert urging cuts. Or when Sen. Max Baucus talks about his own efforts to craft an austerity deal with Republicans. Or when Bill Clinton attends a misguided "fiscal summit" and parrots the misleading statistics of the Simpson Bowles crowd.

Oh, but don't worry. We've been reassured that all of these Democrats are playing a "long game."

Game Change

You can't believe in the "long game" unless you're prepared to take several cognitive leaps. They're not easy. First you have to believe that Democrats are powerless, and that they were even powerless when they held the White House, Congress, and a 60-vote majority in the Senate. Or, as Brian Beutler writes in Talking Points Memo, you have to accept what he calls "The simple reality ... that Republicans have agency here."

I call it the "helpless President" syndrome. Democrats may still hold the White House and Senate, but "agency" rests elsewhere. It always does.

Beutler observes that "In the day to day of legislative politics, it's not always apparent that either party believes there's more at stake than simply appeasing interest groups. But if you ask party leaders directly, they're pretty open about their broader visions." To outline that broader vision he links to a December, 2011 interview he conducted with Nancy Pelosi in which she described a strategy that included, in his words, "keeping entitlement programs ring-fenced from the rest of the budget will keep them from becoming susceptible to conservative plans to scale them back or phase them out."

"On a separate table you have entitlements," Beutler quotes Pelosi as saying "If you want to raise the age or this or that, that's always a fight. But whatever it is, the money should stay in Social Security. They want to address Social Security as a way to unravel it."

"We've got to mobilize the 99 percent," Pelosi told Beutler in December. Then in April she reversed herself and endorsed the Simpson Bowles plan. "I felt fully ready to vote for that myself," said Pelosi, "thought it was not even a controversial thing ..."

Good luck mobilizing the 99 percent with that.

"Responsible" Party

Beutler brushes against a more telling point when he says that "there's something deeper going on here, too, and that you can glean most it from the public record. For years and years now, the Democrats have been a much more fiscally responsible party than the Republicans."

That's true, and it's been true since the Clinton Presidency. "Fiscal responsibility" is a euphemism for what used to be called "conservatism" - an ideology which today's conservatives no longer hold. And while there are merits to it as an abstract idea, or as a principle to be applied where appropriate, it's a very bad idea during times of national economic emergency like the ones we're living in now. (See house fire/water analogy, above.)

"Fiscal responsibility" is simply one of several competing values that must be weighed at all times when making public policy.

A better way to describe what's going on with so many Democrats is to say that they've drifted away from their original set of priorities, and have reordered them so that the merits of government expenditure now take a back seat to their "fiscal responsibility." They're not against government programs. In fact, they support many of them. But when push comes to shove, they tend to support "fiscal responsibility" more.

That's a position that's indistinguishable from that of Republicans from Eisenhower to Reagan. But as for the Republicans ...

House of Pain

... They've gone off the deep edge. Their latest gambit says it all: They're refusing to extend lower interest rates for student loans, which will have a devastating impact on young people who are already struggling with enormous college debt and worst job market in recent memory.

Why? Because Republicans say they "need to offset the expense" for it somewhere else.

That's even led to embarrassing puff pieces like this one in Politico, which includes the extraordinary (for its servility) sentence, "Lawmakers want to help. They just don't have the money."

Aw, gosh. Well why don't you borrow it?

The truth is, Republicans are opposed to all government programs. Unlike Eisenhower, Nixon, or Reagan, today's Republicans aren't just reluctant to fund these programs with new taxes. They don't want them to exist at all. That's why they want to cut them so aggressively. The "find the money to pay for it" argument, coupled with a refusal to raise taxes, merely provides a convenient cover for their hostility.

The Bush tax cuts for the wealthy expire this year, and the Republicans want to give them a new tax cut. That will require a new bill. The Federal deficit will soar if it passes.

Fourth question: Why don't they have to "offset the expense" for that?

Pay Now, Pay Later

But even the Democrats' "fiscal responsibility" is based on a fundamentally flawed premise. The fact that the government is spending less doesn't mean that Americans will be spending less.

We've learned that every time that Federal support to the states has decreased, and state taxes have increased.

We've learned it every time a Federal program like student loans is privatized and the for-profit companies extract more money from Americans' pockets. (To his credit, President Obama fixed that.)

We'll certainly learn it if and when Medicare is capped and seniors have to pay even more out of their own pockets for medical care.

We learned it again just this week, when news stories came out about state plans to make up for lost Federal highway funds, which includes looking for ways to tax drivers based on the number of miles they travel.

That's a regressive tax, unlike the progressive Federal taxation system, and it penalizes middle class earners who have to commute to work. (It's also similar to the high-tech system that led to riots in Johannesburg when I was there in March.)

