Neil Irwin over at the NYT has apparently drawn the unenviable job of explaining what's wrong with Trumponomics. Hislatest entry, on trade deficits, is framed around an important, overlooked point, but he misses some important nuances, and his conclusion re: trade deficits as conditionally benign seemed pretty far off to me. As this is such an important point to my work -- the economically large and persistent U.S. trade deficits have become both a source of damaging bubbles and a steep barrier to full employment -- let me elaborate. (For way more then you bargained for on the issue, see Chapter 5 in the Reconnection Agenda.)

Irwin's point is that trade deficits are not inherently bad, nor surpluses good.

Tru dat. As long as there's been trade, there's been imbalanced trade, as countries invariably produce more than they consume, i.e., they're run a trade surplus, while others, like us, will do the opposite. To somehow insist on balanced trade for all would be a huge policy mistake, one that would preclude billions of people from the reaping the benefits of trade, both as consumers and providers.

Irwin's piece is thus a good antidote to the current trade debate, which sometimes claims not simply that trade deficits are always bad, which is false, but that trade itself is bad for America. As Paul Krugman underscores, the protectionism of today's conservative demagogues is as ill-founded as it is predictable. When your MO is "blaming the other," why not extend that from Muslims and immigrants to our faceless trading partners? (I've argued that trade agreements have become problematic and non-representative of working people both here and abroad, but that's a different point. I've stressed the benefits of expanded trade, which will continue apace either way.)

But persistent deficits of the magnitude we've had here in the U.S. have, in fact, been highly problematic, and they are a symptom of global imbalances--a savings glut, in Ben Bernanke's terminology--that have been, and remain, a serious problem for macro-economies across the globe. Trade deficits are not bad in a "scorecard" sense, but when they persist because they are part of a strategy of mercantilist countries to over-save, under-consume, and under-invest, big problems evolve in lots of other places.

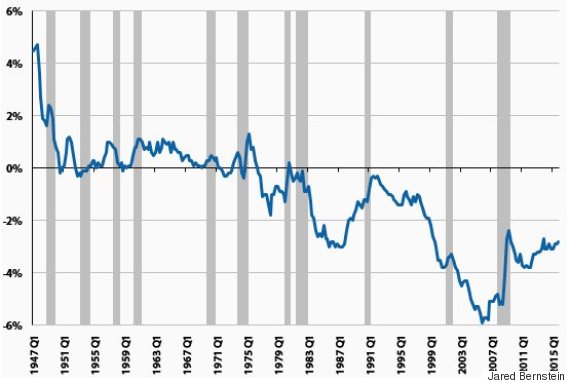

The first problem with the persistent U.S. trade deficits (see figure below) is the extent to which they've displaced U.S. workers. This is not something economists, at least reasonable ones, disagree on (Irwin gets this too but gives it too short shrift here, I thought). It's even in the models--"factor price equalization," the idea that when you expand trade with low-wage countries, putting your relatively high-paid production workers into head-to-head competition with their low-paid workers, wages must fall here.

US Trade Deficit as Share of GDP

Source: BEA

Moreover, as displaced production workers move over to low-end service-sector jobs, the supply effect puts downward pressure on wages in that part of the job market as well. Economist Josh Bivens finds that non-college educated workers have lost around $1,800 in earnings per year through this channel. That's a lot of money for them, and surely the root of a lot of the anger being stoked by the campaign.

What is less well understood is the impact of large, lasting trade deficits on investment flows. Neil argues that such flows can be either beneficial or harmful to deficit countries, but he fails to explain other key moving parts here that determine which of those outcomes are more likely. Here's where the process--and the U.S. outcome shown in the figure above--gets far less benign.

When one country runs a trade surplus, another country must run a trade deficit. That right there tells you that the scolds who say "if only we were more frugal" are wrong about this. We are not the masters of our fates here that Neil's rap suggests. As Bernanke intimates in the above link, when Germany runs an 8 percent trade surplus (!), other countries must consume that much more than they produce. It is in this manner that surplus countries not only export goods to deficit countries. They also import labor demand from those countries, some of whom, like peripheral Europe, could really use that demand.

Of course, we could, too. Neil's right that surplus countries lend their excess capital to us to invest as we see fit. The happy version of this is that those capital flows put downward pressure on our interest rates, and we build all kinds of productive stuff that wasn't being built at the higher rates that prevailed before our trade deficit got larger. The sad, and I fear more realistic version (and Bernanke got this right too in his 2005 paper that introduced the "savings glut" concept), is our rates are already crazy low and thus these flows lead to overinvestment, in dot.com junk, fiber optics, houses, oil rigs, and whatever else looks like the next big thing (the flows also push up the value of the dollar, which worsens the trade deficit).

And when I say "overinvestment," I mean bubbles. Yes, a country can demonstrably get to full employment with persistent, large trade deficits, but they/we do it with bubbles. And bubbles must burst, meaning that we can and do get to full employment in the presence of big trade deficits, but we cannot stay there, and we will often have a hard time getting back to full employment, as has been the case in recent decades.

Bottom line, always go with Neil over Trump. But persistent, large trade deficits and surpluses concentrated in specific countries (US, China, Germany) are bad news. They cost workers in deficit countries jobs and incomes, and they are functions of man (and woman)-made savings gluts that contribute to global instability and investment bubbles, particularly when interest rates are already near zero, where they are now and where they may well be for awhile.

This post originally appeared at Jared Bernstein's On The Economy blog.