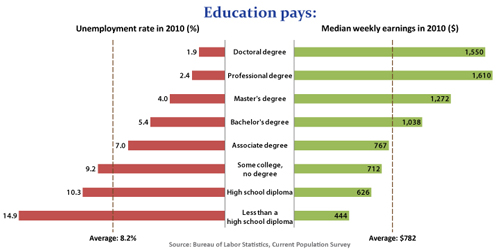

It's tough to get ahead in the US without a postsecondary degree (e.g., associate, bachelor's or higher). This fact is proven by degree: income and unemployment rates (see chart). A bachelor's degree equates to an extra $14,000/year over an associate degree and equates to 1.6% lower unemployment. Yet, achieving these degrees comes at a steep price for the student and the economy. Student debt is debt plain and simple. It saps the discretionary income of young graduates by placing strains on the future purchase of goods that support the economy while often depleting the nest eggs of their parents.

The Department of Education estimates that the annual cost at a public university is $20,800 and over twice that amount at a private institution. Tuitions have been increasing at 5-7% for many years, well above inflation. The Federal Student Aid Strategic Plan FY 2011-15 reports that 77% of tuition costs are supported by federal dollars in the forms of grants and loans. At the present rate of loans and tuition increases, the federal government will soon spend $1 trillion on educational loans.

We have seen this scenario before: uncontrolled increases in cost financed by government-guaranteed loans!

The future of tuition costs coupled with ease of government loans means that our educated workers, the future of this country, are graduating with debts that are on par with mortgages. In addition, family support means that more households are relying on both revolving credit card debt as well as home equity loans. This picture does not bode well for the future of the country.

By 2012, the Department of Education estimates that 800,000 college undergraduates (i.e., 46%) having started in college in 2008 will graduate, on average, with $29,000 debt, and this amount is modest when compared to those with advanced degrees. Furthermore, these loans do not include funding support from parents and other sources. Worse, the default rates keep increasing.

The Department of Education estimates that default rates have increased to 7%. For-profit schools have a default rate of 11.6% for the 2008 national cohort, almost twice public schools and nearly three times private, non-profit schools. The Department of Education estimates that nearly twice (81% vs 46%) as many for-profit students need loans as public school students attending 4-year institutions.

The Department of Education identifies the two largest degree-granting college and university campuses in the US as the University of Phoenix and Kaplan University, both private for-profit entities (owned by Apollo Group and the Washington Post, respectively). This represents 450,000 students, a group larger than the combined enrollment of the next six largest universities.

The Department of Education's Cohort Default Rate database shows that:

- Kaplan University's Iowa campus (OPE ID 004586) has a default rate of 17.2% for 2008 up from a rate of 9.5% in 2006.

- The University of Phoenix (OPE ID 020988) has a default rate of 12.9% for 2008 up from 7.2% in 2006.

The 240,000 people who defaulted on their student loans in 2008 may never overcome the burden of their debt. These defaults will permanently impact their credit history, reducing the likelihood of home ownership and increasing their cost of credit.

Much has been written about the deterioration of the middle class (see Pierson and Hacker, Reich, or Huffington) and wealth inequality. Does student debt further deteriorate the former great American middle class? Are we creating the educated poor?

From a different perspective, our most achieving academic graduates (e.g., doctors, lawyers, MBAs, PhDs) often graduate with debts in the hundreds of thousands of dollars. These debts shape political and social views. We are creating an Ayn Rand generation of the best and brightest.

We talk very little about universal education even though our politicians often talk about our need to compete in a world economy and that education is key to that competition. We focus a great deal of attention, sometimes unwanted, on elementary and secondary education. We, at times, appear concerned about early childhood education. However, when it comes to the big enchilada, junior college or college, we just roll over and go comatose.

We need an educated society. Yet, is the cost of education subtly changing the nature of our society? We have entered a period where it is no longer absurd to question the risk/rewards to our society of seeking postsecondary education as a universal truth. The long-term debt of advanced education is negatively impacting the economy in ways we might not fully understand.