This post was co-authored with Omri Stern and originally appeared in Harvard Business Review.

Israel has been branded the "startup nation." For good reason: A tiny country of only 8 million people -- 0.1% of the world's population -- has more companies listed on the NASDAQ than any country in the world save the United States and China. Frequently cited as one of the world's most vibrant innovation hubs, Israel boasts more startups per capita than any other country in the world.

That's the good news. The bad news is that Israeli startups are struggling to scale. Only a handful of so-called unicorns -- companies that have achieved a valuation of over $1 billion in the last 10 years -- come from Israel, and only one Israeli firm, Teva, ranks in the world's 500 largest companies by market capitalization. As a result, tech-sector employment has declined as a percent of the workforce, from 11% in 2006-2008 to 9% in 2013. That's disappointing for a country with so much potential. But is all of that changing? Are Israeli companies on the verge of developing a repeatable playbook to scale their companies and become market leaders, not just acquisition fodder for the Silicon Valley giants?

We think so.

Decades ago, the thesis of Yossi Vardi, a prolific technology entrepreneur who has invested in 75 Israeli startups, was that Israeli entrepreneurs should seek quick exit opportunities through global corporations interested in buying a window into Israeli talent and technology. Today, this thesis is less relevant. For the first time in history there are Israeli companies scaling up successfully as global market leaders, and the ecosystem is evolving to support them. Indeed, the pattern of scaling seems to be changing meaningfully in recent years. In 2014, for example, 18 IPOs raised a record-breaking $9.8 billion, compared to just $1.2 billion in 2013.

So how do Israeli ventures scale up? What are the challenges and lessons of scaling up? To answer these questions, we built a database of 112 Israeli companies founded between 1996 and 2013 that have met or exceeded $20 million in revenue. We selected this benchmark because it reflects the phase in which companies have proven product viability, achieved initial product/market fit, and are now expanding sales and growing more complex operations. We also interviewed over two dozen Israeli entrepreneurs and the investors from these companies -- the leading thinkers in the region -- to determine the playbook that these startups are executing in order to scale.

Here's what the data say about Israeli startups:

They're Israeli-run but with global footprints. Eighty-two percent have global offices, and yet 91% are still run by Israeli CEOs, as opposed to foreign executives hired from the outside.

American VCs are critical. Ninety-one percent of the firms have received funding from foreign (mainly American) VCs.

The founders have started companies before. Sixty-three percent of startups currently scaling up are run by Israeli entrepreneurs with prior founding experience.

This evolving model is being supported and encouraged by the local Israeli VCs. According to Izhar Shay, a general partner at Canaan Partners, "The investment community has matured to recognize they need to plan for scale. They are seeking to build companies so that they are attractive to late-stage funds." And the late-stage global funds are swarming in, from Accel to KKR to Li Kai-Shing's Horizon Ventures.

This post outlines some of these patterns, seeks to characterize them, and draws out patterns in the data.

Pack Your Bags Early.

Despite hosting a rich startup ecosystem, Israel is simply too small a country for entrepreneurs seeking to build big companies. As a result, Israeli entrepreneurs need to begin immediately thinking outside of Israel since their primary market is often the U.S. The common approach is to incubate the business locally in Israel with a small development team, prove early product/market fit, and then build a sales and marketing organization abroad, usually in the U.S. In the old model of Israeli startups, many Israeli executive teams would hire a vice president of sales in the U.S. to assist with the local go-to-market approach. More recently, Israeli founders are themselves moving to the U.S. to build the satellite office and to personally oversee the recruitment and management of American executives who can lead the sales and marketing efforts.

However, waiting to move to the U.S. until the late-stage go-to-market phase may be too late. All of the risks inherent in launching a startup are exacerbated by the geographic distance between Israel and the U.S. Hiring talent and gathering customer feedback are even harder when teams are so physically far apart, and this separation can make it harder to build culture, forge partnerships, and raise capital.

So how early should the founders pack their bags and ship out to the U.S.? Our analysis and interviews suggest the prevailing wisdom has shifted toward a simple answer: as early as possible. Although the technical team often remains in Israel, many of the executives interviewed recommend departing for the U.S. as early as a year or two after founding. A move allows the business to get close to the customer, learn their pain points, and adapt accordingly. Understanding the market and establishing product/market fit is a critical seed-stage milestone.

When Udi Mokady and Alon Cohen launched CyberArk -- the darling of the cybersecurity industry, with a market capitalization of nearly $2 billion -- the founders abandoned the local strategy early on. "We began selling to local Israeli companies but had a strong feeling we were developing a product and go-to-market strategy that was missing the larger opportunity," said Mokady. As soon as CyberArk raised Series A funding, they set up a U.S. headquarters, in Massachusetts, to immerse the team in the American market. "At the time, moving close to the market was not a given, and venture capitalists did not have a clear playbook. Nowadays the argument is very clear."

