With the financial crisis, we've seen a lot of talk about why it happened and who's to blame. We've pointed a lot of fingers at a lot of targets, including bankers, regulators, and homeowners. We've identified a number of symptoms, including greed, incompetence, fraud, and inadequate regulation.

But none of these explanations speak to the deeper roots of the crisis.

One of the great truths is that "with every great strength comes an equal challenge." So what are the greatest strengths and challenges of capitalism?

The greatest strength of capitalism is its unparalleled capacity for economic expansion.

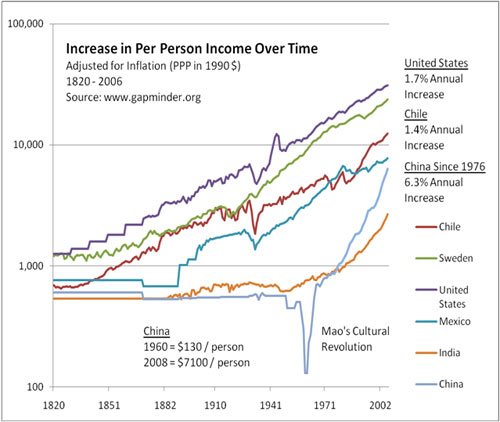

The accompanying figure shows capitalism's remarkable ability to increase our standard of living. For example, for almost 200 years in the US, the amount of real income per person has increased by an average of 1.7% - year upon year upon year. Or look at China. Income was flat until Mao took over, then it plummeted and recovered as they embraced their own version of capitalism, and since then per person income has been increasing by 6.3% per year.

Over time, the power of compounded growth is amazing. In the US, it's the difference (in 1990 $) between $1,200 / person in 1820 and $32,000 / person in 2006. In China, it's the difference between $130 / person in 1960 and $7,100 / person in 2008.

It's why in the US, people now drive to their protests.

At the same time, the current crisis is exposing the challenge that comes paired with capitalism's great strength.

The greatest challenge of capitalism is its addiction to economic expansion.

Many people have been asking about the Wall Street blowup, "how could they have been so greedy?" And, "how could they have been so dumb?"

But what is greed? It's not our desire for money. It's an addiction to our desire for money. It's desire that's gotten out of control. And what always comes with addiction? Denial and self-deception. Greed is stupid - literally - because it's an addiction that causes us to lie to ourselves. Above all else, this crisis was created by an almost ubiquitous level of denial. It was created by the most expensive words in finance, "this time it's different."

This addiction isn't just a problem with the people on Wall Street. Or the people who took out a mortgage they couldn't afford. Or the people who got up to their eyeballs in credit card debt.

It's a core challenge of the system itself.

Our entire financial system is based on the root assumption that the economy will continue expanding -- that there will be more money tomorrow than there is today. How are we funding our retirements? Through the assumption that money we invest in the stock market will grow, because there will be more money tomorrow than today. How do banks make money? By selling interest bearing loans. And what allows us to take out a loan? Our assumption that we'll have more money tomorrow than we do today. Why is our government able to create trillions of dollars in new debt?

Because of the assumption that there will be more money tomorrow than there is today.

Notice how much fear there is of the "R word." Why is a recession so scary? I mean, it's just the difference of a few percentage points, right? No. It's the difference between satisfying our addiction to economic expansion, and going into withdrawal.

It's the difference between the system working and the system failing.

But here's the thing. Exponential expansion isn't sustainable over the long term. It can't be. Our planet has limited resources. Resources that are beginning to be maxed out.

And so this century may be defined in large part by the collision of an unstoppable force -- capitalism -- with an immovable object -- the need for sustainability.

This isn't to say we need to get rid of capitalism. That's regression. Instead, the question we're confronted with is this: how do we evolve our system to the next level? How do create something that includes the strengths of capitalism, while also transcending its root addiction?

In other words, how do we create Capitalism 2.0?

I don't know the answer to this question. Frankly, I don't think anyone does yet. However, here are two big clues.

The next stage of capitalism has to include two key factors. It has to be sustainable and it has to be conscious.

Unconscious capitalism is based in greed, fear and addiction, which creates denial, self-deception, and a lack of awareness. It's blind and reactionary. It's unconscious. It divorces money from meaning, profit from non-profit, and sales from service. It sacrifices long term health for short term gains.

Unconscious capitalism isn't wrong. As individuals, it's blessed us with an unprecedented level of health and wealth. However, infinite exponential expansion can't be sustained. It can't be.

Deep down, we know this. But it terrifies us. So we look away. We prefer to blame Bernie Madoff for his fraud, rather than look at the global Ponzi scheme being created out of our collective denial.

Conscious capitalism requires having the courage to face hard truths today lest they become harder truths tomorrow. It's based in a commitment to personal and spiritual growth, both as individuals, as organizations, and as a world. It requires us to integrate our personal values (i.e. love, growth, giving and connection) with our professional lives. It's based on win/win/win or no deal. It's sustainable.

It's required.

But it's not for the faint of heart.

So what is conscious capitalism and how do we practice it?

We'll be exploring this question in this weekly column.

Welcome.