A number of articles (e.g., Get 'Em While They Last: 'Daily Deal' Sites Dying Fast) have been written in the last month implying the end of Daily Deal (DD) sites (e.g., Groupon, LivingSocial). The latest is a Sunday NYT's below-the-fold front page (yes, print) article entitled: Coupon Site Deal? For Merchants, Not So Hot. Merchants are unhappy: They are losing money, DD customers do not return, and DD customers are harsh critics on review sites like Yelp. It would be tough to read this article and not think the DD industry is dying. However, as the old joke goes: Not so fast, Jones.

The DD business is not a classic web-based business; it requires aggressive marketing of merchants. Both sales personnel and the merchant must be savvy enough to craft offers that attract customers and turn a profit.

The real issue is the structure of the DD offer. Most DD sites do not offer a real value proposition. While most merchants make money from DD offers, performance varies by deal structure and service sector (i.e., restaurants, spas). A survey of DD sites by Utpal M. Dholakia shows that while 70% of DD offers for special events or health services make money, only about 40% of restaurants do. Another negative factor is that only 40% of restaurants, salons, and spas that have run offers plan on doing it again. Maybe the problem is that the merchants do not understand the psychology of deals and have unrealistic expectations of the outcome.

Merchants have an unreasonable expectation of return business. Merchants in the NYT article complained about a poor customer return rate; however, Dholakia shows about 20% of offer users return to the establishment. Given that frequent guests are normally 15% of a restaurant's customers, this daily deal rate should not be viewed negatively. I suspect, but have no evidence, that an additional problem is that site sales personnel paint too rosy a picture of the ultimate benefits of an offer.

The most intriguing discussion in the article referred to the fact that merchants who are reviewed on Yelp can expect to see their rating go down on average by one-half a point AFTER they do a DD offer.

... The long-term reputation of the merchant may be at risk, according to a new study by researchers at Boston University and Harvard that analyzed thousands of Groupon and Living Social deals. The researchers found that fans of daily deals were on average hard to please. After they ate at the restaurant or visited the spa, they went on Yelp and grumbled about it. This pulled down the average Yelp rating by as much as half a point.

"Offering a Groupon puts a merchant's reputation at risk," said John Byers, a professor of computer science at Boston University who worked on the project. "The audience being reached may be more critical," he said, "than their typical audience or have a more tenuous fit with the merchant."

Dr. Byers' comment is a hypothesis since his study identifies the phenomenon but not the cause. I have a very different take.

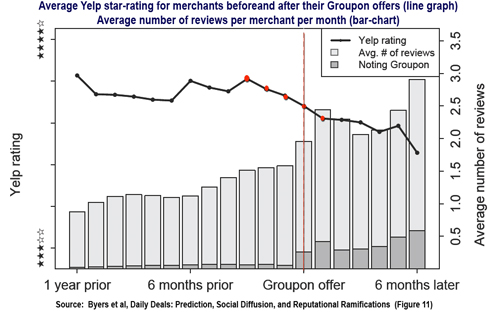

The following is a graph from Dr. Byers' study. The line shows the average monthly Yelp score for the year before and the 6 months following the offer. Look at the five red dots that show the average Yelp score for the three months leading up to the offer and the one month after the offer. The scores are progressively going down. My hypothesis is merchants who are in trouble, as measured by deteriorating Yelp scores, are more likely to use a daily deal site.

It's all about expectation. When I read the NYT article, I recalled an old marketing analysis joke. Two shoe company analysts go off to Africa. They come back and the boss asks what they think. The first says: "The market's lousy, there is no infrastructure, no stores, no distributors." The other analyst says: "This is a great business. No one wears shoes. The growth possibilities are endless!" This is the story of the daily deal industry. It's in its infancy, and depending on your perspective it's lousy or ripe with endless possibilities.