The sharp decline in oil prices over the past few months has put oil-producing countries like Mexico in a difficult position. At the time of writing, the Mezcla Mexicana (Mexican Mix), which is normally priced lower than Brent or West Texas Intermediate, is below the $40-per-barrel mark, a level it had not reached since the 2009 global financial crisis. This weakness in oil prices comes at a time when the government is struggling to overcome a two-year economic slowdown and ensure the attractiveness of Mexico's considerable energy potential after passing the energy reform. Although there are various mitigation strategies in place for 2015, the country will have to make important adjustments in both the short and medium term if low oil prices remain the norm after 2015.

The Fiscal Scenario

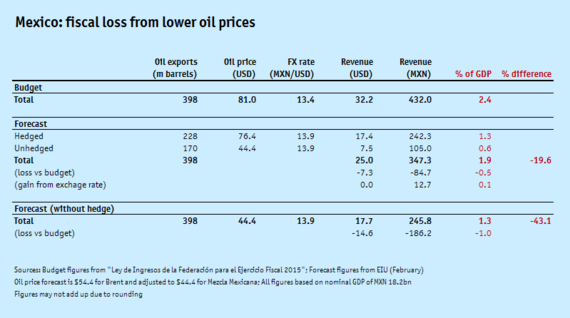

Mexico is a net oil exporter and also depends, to a large extent, on oil revenues to finance its budget: Ten percent of non-financial public-sector revenues come directly from crude-oil exports (and all oil-related revenues account for 30 percent). A fall in oil prices of this magnitude would expectedly result in some severe fiscal disruption, but various factors will help mitigate the shock. First and foremost is the fact that Mexico every year undertakes a massive sovereign-hedging program, the largest of its kind from any country in the world. This involves the finance ministry (SHCP) purchasing oil options from numerous investment banks at a predetermined price, and enough to cover a certain percentage of expected oil sales. This year, the hedging was negotiated at $76.40 per barrel, which is slightly lower than the budgeted price of $81 but still over double the value of Mezcla Mexicana today. Indeed, the SHCP was fortunate to have negotiated this just before global prices plummeted in November and December. It is estimated that the hedges cost USD $773 million, but they are currently helping avert a total loss of over USD $7 billion, which, in retrospect, was quite a bargain (this is under the assumption of a $54.4-per-barrel price in 2015, which is the Economist Intelligence Unit's baseline Brent forecast and a rough approximation for the Mezcla Mexicana being $10 lower than Brent).

The problem, however, is that the hedges -- while substantial -- do not cover the entirety of the 398 million barrels of total oil exports and leave 170 million barrels (43 percent) unhedged. Essentially, the federal government has hedged its own share of the budget while leaving the share allocated to the non-federal public sector -- which includes state-owned firms like Pemex and the CFE -- to the whim of the market. Under the EIU's current baseline assumptions, the hedged share of oil sales would amount to 1.3 percent of GDP in revenue, whereas the unhedged share would provide 0.6 percent of GDP. This is a loss of about 0.5 percent of GDP compared with the situation in which the entire volume of exports had been hedged. Although the overall loss in revenue is still substantial, at 22.6 percent compared with budget figures, this loss would have been 43.1 percent without it.

Making Up the Difference

Two further factors must be taken into account. The first is that the depreciation of the Mexican peso has had a positive effect on the budget, since oil is sold on the global markets in dollars, which are then converted into more pesos than was the case before. Using an estimated $13.91 average MXN/USD exchange rate in 2015, this will have reduced the total loss by MXN $12.7 billion, equivalent to 0.1 percent of GDP (due to rounding, this still leaves the gap compared with the budget at 0.5 percent of GDP) and leaving the total loss versus the budget at 19.6 percent. The second is the fact that local gasoline prices are not set by the market but by a price-smoothing mechanism of set increases known as the gasolinazo. When global oil prices have been high, Mexican gasoline prices have been kept below market, in which case the mechanism acts as a subsidy (a rather expensive one: It cost 1.8 percent of GDP at its peak in 2008). However, when oil prices fall, Mexican gasoline prices will be higher, transforming the subsidy into a de facto tax. According to estimates by the SHCP, gasoline taxes will raise about MXN $30.3 billion in 2015 (0.2 percent of GDP), which, in the absence of a subsidy, will be fully added to the public coffers. Of course, not all of this is "additional" income per se, since it has already been budgeted. But there is a windfall insofar as the difference between prices at the pump (fixed for the year) and the cost of supplying the petrol is wider than originally envisaged.

This still leaves approximately 0.4 to 0.5 percent of GDP worth of revenues unaccounted for. Following initial announcements of cutbacks to Pemex and the CFE, the finance minister Luis Videgaray announced today a series of wide-ranging budget cuts which add up to MXN $124.3 billion, or 0.7 percent of GDP. Of this, around two thirds would be cuts on current spending, but the rest would affect public capital investment. This is rather unfortunate, given that two specific investment projects have been put on indefinite hold: the Mexico City-Querétaro bullet train (Latin America's first), as well as another railway in the Yucatán peninsula. It is likely that the decision to suspend these two rail projects follows the recent fiasco over the initial Mexico City-Querétaro bullet train tender, which was canceled after receiving just one bid. On the positive side, the magnitude of the cuts (which appear to be higher than the projected oil revenue shortfall) seem to suggest that no additional debt will be issued to finance the budget. This will come as a relief given the fiscal laxity seen these past two years: Six percent of GDP has been added to the public-debt stock with Videgaray at the helm of the SHCP.

The Long-Term Effects

The persistence of low oil prices into the medium term is arguably the more important conundrum, since the government will be unable to shield its fiscal revenues to the extent that it could in 2015. It is therefore likely that authorities will be looking to see in what ways public expenditure can be streamlined on a more structural basis. This added degree of fiscal discipline is welcome, insofar as cuts do not affect sectors that are contributing to productivity or serving essential socioeconomic needs. Additionally, the impact of lower oil prices on the attractiveness of the energy reform needs to be considered. An initial round of tenders (known as "Round One") was well received by international investors, but it was focused on shallow-water areas that remain highly profitable even under current prices. More crucial will be whether the follow-up rounds that will involve deep-water and shale will remain so: Authorities are considering the possibility of delaying some tenders if demand appears weak.

In summary, the government will be able to mitigate some of the effects of lower oil prices but not all and will need to find a way of ensuring that the necessary cutbacks will not have an impact on what is still a fragile recovery. Given that macroeconomic management has been less than stellar so far during the term, the pressure will be on Videgaray to achieve results if further public disapproval of the administration (already badly damaged by the political crisis) is to be averted.