This past weekend, the NextGenVest team headed to the Teach For America 25th Anniversary Summit in Washington D.C. It was incredible to see an organization facilitate candid discussions about tough topics -- from the school to prison pipeline, to the need for more diverse educators, to overall education reform.

But one topic was missing from the conversation in the number of panels and talk on #TFA25 twitter conversations. And it was about money -- specifically the role that money plays in a student's chance of success in getting to and graduating from college.

A student's chance of getting the money to go to college is still very hard.

There are a ton of fees to even apply to college: To even submit an application, a student could have to pay up to $90 at some universities. Though most offer a fee waiver, the process requires yet another form and another deadline to remember.

The financial aid application process is painful: Whether it be keeping track of the multiple forms for each school, the deadlines, or the tax returns, the process is flat out awful. It's so awful that students who qualify for aid left $2.9 billion on the table in free money in 2014.

There is a lack of guidance throughout the process: 1 in 5 high schools lacks a guidance counselor.

A low-income student's chance of graduating college is potentially even more alarming.

The "summer meltdown" is real: Up to 40% of students who are accepted into college never make it to class in the fall.

The pressure to repay exists even in college: 30% of students who take out student loans drop out before graduating.

This is a pretty big deal especially given the magnitude of low income students -- 1,000,000 low income 9th graders according to Jeff Nelson, CEO and Founder from One Goal on the "To and Through: Case Studies in Access, Preparation, and Success to and Through College" panel.

Our team at NextGenVest aims to change the experience for low income students by leveraging the ever-changing attention graph and meeting them where they already are...their phones.

Our free text message service sends students reminders on financial aid deadlines while allowing them to ask questions on their individual forms.

Students can sign up by texting "I want reminders" to our hotline 646-798-1745.

We see low-income students' access to the money needed to go to college and successfully graduate as one of the single most important education topics to be discussed and analyzed.

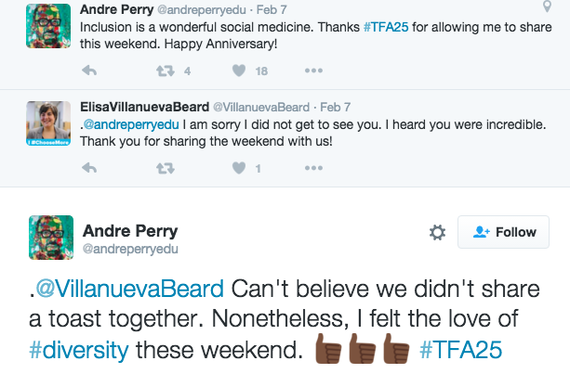

We hope to continue the amazing discussions from #TFA25 and engage all of the passionate educators in the discussion about college financing using #FundMyPassion.

Aja Beckham, a student at University of Illinois, and speaker at the #TFA25 To & Through College Panel is kicking off the discussion on why the financial aid process is confusing, but hugely necessary to bring low-income students into college.

What policy recommendations do you have to make college more affordable? Let's start the discussion #TFA25 #FundMyPassion -- @NextGenVest