Similarly, when Yaron Samid launched BillGuard, his team debated whether to build an enterprise or a consumer company. One-and-a-half years after founding the company, Yaron moved to New York and discovered that consumers, rather than banks, were the primary customer of BillGuard's service, which helps customers identify fraudulent credit card charges. With the development team based in Israel, Samid shuttles between New York and Tel Aviv, where he shares weekly insights garnered from conversations with partners, consumers, and investors in the market. Viewing this as the typical challenge of running a global company, Samid believes there is no substitute for the learning that comes from being close to the market.

The second reason to move early is to hire the absolute best sales and marketing talent. Again and again, the most challenging issue we heard about from entrepreneurs and investors is finding and retaining exceptional talent, a problem exacerbated by geographical and cultural distance. According to Modi Rosen, general partner of Magma Ventures, "The challenge of scaling is primarily in hiring for the sales and marketing front. Having the founder [locally] present for this process can be the difference between success and failure." Companies should strengthen the Israeli management team with local talent who understand how to define the market, how to sell into it, and how to gather feedback. Furthermore, companies need particular executives to serve as the primary liaison between the sales and marketing team in the U.S. and the development team in Israel. There are many Israeli professionals who have worked in the U.S. and have gained management experience at large organizations such as Google, Microsoft, and Amazon. There are also American executives who have experience working with startups with R&D in India, China, and Israel. Both cohorts can bridge cultural and geographical gaps.

In CyberArk's case, Mokady admits the team faced major challenges in hiring talented and seasoned American executives. "We had a rough start," he says. "As an unknown Israeli company breaking in to the U.S. market, we were not able to attract A-rated sales and marketing professionals. It took some time to gain momentum and learn how to attract local talent."

One of the key lessons CyberArk learned is to partner with VCs in order to source top talent. Mokady believes that partnering with a Boston-based VC would have helped CyberArk address its talent problems more effectively because the VC would have vouched for the company. With that said, the founding team had big dreams of becoming a global company from the beginning. Although their investors were not local, CyberArk still benefitted by partnering with foreign VCs that helped them make the leap from Israel to the U.S.

Think Bigger.

This takeaway surprised us. After all, Israeli entrepreneurs are known to be tenacious and eager to tackle complex technological and entrepreneurial challenges. However, in our interviews with Israeli venture capitalists, we learned that around the board room, Israeli entrepreneurs tend to become overly preoccupied with the product and core technology. This fixation generates a short-term view on the potential of the venture to expand beyond the immediate product line. Of course, almost all entrepreneurs are preoccupied with near-term priorities, but our interviews uncovered a pattern of Israeli companies putting too much focus on the product at the expense of building a broad vision for growth, even after achieving product/market fit.

Scaling up begins with thinking about how you build a bigger story and a bigger vision once the company is expanding. Alan Feld, cofounder and managing partner of Vintage Partners, cautions Israeli entrepreneurs not to define their product category too narrowly. "The big idea is to think as a potential industry leader rather than a one-product company. Think of where you want to be in five years and begin building a product pipeline to get there." For Netanel Oded, of Israel's National Economic Council, the critique is more poignant: "In Israel, nobody is saying 'I'm going to completely disrupt transportation.' Israeli entrepreneurs are first and foremost focused on applying technology to create a business, not necessarily on disrupting big markets through the use of technology." This subtle difference risks limiting the scope of the opportunities Israeli entrepreneurs are chasing.

Once startups begin to scale up, founders need to ask long-term strategic questions such as: How do I support growth in human capital? How do I strengthen my market position through acquisitions and innovation? How do I prove the unit economics to justify raising a growth round that will let me expand more rapidly? These are also questions that will concern late-stage investors who provide the companies the opportunities to scale and, eventually, go public.

Partner with Foreign VCs

Israeli entrepreneurs are becoming more focused on getting foreign (mostly American) VC partners in the early stages to help them pursue these opportunities from the onset. American VCs have a significantly wider network and have a capability to access management talent, data, partners, and customers to help a company scale. American VCs think about scale from the start, because their large fund sizes necessitate bigger returns. They spend more time on strategy, go-to-market, business development, and financing.

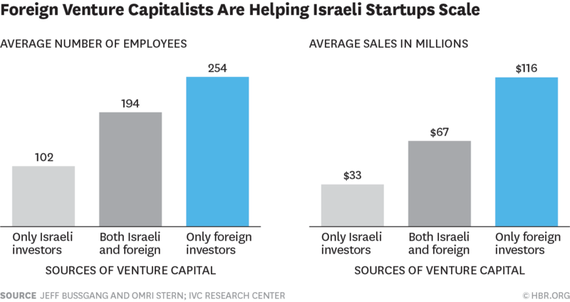

The data reveal how dramatically foreign investors impact the growth of Israeli companies, as measured by annual sales and number of employees. Israeli companies funded solely by foreign investors generated more growth than those funded by both Israeli and foreign VCs and significantly more growth than companies funded by Israeli investors alone. (One caveat: This may not point to causation, as some investors are better than others at picking rapidly-growing companies.)

