We often hear the concept of emerging economies, usually attributed to third world countries in which growth rates far surpass those of the traditional economies, attract immense amounts of foreign direct investment and whose currencies become appreciated over time. Colombia, as a specific case to be discussed, has been included in this list for the past few years, and its economy has lived up to its name, up until now. The global economy is taking a turn, and the time for these so called "emerging" economies to prove their resistance to external shocks has come.

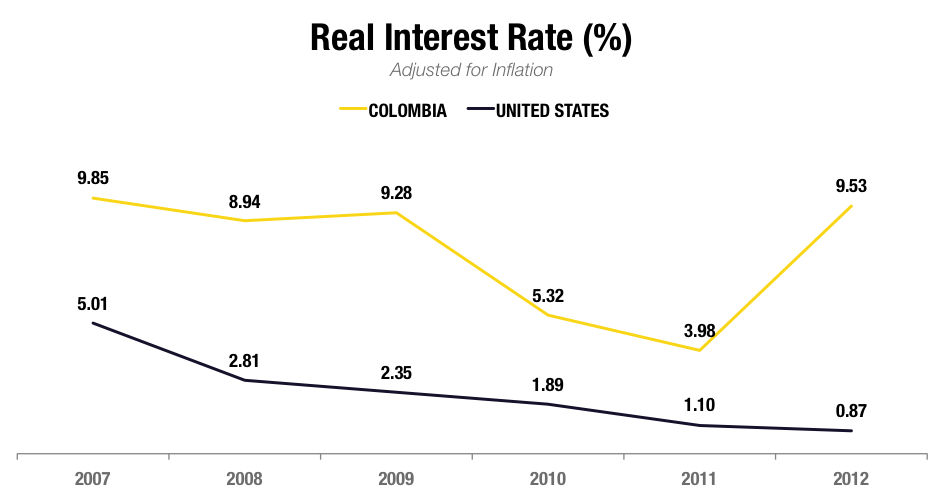

The United States financial crisis shifted the global economical dynamics, and suddenly developed economies weren't as attractive as they used to be. Real interest rates--that is, the rate of interest adjusted by inflation, for comparative measures--in the US declined from 5% in 2007 to 2.8% in 2008 and gradually decreased to 0.87% in 2012. Measures were taken in order to boost the economy and increase the currency flow, which placed the country into monetary expansion. This fiscal stimulus has continued for the past years, in which the FED has lowered the country's interest rates to extremely low levels--through what has been considered as unconventional methods--, and where low growth rates for the economy have been recorded. As Marco Polo (pen-name), an experienced global financial investor and advisor at OfWealth puts it:

When all else has failed, and the government of a bankrupt country is really desperate, it instructs the central bank to print money for the government to spend, so it can stay in power. The central bank does what it's told, so that it doesn't lose its "independence", but comes up with a fancy name and a complex process to hide what is really going on. It then buys government bonds by the bucket load, which creates artificial demand and raises bond prices, which means bond yields are reduced. This means the government can borrow new money at lower interest rates than before. But the best part is that the huge amount of bonds owned by the central bank itself are effectively interest free loans, since interest received is paid back to the government.

