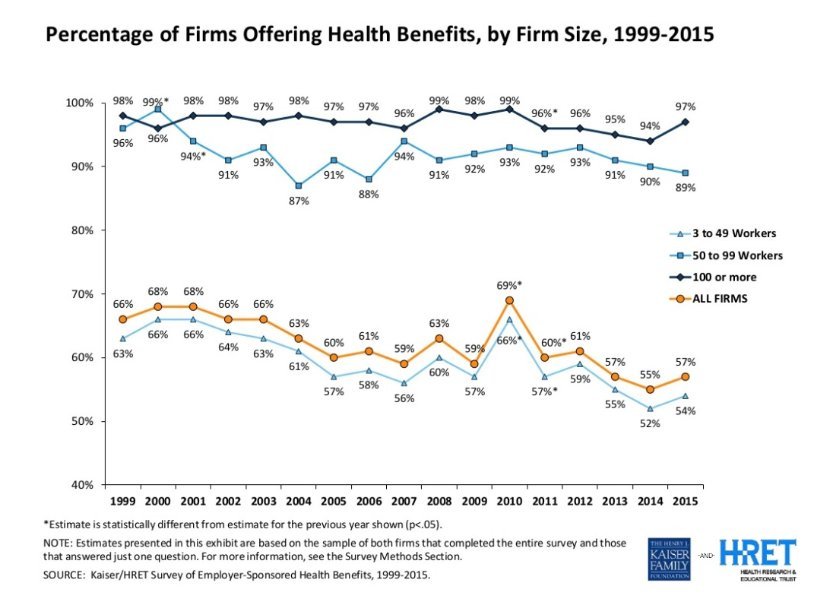

I have spent my entire 24 year career helping employers shop for, buy and manage their employee benefits. In that time, the vast majority of large employers (50+ employees - for this discussion) have offered (and plan to continue to offer) their employees health insurance. In 2010, the Affordable Care Act introduced new incentives (see employer shared responsibility penalties) to make sure that continues. So far, it looks like that is happening as expected.

However, the small employer market (under 50 employees - not subject to employer mandate) has been much more volatile over the last 15 years. That volatility has intensified in recent years. - peaking at 66% in 2010 and then bottoming out at 52% just 4 years later.

Why has this happened and what does the future hold for small employers?

For small businesses, the initial decision to offer benefits is almost always driven by a key employee/employees who push the issue with the business owner. Leading up to the 2010 passage of the Affordable Care Act, every news organization, talk show, politician, etc. talked about healthcare and health reform in some form just about every day. So, naturally, employees who had not thought about it before, were now asking about it. Employers who hadn't offered coverage before decided to make an offer for the first time.

This led to an almost 10% jump in firms offering health benefits from 2009 to 2010. But, that increase completely vanished in 2011. And, over the following years, the trend to away from group insurance increased as the % of firms offering health benefits reached a 15+ year low in 2014.

For employers with a higher percentage of low income employees, the move away from group insurance may continue. This is because these employers cannot (and do not want to) compete financially with the subsidy available to low income employees. Here is an example of how income impacts an individual's coverage choices:

An unmarried 40 year old with 2 children under 18 years old can expect to pay about $391/month for herself or about $779/month for her and her children with no subsidy or medicaid available. She will also have the following subsidy options at different income levels:

However, I expect that employers with higher-paid and geographically diverse employees will see that trend of moving away from group coverage reverse considerably. This has already started and will accelerate very quickly. Here are the 3 main drivers of that move:

- Taxation of Employer Contribution to Individual Plans - In an updated Q&A about the practice of reimbursing individual health premiums, the IRS Q&A warns: "such an arrangement fails to satisfy the market reforms and may be subject to a100/day excise tax per applicable employee (which is36,500 per year, per employee) under section 4980D of the Internal Revenue Code." Though there are pockets that disagree with this interpretation and are fighting for a change, most have come to grips that it is best to avoid the practice rather than risk penalties.

- Implosion of the Individual Health Insurance Market - Just about every carrier that has offered products on the individual exchange has lost money. Some have lost so much money, they have decided to get out of the exchanges altogether. The carriers that have remained have increased their prices significantly while drastically limiting their product offering - eliminating platinum-level plans, restricting the number of zip codes that they offer policies AND introducing more and more "narrow" network options.

- Small Group Relative Stability - Trend price increases for small group (and group in general) have been modest in comparison to what we were seeing a few years back (pre-ACA) AND are modest compared to increases we have seen and expect to see in the individual market. In addition, there are now considerably more plan options to choose from in group vs. individual. And finally, the price of comparable group plans are less than individual plans with similar benefit levels. Individuals who are not eligible for subsidies because of their income will discover this discrepancy and push for change from their employer. It will start with the business owner who is just a phone call or email away from discovering what this means to them and their families.

If you own a small business and want to see how all of this impacts you, your family and your employees we are always here to help.

This blogger graduated from Goldman Sachs' 10,000 Small Businesses program. Goldman Sachs is a partner of the What Is Working: Small Businesses section.