But American VC partners might not always be the right choice, especially in the earliest stages. Many entrepreneurs and investors argue that Israeli VCs are more frugal and that this discipline is an important early attribute for startups. According to Ori Israely, investor and former general partner of Giza Venture Capital, "There is more fit between [an] Israeli entrepreneur and [an] Israeli investor in the seed stages. Israeli funds often know how to work better with the early stage companies because they provide efficient capital, not necessarily more capital." Israeli VCs seek to invest relatively smaller amounts--not to squeeze out the entrepreneurs, but to help them be more efficient in the early stages.

The extra runway from an American VC can come with strings attached. Once entrepreneurs bring in an American VC that typically invests at higher valuations, there is greater pressure to hit bigger milestones, move to the U.S., and pursue larger outcomes. So the decision on when to bring on an American VC is an important and strategic one.

Lead Your Company to Scale.

A decade ago, the traditional model for building up Israeli companies was to hire an American CEO. Our interviews and analysis suggest that this model failed. Today, companies reaching scale are run by Israeli founders and/or Israeli CEOs. Studying the liquidity events of Israeli firms valued over $150 million, Vintage Partners found that 81% were run by Israeli founders, while half of the remaining 19% were run by professional CEOs who were Israeli. In short, Israeli entrepreneurs are leading their companies to scale.

This conclusion is an interesting one. On one hand, Israelis need to continue to lead their companies to scale effectively. On the other hand, they need to attract foreign VCs to help them do so -- typically by moving to the U.S. and recruiting a U.S.-based executive team.

So how can Israeli entrepreneurs effectively lead their organization to scale? Our interviews suggest Israeli founders have worked hard to mitigate the risks associated with a move to the U.S., developing techniques to effectively manage distributed teams and cut through cultural barriers:

Focus on culture from day one. Startups are incredibly fluid early on, and these early days are critical to building teams that can communicate and function effectively in geographically distributed circumstances. Over the course of 2-3 years, the product, the value proposition, and the competition will change dramatically. Yahal Zilka, of Magma Ventures, emphasizes that for the company to be aligned in multiple locations and react effectively to rapidly changing circumstances, employees need to develop a culture of trust and respect that transcends continents.

Place one founder on each continent. If the founding team contains more than one person, an effective formula that we've witnessed is placing one founder in Israel and one abroad, where he or she will recruit the management team. Typically, these founders know each other very well, have a deep mutual trust and respect, and can communicate seamlessly, often from years of serving in the military together. Alon Cohen, cofounder and former CEO of CyberArk, moved the company headquarters to Dedham, Massachusetts, just one year after founding in Israel. Cohen said that moving the headquarters to the United States had been talked about for some time after the company was founded, in 1999. Shortly after the move, the company hired 25-30 people in the U.S. while maintaining R&D in Israel. Fifteen years later, CyberArk employs more than 500 individuals worldwide and serves more than 1,800 customers, including 40% of Fortune 100 companies.

Get a mentor with a solid track record. It may sound obvious, but unlike in Silicon Valley, there are not many entrepreneurs from Israel who have built unicorn-sized companies. "Over the growth stages in particular, Israeli entrepreneurs need access to mentors that can deliver contextual insights and ask tough questions about scaling up in the United States," says Dror Berman, of Innovation Endeavors. The mentors who serve this role in the U.S. know how the entrepreneurial game is played, know the relevant growth-stage investors and investment bankers, and are adept at navigating exits at different stages. There are also more institutions and infrastructure for training managers, such as MBA programs, executive education, and certification programs. Most Israeli entrepreneurs have not been through this whole cycle at scale. Those that have are gold.

Israeli entrepreneurs are influenced by the success stories of their past. From 1995-2010, the Israeli startup ecosystem was not focused on creating big companies. Things have changed dramatically in the past two decades. What was once the story of ICQ's $287 million exit to AOL is now the story of MobileEye's NYSE IPO and $12 billion market capitalization. Years from now, Waze's $1 billion sale to Google may look like merely a solid outcome, rather than the canonical case study of Israeli entrepreneurship that it is today.

It is time for more Israeli entrepreneurs to swing for the fences. Building big companies means Israeli entrepreneurs should pack their bags and move to a large market early, partner with American VCs, continue to lead the company through the mid-to-late stages, and focus on building a culture.

In our data set, we found over 100 companies that have the potential to become unicorns and decacorns. We look forward to watching that list grow and evolve.

Many thanks to all those interviewed as well as Walter Frick for his help in editing.