The motorist tax idea is a refresher course in a time-tested principle: Pay now or pay later. In many cases cuts to Federal spending will lead to increased costs for Americans elsewhere. They give Washington politicians the chance to brag, pose for photographs, and please donors. But the public pays the bill in the end.

Borrow

The fiscal policy these Democrats have embraced is absolute madness, especially at this moment in history. Consider this:

Right now international markets are - literally - paying the United States government for borrowing money. The government is, in effect, receiving interest for its loans instead of paying it.

We'll have to rebuild our infrastructure someday. When everything starts collapsing - even more than it is right now - that kind of deal may not be available.

Build, Cut, Teach

What else should we be doing besides rebuilding our country's crumbling physical plant?

We need to cut the military - not just slow the rate of increased spending, as the Obama budget does, but decrease it in hard-dollar terms. That'a money we really can't afford. We can't afford to lose our young troops to injury and death in unnecessary wars, either.

We need to fix our health care system - really fix it. Because you know what we really can't afford? We can't afford to let our runaway for-profit healthcare system force us to pay so much more than other industrialized countries are paying, for worse outcomes and with a much higher rate of inflation. That means real negotiation on drug prices, eliminating greed in billing and overtreatment, and building a public insurance system that's available to everyone.

We need to teach our kids. We need to fully fund education, preschool through grade twelve, and we need to make college affordable again. That means re-financing the public university system and making sure that low-cost loans are available to every student that needs one.

Tax the Rich, Increase Social Security

The richest people in this country have enjoyed an unprecedented run of income appropriation, capturing more of this nation's income than at any time in modern history.

They've lived like kings, queens, Pharoahs, and pashas. They'll still live that way, even when they're paying Nixon-era rates of fifty to seventy percent on the highest levels of income (in the multi-million dollar range).

And we need to increase Social Security, not cut it. Its benefits have not been keeping up with the real increases in living costs faced by seniors and the disabled. That needs to be rectified. And since Wall Street and other cop orate greed has damaged our destroyed the other two legs of the retirement "stool" - real estate and pensions - Social Security has become even more important.

Social Security's benefits should be increased, the payroll tax cap should immediately be readjusted to cover 95 or 100 percent of income, and additional benefit increases could be subsidized with a financial transaction tax that would also discourage a little bit of that reckless Wall Street gambling.

So now what?

Where are the political leaders who will argue for these things? The Democratic Party's been an uncertain trumpet for a long time, but it has gone almost completely silent.

Who will fight for these simple, popular, and fair ideas? And what do we do about those Democrats in Washington? If the Republicans get into power they'll wreak unthinkable havoc on an already-damaged nation. But merely re-electing the same old Democratic crowd isn't going to be enough. We'll need a strategy - one that thinks beyond merely voting for Democrats, one that envisions a bolder movement that isn't tied to a party or ideology.

In other words, yes: We do need a Tea Party of the left.

The left's strategy is the subject of heated debate right now, of course, which allows me an opportunity to introduce a shameless but entirely appropriate plug for the American Dream conference next week (June 18-20) in Washington DC. I'll be there, on a panel with New York Attorney General Eric Schneiderman, Heather McGhee of Demos, and MSNBC's Alex Wagner. Paul Krugman will be there too. And Katrina Vanden Heuvel and ... well, and a lot of folks, debating exactly these sorts of issues.

The debates won't just be on the stages, either. There will be fierce arguments, as well as the kind of exchanges I like to think of as "being in heated agreement," in the hallways and around the snack tables.

We need a lot more meetings like this one. The Occupy movement has been a great shot in the arm for the economic justice movement. But it's time to take it to the next level.

One thing's for sure: We can't depend on the Democrats or anyone else to do it for us. Their "long game" is taking way too long:

It's too long for the Americans who have been out of work for three years. It's too long for the youth of America, another wave of whom are entering the worst job market in recent memory this month. It's too long for the generations, young and old, who are long on debt and short on hope.

The real struggle isn't between the "fiscal cliff" and radical Republicans up against some self-sacrificing (well, you-sacrificing) Democratic leaders (we'll also give a shout out to some of the great Democrats out there, too). The real struggle is between two visions of our country: One is pragmatic, optimistic, and time-tested over the last 75 years. The other was forged in corporate-funded think tanks and is based on the sacrifice of both time-tested principles and sound economic thinking, by those who would surrender to corporate power and the radical Right.

That's the real budget battle, and it's been decades in the making. That's your "long game" for you. You want a better one? Start it yourself.

(UPDATE: This post has been amended to reflect accurate GDP figures.)

Richard (RJ) Eskow, a consultant and writer (and former insurance/finance executive), is a Senior Fellow with the Campaign for America's Future and the host of The Breakdown, broadcast Saturday nights from 7-9 pm on WeAct Radio, AM 1480 in Washington DC.