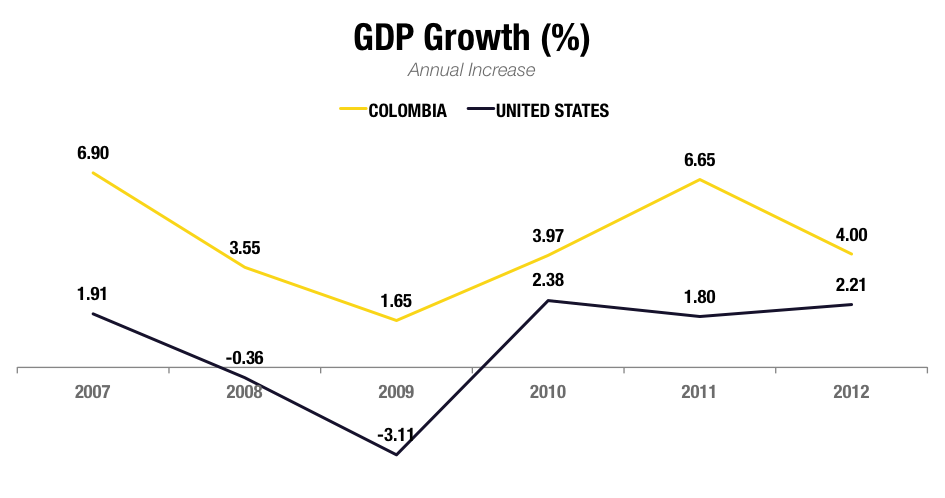

After a negative growth rate in 2009 (-3.1%), there has been a relative stabilization for the following years, fluctuating around 2% between 2010 and 2012. The massive amounts of liquidity injected into the financial system in a virtually interest free environment, drove investors to seek for higher yields, which were to be found abroad: at emerging markets.

Colombia--amongst other emerging economies--suddenly became an attractive spot for investment. Recent growth in its economy--3.97% in 2010 and 6.6% in 2011--, what appears to be political stability, substantial decrease in violence, a healthy commercial balance, higher interest rates and a market open to new opportunities, services and products were all important factors to lure capital. Foreign direct investment rushed into the country, with spikes for year 2011 (USD $13.4 billion) and 2012 (USD $15.8 billion). (World Bank) It seemed as if Colombia was a hidden miracle no one was aware of. It had somehow developed a "resistance" to external shocks, or so it seemed.

The following is a comparison between Colombia and the United States, both for changes in GDP, as well as in Real Interest Rates for the period in consideration:(Retrieved from World Bank)

It seems as though the crisis in the US has actually been beneficial to the Colombian economy. But sudden prosperity can only last for so long.

The Federal Reserve System of the United States has announced the end of its monetary expansion policies in the months to come (subject to data). At a domestic level, this means interest rates will necessarily rise, and this will make the acquisition of international funding a bit more difficult. Once again, capitals will be lured back into the US, and the public will be under the impression that the economy is recovering--this may be true to some extent, but requires further analysis--in the current economical juncture.

One thing is certain: America's financial and economical decisions will have an effect on emerging economies in the times to come. The reversal of flows will destabilise emerging economies, and an effort to attract investment will have to be made in order to keep the increasing growth rates in the GDP. This begs the question, has Colombia really been resistant to external shocks? There seems to be no apparent structural improvements in its economy. Rather than becoming more competitive, a study by the Institute for Management Development (IMD) ranks Colombia at place 52 (among 59 countries) in its international competitiveness indicators. Increase in FDI flows led the country to believe it was in some sort of economical boom, while handicapping productivity in labor intensive sectors--also known as Dutch Disease--and making long term effects evident, reflected in the currency's behaviour for the past few months.

Pessimistic? The data speaks for itself. Foreign Direct Investment flows to Colombia have increased by merely 5.5% during the first semester in 2013 when compared to same period for the previous year--totalling USD $8.2 Billion in the former and USD $7.8 Billion in the latter--keeping in mind that 58,9% of this figure is directed to the oil & gas industry. (Bank of the Republic) Likewise, total exports have shrunk by 4.3%, exporting nearly USD $1.5 Billion less in 2013 when compared to 2012. (National Department of Statistics) These, among other factors, are beginning to show the truth behind the Colombian economy. Colombia's GDP growth for the second trimester of the present year was 4.2%--0.6% less than 2012--which means the remaining trimesters need a rate of 5.2% to reach the governments goal of 4.5%. The Central Bank predicts a rate of 4.0% for 2013, which seems astronomical for local analysts, who fix the percentage near 3.5% and some even in 3.0%. The recent delay announced by the FED in the US tapering has allowed for some extra time before the effects become apparent in Colombia. When will the fiscal stimulus stop is an uncertain matter, but the real question is, how will the Colombian economy respond to the external shocks when it happens? That remains to be seen.