Some bloggers have suggested that manufacturing is doing well, just because output has grown for the past few months. One sets up a straw man in a piece title "No, Virginia, U.S. Manufacturing isn't dead," but no serious economist claims that manufacturing is dead. Manufacturing employed 11.5 million workers in January, 2010, 8.9% of U.S. non-farm employment. However, nearly 6 million manufacturing jobs have disappeared since 1998, and manufacturing's share of GDP has fallen by a similar share in that time. The Bonddag blog and many others claim that productivity growth is responsible for manufacturing job loss, but they've got it wrong. Growing manufacturing trade deficits from 1998 to 2006, and the worst recession since the 1930s are responsible for the vast majority of all manufacturing job loss. We can reclaim a large share of these jobs by shrinking the trade deficit and putting this recession behind us.

I explained the relationship between manufacturing output, productivity growth, trade deficits and job loss in my Snapshot on Manufacturing Job Loss: Productivity is not the culprit. It shows that productivity has always grown rapidly in manufacturing--there was no big upsurge in the past decade. The recent uptick in productivity occurred in other sectors of the economy, which does help explain why job growth economy-wide was so terrible in the Bush era, but that's another story. With manufacturing, the story is simple.

In the past, we had high growth in real output and high output growth in manufacturing leading to stable employment. Then, after 2000, productivity growth continued but output growth flat-lined and manufacturing employment collapsed. The reason: a soaring trade deficit in manufacturing products. People kept buying more manufactured goods; they just bought them from China and other exporters, not from U.S. manufacturers. Josh Bivens reviewed this history in his earlier Snapshot on Trade Deficits and Manufacturing Employment.

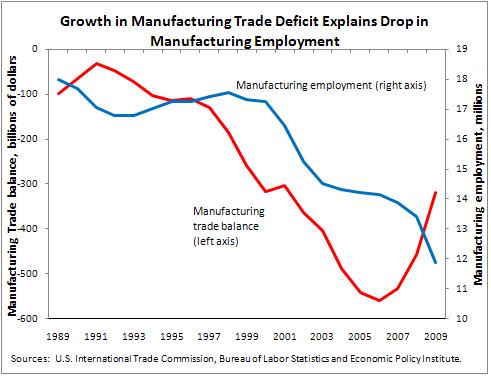

In the past, employment and the trade deficit in manufacturing were roughly stable for 30 years from the late 60s through the late 90s.* Then the Asian financial crisis hit in 1998. The value of the dollar soared along with the manufacturing trade deficit. Manufacturing employment fell like a rock, with a lag of about 2 years, as shown in the graph below. The manufacturing trade balance did start to improve in 2007, but the big drop in the deficit came in 2008 and 2009, and was caused by the recession. The recession was also responsible for the loss of about 2 million of the 5.7 million manufacturing jobs lost since 1998.

Bonddad is misguided, and his analysis is confused. His first mistake is to plot a chart of the U.S. Industrial Production Index since 1960 with a trend line (it's clearly not a fitted trend, but something done with a ruler or graphing software). He says that the increase in manufacturing output is "continual", suggesting that growth has been steady, but that's flat out wrong. One problem is that you can't calculate or "eyeball" growth rates from a linear plot of output. Every introductory, undergraduate finance student learns that you have to plot stock prices on a logarithmic graph to spot changes in growth rates. This is simply because growth compounds--remember, your grandmother taught you that bit of wisdom about the advantage of putting your money in a savings account.

In fact, growth in U.S. manufacturing output dropped sharply after 2000, as shown in my snapshot above. If we use the FRB industrial production index and the business cycle peaks shown on Bonddad's graph, and calculate simple compound average growth rates, the index grew 4.1% per year between July 1990 and March 2001 (the Clinton Business cycle). However, growth in the index fell to only 1.8% between March of 2001 and December 2007. The BLS output numbers show even slower growth in the Bush era, as indicated in my snapshot above.

Bonddad makes a number of mistakes in analyzing the relationship between trade and employment. First, he cites a chart from SilverOz that supposedly compared imports of total goods and services with manufacturing employment. However, exports matter too, and for manufacturing, what is most relevant is the manufacturing trade balance, the difference between imports and exports of manufactured goods. The graph reportedly includes imports of both services and non-manufactured commodities, which are clearly un-related to manufacturing. Furthermore, exports sales can support domestic employment, and imports displace employment. You have to look at changes in the manufacturing trade balance to get an accurate picture of the impact of trade on the demand for manufacturing output and labor.

But there are more problems with Bonddad's trade and employment graph. It has a blue line which purports to measure imports of goods and services (measured with a negative sign, which is appropriate). But this series never exceeds $700 billion in imports. However, U.S. imports exceeded $2.5 trillion in 2008. Something is wrong here. It's not the trade deficit either, because that was $-760 billion in 2006. Finally, the story is about manufacturing employment. The graph reports employment in "goods producing industries," which include a number of domestic, non-manufacturing industries. The graph should compare manufacturing employment with the trade balance in manufactured goods, as I do in the chart above.

To close the trade gap and rebuild manufacturing will required a coherent trade and industrial strategy. We must end currency manipulation by China and other Asian countries, aggressively attack unfair trade practices and rebuild manufacturing. We also need to create at least 4 to 5 million jobs in the rest of the economy to help end the recession, and rebuild demand for manufactured products. These are topics for another day. That discussion should start by acknowledging that productivity growth is a key source of strength and competitiveness in manufacturing, and is not responsible for manufacturing job loss.

*The exception was the period from 1979-1989, when the trade deficit also soared and manufacturing employment also dropped. This was also caused by an over-valued currency, which was corrected by the 1985 Plaza Accord. Subsequently, the trade deficit declined and manufacturing employment stabilized.

For more information, please visit EPI.org.